Home > Chemicals & Materials > Specialty Chemicals > Custom Synthesis > Anisole Market

Anisole Market Analysis

- Report ID: GMI2615

- Published Date: Aug 2018

- Report Format: PDF

Anisole Market Analysis

The purity of anisole depends upon its manufacturing process which comprises of reaction of phenol and sulphur hydroxide with dimethyl sulfate. Product with purity above 99.5% will observe a steady demand in the coming years, with a projected growth rate of 4.8%. Leading industry participants for instance, Merck Inc., Oakwood Products, Inc., etc. have been engaged in manufacturing methoxybenzene with purity above 99.5%.

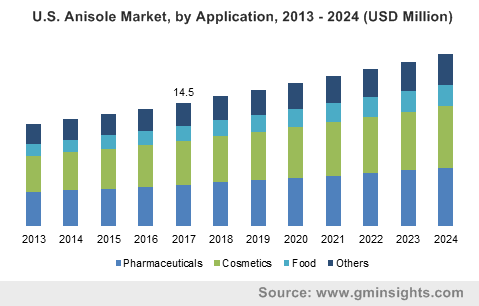

Pharmaceuticals segment is expected to observe significant growth with a CAGR of 4.4% in global anisole market over the forecast period. The product serves as a key precursor in producing various pharma compounds, for instance, mequinol- a type of phenol used in dermatology and organic chemistry.

Rising preference for premium product usage, reliance on the imported personal products, and prominent level of discretionary expenditure have made Asia Pacific a promising market for anisole in various cosmetics and personal care products, with the highest share of close to 30%. Positive change in social economic factors such as increase in disposable income and consumer purchasing power, rise in self-conscious young population, have been instrumental in shifting consumer preference toward better lifestyle. Upward trends in self-grooming habitats are estimated to propel the anisole market demand by 2024.

China with a population of 1.3 billion, holding over 480 million urban residents, followed by India will present the largest number of potential cosmetic customers in the world. Such trends exhibit that the demand for anisole as a fragrance ingredient in cosmetics is likely to have an upward growth trajectory in coming years.

The product serves as an intermediate in several derivatives, for instance, 4-allyl anisole, which has been highly useful ingredient in the pesticide products that protect conifers in parks, forests, recreation areas, etc., from insects such as bark beetles. According to Eurostat data, in 2015, the EU-28 had a total area of 11.1 million hectares cultivated as organic, rising from 5.0 million hectares area in 2002. Organic area in the EU increased by about 500,000 hectares per year during the last decade. Such trends exhibited by the agriculture segment will drive the anisole market growth in the future years.