Summary

Table of Content

Assembly Fastening Tools Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Assembly Fastening Tools Market Size

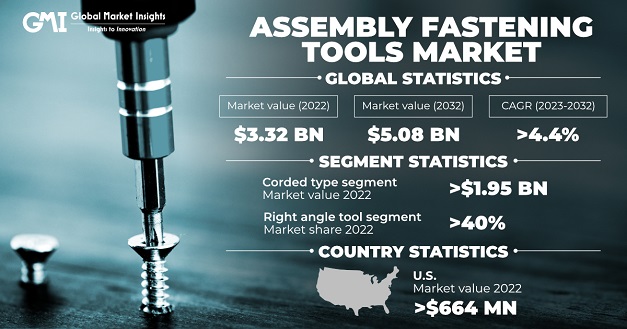

Assembly Fastening Tools Market was valued at USD 3.32 billion in 2022 and is projected to witness more than 4.4% CAGR from 2023 to 2032. As industries expand, especially in sectors like automotive, construction, and manufacturing, the demand for assembly fastening tools increases. Emerging markets and industrialization in developing countries can significantly boost the demand for these tools.

To get key market trends

The automotive industry's growth, driven by production and aftermarket services, is a significant driver for fastening tool demand. As the automotive sector evolves, tools catering to electric vehicle assembly or specific lightweight material fastening are increasingly required. Infrastructural development, construction projects, residential housing, and commercial building activities generate demand for assembly tools. As construction methods evolve and incorporate new materials, tools suited for different construction needs drive market growth.

Assembly Fastening Tools Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2022 |

| Market Size in 2022 | USD 3.32 Billion |

| Forecast Period 2023 to 2032 CAGR | 4.4% |

| Market Size in 2032 | USD 5.08 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Price fluctuations in raw materials and manufacturing costs can affect profitability. Maintaining competitive pricing while ensuring quality can be challenging. Economic fluctuations, trade disputes, or geopolitical tensions can impact market demand and consumer spending, affecting the industry's growth. Stricter environmental regulations and the need to comply with sustainability norms pose challenges for manufacturers to create tools that are energy-efficient and eco-friendly without compromising performance.

Assembly Fastening Tools Market Trends

The need for assembly fasteners is rising across a range of end-use industries, including construction, heavy machinery, semiconductor, and electronics, automotive, and aerospace and defense. Assembly fasteners are utilized for strong load bearing capacity, quick assembly and disassembly during transit, and permanent and temporary joining. Market participants in the worldwide market for assembly fastening tools include concentrating on boosting fastener production to meet the needs of diverse end-use sectors around the world. Due to their low maintenance requirements and affordability, these fasteners are extensively used in many end-use sectors.

Assembly Fastening Tools Market Analysis

Learn more about the key segments shaping this market

The corded type of segment crossed USD 1.95 billion in 2022. Corded tools provide a consistent power supply, ensuring uninterrupted performance without the need for recharging or battery replacements. This consistency is crucial in heavy-duty or continuous operations, offering sustained power for high torque aplications. Corded tools often provide higher torque and power output compared to their cordless counterparts. This makes them preferred for heavy-duty applications in industries such as construction, manufacturing, and automotive assembly, where immense torque is required.

Learn more about the key segments shaping this market

Based on tool type, the right angle tool accounted for over 40% market share in 2022. The primary advantage of right angle tools is their ability to access tight or confined spaces where traditional tools may not fit. This characteristic is highly sought after in assembly processes where space constraints are common, such as in cabinetry, automotive interiors, or machinery assembly. These tools offer improved maneuverability in situations where a straight-on approach is not feasible. They are ideal for reaching into corners, around obstructions, or other hard-to-reach areas.

Looking for region specific data?

North America dominated the global assembly fastening tools market in 2022. Within North America, the U.S. generated a revenue of over USD 664 million in 2022. North America has a significant automotive manufacturing sector, driving demand for assembly tools. The need for precision fastening tools, especially in the production of conventional and electric vehicles, contributes significantly to the market demand. The region houses a diverse range of manufacturing industries, including aerospace, electronics, machinery, and more. Each sector demands specific assembly fastening tools, contributing to the overall market demand.

Assembly Fastening Tools Market Share

Major players operating in the assembly fastening tools industry include:

- Stanley Black & Decker

- Robert Bosch GmbH

- Hilti Corporation

- Makita Corporation

- Atlas Copco

- Ingersoll Rand

- Snap-on Incorporated

Stanley and Robert are dominant players in the assembly fastening tools industry due to their vast product portfolio. Stanley’s ecosystem integration, along with consistent innovation, have attracted millions of customers. Their brand recognition and exclusive content deals solidify their leadership in the highly competitive market.

Assembly Fastening Tools Industry News

- In March 2022, FEIN became a partner of the professional 18V system from Bosch. In the future, FEIN and Bosch would rely on a uniform battery platform for 18-volt 4/6 battery technology.

- In June 2019, Atlas Copco AB announced its plan to acquire self-piercing riveting business of Phillip-Tech (Beijing) Co., Ltd. Its riveting solutions are in high demand by automobile manufacturers in China and thus, this acquisition is expected to help Atlas Copco AB to expand its assembly tools business in China.

This assembly fastening tools market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue and volume (USD Million) (Thousand Units) from 2018 to 2032, for the following segments:

Market, By Type

- Corded

- DC Electric Tools

- Screwdriver

- Wrench

- Nutrunners

- Others (Presses, Balancers, Retractors, etc.)

- Pneumatic

- Screwdriver

- Wrench

- Nutrunners

- Others (Presses, Balancers, Retractors, etc.)

- Cordless

- Screwdriver

- Wrench

- Nut runner

- Others (Presses, Balancers, Retractors, etc.)

Market, By Tool Type

- Right Angle Tool

- Inline Tool

- Pistol Grip Tool

- Others (Torque Tool, Pneumatic Tools, etc.)

Market, By Control Mechanism

- Transducer Controlled

- Current Controlled

- Clutch Controlled

Market, By End-Use

- Aerospace & Defence

- Heavy equipment

- Automotive

- Semiconductor & Electronics

- Construction

- Others (Marine, Telecommunication, etc.)

Market, By Distribution Channel

- Direct

- Company Owned Stores

- Company Owned Websites

- Indirect

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Indonesia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- GCC

- South Africa

Frequently Asked Question(FAQ) :

How big is the U.S. assembly fastening tools industry?

The U.S. assembly fastening tools market was worth over USD 664 million in 2022, backed by the booming automotive manufacturing sector in the region, driving demand for precision fastening tools, especially in the production of conventional and electric vehicles.

Who are the main assembly fastening tools makers?

Stanley Black & Decker, Robert Bosch GmbH, Hilti Corporation, Makita Corporation, Atlas Copco, Ingersoll Rand, and Snap-on Incorporated.

What is the size of assembly fastening tools market?

The market size of assembly fastening tools was worth USD 3.32 million in 2022 and is anticipated to register a CAGR of over 4.4% between 2023 and 2032, favored by the rapid industrialization, especially in sectors like automotive, construction, and manufacturing.

Why is right angle tool gaining traction in assembly fastening tools market?

Right angle tool segment accounted for over 40% market share in 2022 and is projected to grow through 2032. The primary advantage of right angle tools is their ability to access tight or confined spaces where traditional tools may not fit.

Assembly Fastening Tools Market Scope

Related Reports