Summary

Table of Content

Animal Feed Enzymes Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Animal Feed Enzymes Market Size

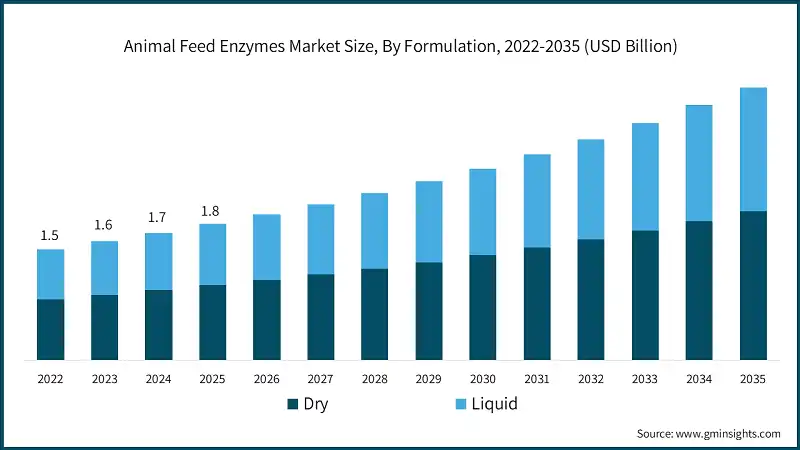

The global animal feed enzymes market size was valued at USD 1.8 billion in 2025. The market is expected to grow from USD 1.9 billion in 2026 to USD 3.6 billion in 2035, at a CAGR of 7.2% according to latest report published by Global Market Insights Inc.

To get key market trends

- Animal feed enzymes can be defined as biological catalysts that enhance the digestibility of the nutrient contents present in the diet feed to animals. That is partly responsible to foster their growth, immunity, health, productivity, etc. While feed conversion is of high priority on a global scale rather than clamped on to the capacity of muscle and other tissues to stock nitrogen and other nutrients, a rising motivating factor (i.e., for animal-production output).

- According to Food and Agriculture Organization (FAO), world meat production will grow by 1.4 % boosted by the expansion of poultry, while bovine output will see a decline due mostly to reduced live cattle supplies in Brazil and the U.S.

- Enzymes can efficiently increase feeding efficiency of the livestock; they can take apart complex-rooted components of feed, like fibers, starches, and phytates that stimulate absorption. The ongoing reflected desire for obtaining such an enzyme will hinge on upturns in costs that are tied to feed. Feeding accounts for a huge costing-around anywhere in the range of 60 to 70% of the total cost of livestock production. Enzymes thus suggest a way to reduce the amount significantly of feed needed to support a given rate of growth through feed-efficiency-ameliorating factor.

- The recent attentiveness toward food source supply and ever-growing demand for meat has brought the eternal issue of animal health or animal welfare. At this time enzymes supports high-tech trends to reward highly hazardous animals with speeding nutrient absorbing, slashing antibiotic needs, hormone therapies, waste practices, and blow emission off into the atmosphere. As laws tighten surrounding antibiotic regulation in livestock on various continents, enzymes are poised in direct line to promote healthy growth and productivity.

Animal Feed Enzymes Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 1.8 Billion |

| Market Size in 2026 | USD 1.9 Billion |

| Forecast Period 2026 - 2035 CAGR | 7.2% |

| Market Size in 2035 | USD 3.6 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising global meat consumption & protein demand | Leads to increased adoption of feed enzymes to improve feed efficiency and support higher meat production levels |

| Feed cost optimization & efficiency pressures | Drives the demand for cost-effective enzymes that enhance nutrient utilization, reducing overall feed costs |

| Animal welfare & performance enhancement focus | Encourages the use of enzymes to improve animal health and growth performance, positively impacting market growth |

| Pitfalls & Challenges | Impact |

| Heat stability & storage limitations | Limits the effectiveness and shelf life of enzymes, posing challenges for widespread market adoption and distribution |

| Competition from alternative feed additives | Poses a threat to enzyme market share as other additives may offer similar benefits at lower costs or with different functionalities |

| Opportunities: | Impact |

| Organic & non-GMO enzyme demand | Boosts market growth by creating a niche for organic and non-GMO enzyme products tailored to consumer preferences and regulatory standards |

| Personalized nutrition & precision feeding | Opens new avenues for specialized enzyme formulations tailored to individual animal needs, enhancing feed efficiency and market scope |

| Market Leaders (2025) | |

| Market Leaders |

18.1% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | Japan, India, South Korea |

| Future outlook |

|

What are the growth opportunities in this market?

