Home > Media & Technology > Next Generation Technologies > Fintech > Asia Pacific Mobile Wallet Market

Asia Pacific Mobile Wallet Market Analysis

- Report ID: GMI3290

- Published Date: May 2019

- Report Format: PDF

Asia Pacific Mobile Wallet Market Analysis

The semi-closed mobile wallet market is anticipated to grow at a CAGR of over 18% over the forecast timeline due to the rise in the number of mobile wallet product offerings by tech players. This is credited to the shifting customer preferences toward mobile payment applications. The population within the age of 16 to 34 (millennials) prefer a bank-free existence in the future as they are increasingly tech-savvy and habituated to digital financial services offered by technology players.

The banks market is expected to register a growth rate of more than 17% over the forecast timeframe. The banking organizations are launching their own mobile wallets to monetize on myriad opportunities to upsell and cross-sell their financial services & policies. It also provides them with actionable insights to better understand customer preferences, helping them offer a tailor-made banking experience for their customers. The telco industry is anticipated to witness a CAGR of over 20% over the projected timeline. The rising number of partnerships among mobile networks and card issuers is spurring the growth of the telco-based mobile wallet market.

The tech companies accounted for over 70% of the revenue share in the Asia Pacific mobile wallet market in 2017. The tech enterprises including Flipkart, Uber, Ola, and MakeMyTrip have been increasingly investing in developing their own mobile wallets to offer a seamless banking experience to their customers. The players are leveraging on their tech infrastructure to build new & innovative product offerings for their users. Moreover, the supportive regulatory framework is further supplementing the growth of the market.

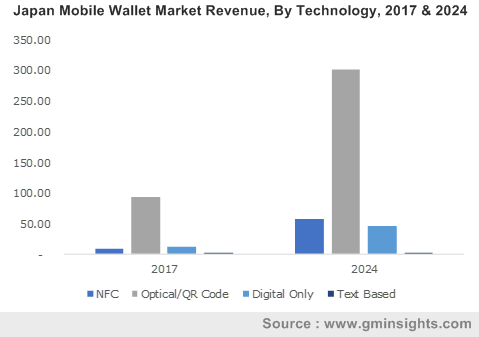

The optical/QR market is forecast to grow at a CAGR of over 17% during the projected time period. The inexpensive nature of mobile wallet applications is encouraging its use in the region as the technology does not incur any added costs apart for a smartphone. This has been the primary factor, which has been supplementing its adoption in countries, such as Thailand, Indonesia, and the Philippines, where the retail outlets do not have access to the point-of-sale infrastructure.

China dominated the Asia Pacific mobile wallet market with over 95% share in 2017. This is attributed to the presence of numerous e-commerce platforms and a high degree of smartphone penetration in the country. Large players, such as Tencent, Alibaba, and Baidu, are forming tie-ups with various retail outlets and online platforms to increase the availability of product offerings across various channels. For instance, in May 2015, Tencent partnered with Didi, a taxi hailing application, to facilitate in-app payments for its customers for Didi rides. This partnership with Didi opened a broader universe of payment partners for the WeChat application, enabling in-app payments for everything from cell phone bills to utility fees.