Summary

Table of Content

Anisole Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Anisole Market Size

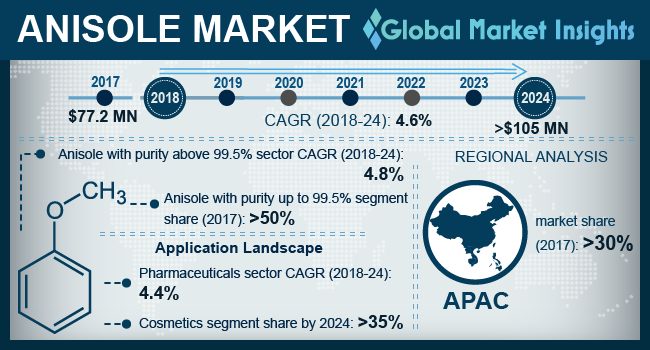

Anisole Market size was over $77 million in 2017, with projected gains close to 5% CAGR between 2018 and 2024. High prospects in the cosmetics sector and artificial fragrance associated with the product will drive the market demand in various cosmetics in the coming years.

As per a report by the U.S. Department of Commerce, Asian countries observed an escalation in the per capita cosmetics spending in recent 5 years. Few key trends favoring the anisole market share in Asia Pacific region have been the organized retail, rise of urban population, westernization of the FMCG sector and the vociferously thriving e-commerce industry.

To get key market trends

With an exponential rise in women expenditure on skin and hair care products and the upward trends in male grooming business, global anisole market will observe significant demand by 2024. The escalating demand for male grooming solutions has resulted in the scope beyond deodorants and shaving gels for men in the recent decade.

For instance, in India, the use of face-cleaning products among men increased about 60 times during 2009 to 2016. Currently, the male personal care industry prominently comprises fairness creams and beard balms, beard shampoos, etc.

Anisole Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2017 |

| Market Size in 2017 | 77 Million (USD) |

| Forecast Period 2018 - 2024 CAGR | 5% |

| Market Size in 2024 | 105 Million (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

As per Euromonitor International Personal Appearance Survey, range of beauty and personal care (BPC) products - socially acceptable for men has widened in past 10 years. One third of men spend more than thirty minutes a day grooming, featuring a vast scope of opportunities for BPC manufacturers to develop solutions catering the unique needs of the appearance-conscious segment of men. Such traits will drive the market in cosmetics and personal care products over the forecast timeframe.

With an essential involvement of phenolic components in synthesis of product, anisole (methoxybenzene) market growth will be highly subjected to crude trends. The price fluctuations of the crude oil will lead to a moderate growth of the overall anisole market.

Anisole Market Analysis

The purity of anisole depends upon its manufacturing process which comprises of reaction of phenol and sulphur hydroxide with dimethyl sulfate. Product with purity above 99.5% will observe a steady demand in the coming years, with a projected growth rate of 4.8%. Leading industry participants for instance, Merck Inc., Oakwood Products, Inc., etc. have been engaged in manufacturing methoxybenzene with purity above 99.5%.

Pharmaceuticals segment is expected to observe significant growth with a CAGR of 4.4% in global anisole market over the forecast period. The product serves as a key precursor in producing various pharma compounds, for instance, mequinol- a type of phenol used in dermatology and organic chemistry.

Learn more about the key segments shaping this market

Rising preference for premium product usage, reliance on the imported personal products, and prominent level of discretionary expenditure have made Asia Pacific a promising market for anisole in various cosmetics and personal care products, with the highest share of close to 30%. Positive change in social economic factors such as increase in disposable income and consumer purchasing power, rise in self-conscious young population, have been instrumental in shifting consumer preference toward better lifestyle. Upward trends in self-grooming habitats are estimated to propel the anisole market demand by 2024.

China with a population of 1.3 billion, holding over 480 million urban residents, followed by India will present the largest number of potential cosmetic customers in the world. Such trends exhibit that the demand for anisole as a fragrance ingredient in cosmetics is likely to have an upward growth trajectory in coming years.

The product serves as an intermediate in several derivatives, for instance, 4-allyl anisole, which has been highly useful ingredient in the pesticide products that protect conifers in parks, forests, recreation areas, etc., from insects such as bark beetles. According to Eurostat data, in 2015, the EU-28 had a total area of 11.1 million hectares cultivated as organic, rising from 5.0 million hectares area in 2002. Organic area in the EU increased by about 500,000 hectares per year during the last decade. Such trends exhibited by the agriculture segment will drive the anisole market growth in the future years.

Anisole Market Share

Few significant players in global anisole market have been:

- Solvay SA

- Merck

- Atul Ltd

- Westman Chemicals Pvt. Ltd.

- Huaian Depon Chemical Co., Ltd

The industry will be marked with a forward integration among raw material producers and product manufacturers in future years, due to high demand of anisole. For instance, Solvay has been producing phenol as well as anisole to serve several end-user industries.

Industry Background

Anisole is an organic substance that smells like an anise seed. Application of this chemical in several industrial verticals has been rising owing to unique chemical and physical properties of methoxybenzene. The end-user industries of the anisole industry include cosmetic, pharmaceutical and food manufacturing companies.

Anisole has been typically used as a precursor to insect pheromones, perfumes and pharmaceuticals; as an intermediate in manufacturing of fragrances, pharmaceuticals and dyes; as a solvent in the synthesis of organic compounds.

Anisole market research report includes in-depth coverage of the industry with estimates & forecast in terms of volume in Tons & revenue in USD million from 2013 to 2024, for the following segments:

By Purity

- Up To 99.5%

- Pharmaceuticals

- Cosmetics

- Food

- Others

- Above 99.5%

- Pharmaceuticals

- Cosmetics

- Food

- Others

By Application

- Pharmaceuticals

- Cosmetics

- Food

- Others

The above information is provided on a regional and country basis for the following:

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Mexico

- MEA

- Saudi Arabia

- South Africa

Frequently Asked Question(FAQ) :

What was the global Anisole Market share in 2017?

The overall Anisole Market was valued at 77 mn in the year 2017.

How much is the Anisole industry expected to be worth by the end of the year 2025?

According to credible reports, Anisole Market would record a CAGR of 5% over the anticipated time span.

What will be the worth of global anisole market by the end of 2024?

According to the report published by Global Market Insights Inc., the anisole business is supposed to attain $105 million (USD) by 2024.

What are the key factors driving the market?

Increasing demand for anisole in pharmaceuticals sector are the major key factor expected to drive the growth of global market.

Which are the top companies in the anisole industry?

Solvay S.A., Merck & Co., Inc., Evonik, Atul Ltd, Triveni Chemicals, Huaian Depon Chemical Co. Ltd., Shanghai Worldyang chemical Co., Oakwood Products, Inc., Clean Science and Technology Private Limited, Eastman Chemical Company are some of the top contributors in the industry.

Which application segment is expected to drive the market during the forecast period?

The Pharmaceuticals application segment registered a significant market share in 2017 and is projected to record a remarkable growth rate throughout the forecast period.

Anisole Market Scope

Related Reports