Animal Feed Enzymes Market Trends

- The innovation in enzyme engineering is leading the way for more resilient enzymes, heat-stable, and pH tolerant, capable of withstanding pelleting and feed processing conditions. Next-generation enzymes maximize efficacy and have wider realms of application, thus minimizing the numbers of enzyme supplementations required. The stability of enzymes is being emphasized alongside efforts to stabilize manufacturing and keep costs low, as witnessed in biotechnology research.

- Governments as well as regulatory bodies are increasingly shifting towards the stance of natural, non-GMO, and organic inputs to support animal health and food safety. These developments impel the enzyme manufacturers to resort to cleaner-label products prone to stricter regulations thereby affecting the pipelines of product development. Such regulatory trends create fertile ground for innovation in safe, sustainable enzyme solutions to fulfill the consumer need for organic products.

- The livestock sector is increasingly adopting enzymes which reduced the manure output through improved nutrient absorption and hence control environmental pollution. This shows that enzymes are in the forefront of greenhouse gases reduction and resource conservation.

- The area of enzyme production and distribution is being transformed by digital tools, from automation to Internet of Things. Enhanced process control and supply chain transparency will serve to improve consistency in products, reduce wastage and bring in line with government-pushed initiatives of modernizing agricultural supply chains. This will also allow real-time monitoring of enzyme efficacy which further ensures higher standards of products for consumer confidence.

Animal Feed Enzymes Market Analysis

Learn more about the key segments shaping this market

Based on formulation, the animal feed enzymes market is segmented into dry and liquid. Dry dominated the market with an approximate market share of 54.9% in 2025 and is expected to grow with a CAGR of 7.1% till 2035.

- The formulation of enzymes in dry form presently dominates the market mainly owing to easy handling, a longer shelf life, and stability during storage and transport. Dry enzymes are less susceptible to spoilage and degradation compared to liquid forms, rendering them highly cost-effective for manufacturers and end-users. The other goods being highly blended into premixed feed formulations result in easier manufacturing processes as well as maintaining uniform enzyme distribution.

- The acceptance of this segment is also driven by decades of research and improvements towards arriving at the stable dry enzyme formulation that maintained its biological activity under different environmental conditions, which matches the industry's need for reliable scalable solutions.

- Liquid enzymes might possess the advantage of rapid dispersion and instant efficacy, but these are compensated by poor storage stability and high transportation costs arising from temperature and handling sensitivity. These factors, in turn, hamper their wider acceptance in areas with less advanced logistics infrastructure.

Learn more about the key segments shaping this market

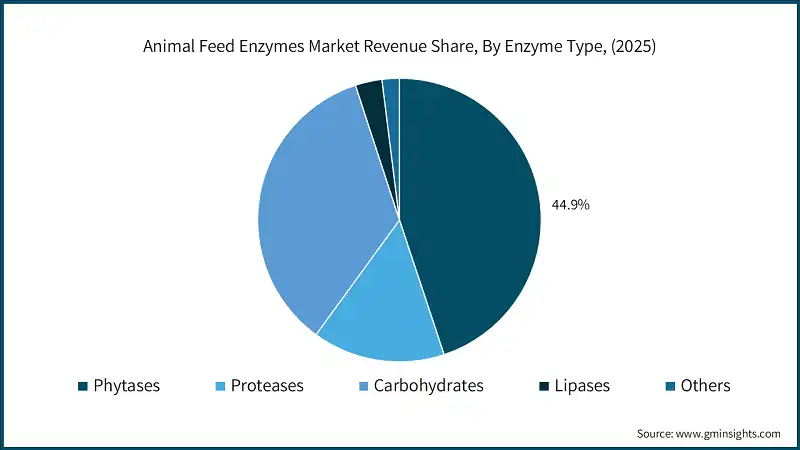

Based on enzyme type, the animal feed enzymes market is segmented into phytases, proteases, carbohydrates lipases and others. Phytases held the largest market share of 44.9% in 2025.

- Phytases dominates, primarily because of resolving a general application problem associated with livestock phosphorus deficiency in their diets. It increases the bioavailability of phosphorus for incorporation in plant materials wherein the use of inorganic phosphorus supplements is reduced such that fewer amounts of them are used to be added to animal feeds.

- Because of the increasing emphasis on sustainable farming practices and waste management reporting, low phosphorus excretions among phytases are further aligning with standards for government and society, supporting adoption. The application spectrum is large, ranging from poultry, through swine to ruminants, and with ongoing innovations and further product development to improve stability and efficacy.

- Proteases help in digestion and breaking down proteins to amino acids, which in turn enhances nitrogen utilization and performance of the animals. Consumption of proteases increases due to the change towards high protein diets in livestock, especially in poultry and particularly in the pork sectors. Continuous innovation in enzyme formulations to improve activity under diverse feed processing conditions also supports their growth.

