Summary

Table of Content

Automotive Camera Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Automotive Camera Market Size

Automotive Camera Market size surpassed USD 5.5 billion in 2018 and is poised to grow at a CAGR of over 19% between 2019 and 2025. The global industry shipments are expected to reach 300 million units by 2025.

The growing concerns regarding vehicle & passenger safety across the globe coupled with increasing technological advancements in camera-based driver assistant sensors are expected to drive the automotive camera market growth. The increasing sales of passenger vehicles owing to rise in consumer disposable income are further contributing to the industry growth.

To get key market trends

Several government initiatives regarding passenger safety in economically advanced countries including the U.S. and Canada are surging the adoption of cameras in vehicles. The camera sensors are integrated with vehicles for various applications such as lane & side assist and maintaining a safe distance from other vehicles. Moreover, the increased consumer awareness about ADAS systems is supporting the demand for advanced safety features in passenger vehicles, influencing the market expansion.

Automotive Camera Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2018 |

| Market Size in 2018 | 5.5 Billion (USD) |

| Forecast Period 2019 - 2025 CAGR | 19.5% |

| Market Size in 2025 | 19 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Automotive Camera Market Analysis

The stereo automotive camera segment is gaining high traction owing to its vehicle safety features such as Adaptive Cruise Control systems (ACC), Forward Collision Warning systems (FCW), and lane assist systems. Stereo camera is an advanced technology that uses two cameras to capture images, calculating the distance between a camera and an object accurately. These components are used for autonomous driving & collision-sensing applications to improve vehicle safety.

Moreover, stereo systems consist of low-cost visible light cameras, offer distance information, and cover the entire field of view. The rapid adoption of these systems in various vehicles is boosting the automotive camera market demand.

Learn more about the key segments shaping this market

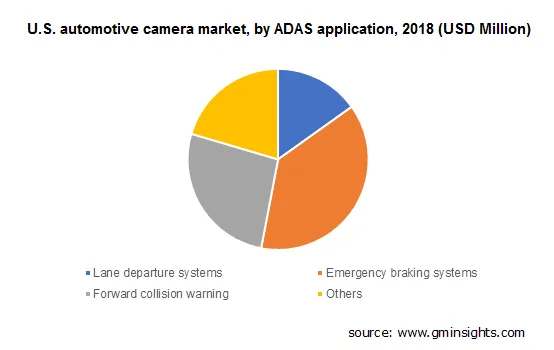

The adoption of vehicle vision systems is rapidly increasing in Advanced Driver Assist Systems (ADAS) to provide lane departure assist, emergency braking, and forward collision warning to drivers. The automatic braking system typically uses cameras and sensors to detect pedestrians crossing the street and applies breaks automatically if a pedestrian is in danger of being hit. Lane departure warning system uses a camera to detect unintentional vehicle lane shift and alerts drivers to steer vehicles back to the lane.

Additionally, vehicle cameras are integrated with ADAS to aid the automatic switching of vehicles’ headlights in low light conditions. These components can capture the surrounding images and identify collision threats and inform drivers, driving the market revenue.

The rising passenger vehicle production in the emerging Asian economies, including India and China, due to rise in the middle-class income is slated to fuel the automotive camera market size. According to World Economic Forum, the number of passenger cars is anticipated to reach 2 billion by the end of 2040. The increasing adoption of safety features in passenger cars, such as auto park assist and lane departure warning, is increasing the adoption of these components.

The increasing road fatalities are compelling the demand for advanced safety features in all new cars. The in-cockpit camera system will transmit a warning sound if it detects drowsiness in drivers, which will help to reduce the number of road fatalities significantly. Additionally, various governments across the globe are implementing stringent laws regarding passenger safety, which will further add up to the market development.

Learn more about the key segments shaping this market

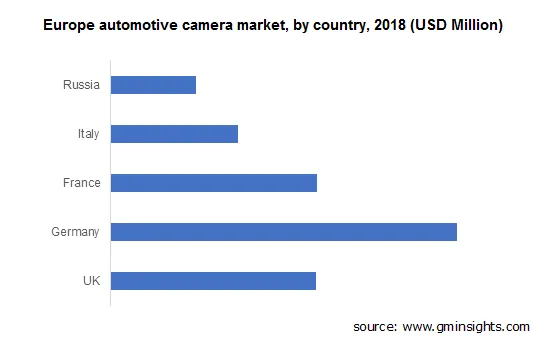

The Europe automotive camera market is estimated to observe over 21% growth during the forecast period propelled by increasing production of passenger & commercial vehicles in the region. Furthermore, several regulations & safety standards for automobile companies in the EU for reducing number of road fatalities will provide lucrative opportunities for the car manufacturers operating in the market.

Automotive Camera Market Share

The prominent players in the automotive camera market include

- Robert Bosch GmbH

- Continental AG

- Aptiv PLC

- Magna International Inc.

- Veoneer

- Denso Corporation

- Mobileye

- Valeo

These companies are offering advanced camera systems with high image resolution, wide angle view, and night vision features.

For instance, Continental AG developed multifunction mono camera, MFC500, which is integrated with advanced technologies, such as neural network and machine learning, to assist drivers in real-time.

The players are also incorporating advanced sensors into the new products to deliver high performance & productivity to passengers. Leading companies in the industry are entering into strategic mergers & acquisitions with other industry players to develop advanced driving technologies.

The automotive camera market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD and shipment in Units from 2015 to 2025, for the following segments:

By Type

- Mono

- Stereo

- Trifocal

By Vehicle Type

- Passenger Cars

- Utility Vehicles

- Commercial Vehicles

By Application

- ADAS

- Lane departure systems

- Emergency braking systems

- forward collision warning

- Others

- Parking assist

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- South Africa

Frequently Asked Question(FAQ) :

Why is the stereo automotive camera segment witnessing high demand?

The stereo segment is gaining high traction in the market owing to its vehicle safety features such as Adaptive Cruise Control systems (ACC), Forward Collision Warning systems (FCW), and lane assist systems.

Which are the major companies operating in the automotive camera landscape?

The prominent industry players include Robert Bosch GmbH, Continental AG, Aptiv PLC, Magna International Inc., Veoneer, Denso Corporation, Mobileye, and Valeo.

How many automotive camera shipments are expected across the globe by 2026?

According to this research report by GMI, the global industry shipments are expected to reach 300 million units by 2025.

What are the growth projections for Europe automotive camera market?

The Europe market is estimated to observe over 21% growth during the forecast period propelled by increasing production of passenger & commercial vehicles in the region.

How much did the global automotive camera market size account for in 2018?

The market size of automotive camera estimated at around USD 5.5 billion in 2018.

How much growth will the automotive camera industry share witness during the forecast timeframe?

The industry share of automotive camera will grow at a CAGR of over 19% from 2019 to 2025.

Automotive Camera Market Scope

Related Reports