Home > Industrial Machinery > Industrial Equipment > Assembly Machine Market

Assembly Machine Market Analysis

- Report ID: GMI4287

- Published Date: Aug 2019

- Report Format: PDF

Assembly Machine Market Analysis

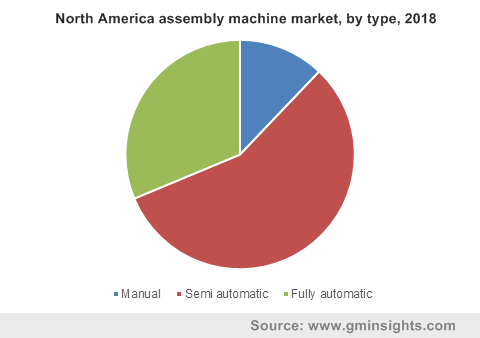

In 2018, semi-automatic machines accounted for over 55% of the assembly machine market share and are being adopted by businesses to improve the quality and labor productivity as manual assembly machines are time-consuming. They are operated partly automatically and partly manually for loading & unloading the entire system in the manufacturing process. Small and Medium Enterprises (SME) are highly implementing these machines to cut their operational costs, enhancing productivity in manufacturing processes. Moreover, these machines are integrated with robots, palletized conveyor lines & automated feeders, and require less human interaction for loading & unloading of parts in each step of the assembly process. Businesses having less production and high-quality manufacturing prefer these machines to improve the production process while retaining the adaptability of operator’s input.

The food & beverage sector is witnessing growing usage of automated machinery. Changing customer preferences on consumable products, rising consumer income, the adoption of western culture in several countries, and transformation of the retail trade sector are resulting in higher consumption of food & beverage products. Manufacturers are adopting the equipment for the manufacturing of sports drink dispensing closures, syrup delivery valves, and plastic bottles. These machines are helping businesses to speed up the production process. Moreover, suppliers are offering machines for the assembly of specific components. For instance, RNA Automation Limited is providing cap assembly machines to efficiently feed, orient, and assemble the push-pull cap. These machines can be connected to other machines in production lines, enabling quick & automatic feeding, filling, assembly, capping, and discharging of finished products, increasing the productivity.

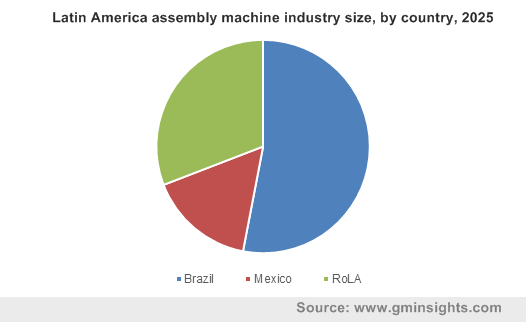

Increasing government initiatives and support to improve economic conditions in countries, such as Brazil, Mexico, and Argentina, will drive the adoption of automated solutions in the Latin American market. According to the World Bank’s Enterprise Surveys, 31.6% of companies have inadequately trained workers. Lack of skilled workers is forcing industries to invest in technologies, such as Industry 4.0. The rise in government and organization initiatives for improving the manufacturing sector will provide lucrative growth benefits to the assembly machine market. For instance, organizations under Brazil's National Confederation of Industry (CNI), announced their plan to invest in automation for the manufacturing of goods. The rise in the manufacturing sector coupled with the growing need for efficiency and quality in manufacturing processes continues to drive the Latin American market growth. Food, beverages, healthcare, and pharmaceutical industries are major deployers of machinery in the Latin American region. Several consumers are importing their machinery from countries including the U.S., Germany, and Italy.