- Carbohydrates are popular for use in improving digestibility with a specific focus on complex carbohydrates such as fiber and starch, particularly monogastric animals. Adoption is buoyed by the trend toward using plant-based feed and the need to improve energy extraction from fibrous sources, especially in areas focusing on sustainable feed formulations.

- Market expansion is mainly due to lipases gaining ground in specialty applications such as aquaculture and dairy feed. There has been continued advancement in enzyme technology to widen their applicability in niche markets where fat digestion is critical, such as fish and shrimp farming

Based on livestock, the market is segmented into poultry, swine, ruminants, aquaculture and others.

- The poultry feed enzymes market is the largest owing to their heavy production and demand for cheap protein sources by consumers. Enzyme supplementation becomes therefore essential in view of increased feed conversion ratios and decreased feed cost to satisfy the rapid growth of poultry.

- Swine represent another major segment owing to the world-wide demand for pork products. Enzymes in swine feed aid in the digestion of complex carbohydrates and proteins, thus improving growth performance and feed efficiency. Also, the increasing focus on feed optimization, i.e. to address cost and environmental impacts, boosts the adoption of enzymes in the swine sector even further, especially in those regions with intense pig farming practices.

- Enzymes used in ruminants are mainly focused on fiber breaking down and absorption owing to the complexity of ruminant digestion. However, with increasing awareness for sustainable farming practices, the gradual spread of enzyme applications in this segment for enhancing feed efficiency in dairy and beef cattle will be supported.

- Aquaculture is an emerging segment spurred by the escalating worldwide demand for seafood. Enzymes help improve feed digestibility for fish and shrimp, thereby reducing feed wastage and pollution. Enzyme use is gaining momentum with increasing input intensification to sustain sustainable fish farming practices.

Looking for region specific data?

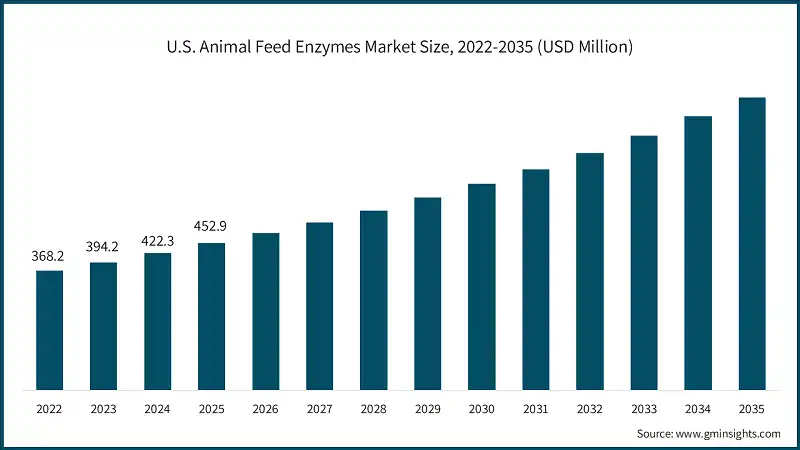

The North America animal feed enzymes market will grow at a CAGR from approximately 7.2% between 2026 and 2035.

- The growing awareness among consumers about environmental impact and animal welfare has created demand for enzyme solutions, which improve feed efficiency and reduce waste. The focus on precision livestock farming and innovations relating enzyme formulations to the specific needs of different animals further develops the market.

- This acceptance is supplemented by supportive regulations designed to advance environments and the need to control greenhouse gas emissions from livestock. The investments in advanced enzyme technologies focusing on improving nutrient absorption and feed conversion ratio are also expected to ensure the steady growth of the market during the reference period.

The animal feed enzymes markets in Europe, especially in a few countries like Germany, are expected to grow with a rapid pace in the coming years.

- Stringent environmental regulations and the focus on circular economy principles are promoting the use of enzyme-based feed additives that would support sustainable and organic livestock production. The continuing research and development are improving enzyme formulations for better digestibility, thus avoiding feed waste and complying with eco-label standards.

- Increased demand for allergen-free, vegan, and natural feed ingredients is pushing companies to innovate bio-based enzyme solutions. These market developments and the motivating policies will support rapid growth in the coming years.

The animal feed enzymes market in China and India is expected to have lucrative growth between 2026 and 2035, with CAGR 7.4% in the Asia Pacific region.

- Rapid urbanization and increasing disposable incomes generate an incredible demand for high-quality and efficient animal feeds. Government initiatives encourage sustainable farming and minimize environmental impacts which in turn promote the adoption of enzyme technologies.

- The increasing preference for natural and organic livestock feeds, which is now being further fueled by the growth of health and welfare markets worldwide that is also enhancing the demand for enzymes. Increased investment towards biotech R&D and eco-friendly manufacturing practice will ensure the strong growth in the market in these regions.

Between 2026 and 2035, the animal feed enzymes market in the Middle East is projected to grow significantly during this period.

- The ever-growing demand for premium animal products and environmentally-conscientious farming practices stand as the major drivers for the region. Governments are upholding the promotion of biological feed additives and environmentally-responsible livestock management solutions within which the enzyme technology will improve digestibility and disallow waste.

- The developed hospitality and tourism spheres, along with regional health and wellness trends, will further elevate the demand for premium sustainable livestock and aquaculture products. These factors are, in turn, expected to create a conducive atmosphere for the widespread acceptance of enzyme-based solutions, hence influencing market growth during the forecast period.

Between 2025 and 2034, a promising expansion of the animal feed enzymes market is foreseen in the Latin America.

- Supportive policies for organic farming and sustainable waste disposal practices have opened avenues for the application of enzymes that enhance feed efficiency and lessen environmental impact. Increase in disposable incomes and research into the use of natural additives is paving the way for biobased enzymes to be developed and adopted.

- Sourcing sustainable practices for livestock, particularly in dairy, poultry, and aquaculture sectors, is expected to augment market growth in accordance with global trends toward green and health-conscious food production.

Animal Feed Enzymes Market Share

Animal feed enzymes industry is moderately consolidated with players like Novonesis, BASF SE, Adisseo, Cargill, Inc. and Novus International accounted for 56.3% market share in 2025.

The animal feed enzymes market consists of such leading companies operating mostly in their regional areas. Their long years of experience with animal feed enzymes allow these companies to maintain a strong market position worldwide. Their product offerings are diverse and majorly supported by production capacities and distribution networks, which can serve the increasing demand for animal feed enzymes in various regions.

Animal Feed Enzymes Market Companies

Major players operating in the animal feed enzymes industry includes:

- BASF SE

- AB Enzymes

- Adisseo

- Alltech

- Cargill, Inc.

- Elanco Animal Health

- Foodchem International Corporation

- International Flavors & Fragrances, Inc.

- Kemin Industries

- Kerry Group

- Novonesis

- Novus International

Novonesis has an extensive portfolio of enzymes combined with biotechnology know-how, a global distribution system, and powerful research and development capabilities. The merged entity of Novozymes and Chr Hansen offers all types of feed enzymes including phytases, carbohydrates, and proteases as well as multi-enzyme solutions under brands such as Ronozyme and other product lines.

BASF SE is a significant contender in this competitive landscape by leveraging its global chemical and life sciences company status for diversified agricultural solutions. BASF's business in animal nutrition markets feed enzymes in tandem with other products-additives, vitamins, carotenoids, organic acids, and more, to realize integrated nutritional solutions. The enzymes are phytases, carbohydrates, and combinations sold under the Natuphos (phytase) and various brand names.

Adisseo is the global leader in feed additives, holding a strong position in enzyme products, notably phytase products. The company deals mainly with China National Bluestar, the company boasts an all-inclusive enzyme portfolio featuring Rovabio-carbohydrase, Rovabio Advance-multi-carbohydrase, and Rovabio Excel-xylanase-based, as well as its flagship-Rhodimet methionine and other additives.

Cargill Inc., which is affected by the best animal nutrition business since it belongs to one of the largest producers of world animal feed as well as a leading trader across the world on agricultural commodities. Enzyme offerings from Cargill can be embraced in a comprehensive feed and nutrition solution that provides clients with process integrated feed formulation support and the best supply chain services.

Novus International, an arm of Mitsui & Co., is a prominent company in the feed enzymes industry, with significant strength in phytase products and also slowly growing in other enzyme classes. The flagship product in the company's enzyme portfolio is Cibenza, which is marketed alongside its methionine products (Alimet, MHA) and other feed additives, such as Rhodimet.

Animal Feed Enzymes Industry News

- In October 2025, BASF reviewed strategic options regarding its feed enzymes business with a view to emphasizing its competitive innovation pipeline, global brands, and focus on key value chains that would unlock further growth while continuing meaningful engagement of stakeholders.

- In April 2025, NOVUS introduced CIBENZA XCEL Xylanase Enzyme Feed Additive in India to showcase their commitment to regional innovation, technical service, and cost-effective solutions for enhancing nutrient utilization in poultry production at times of rising feed energy costs.

- In January 2023, the two giants- Cargill and BASF- has expanded their partnership to include the United States besides the co-development of high-performance enzyme solutions for animal protein producers that would bring sustainability, productivity, and efficiency in feed through joint innovation and market collaboration.

This animal feed enzymes market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Kilo Tons) from 2022 to 2035, for the following segments:

Market, By Formulation

- Dry

- Powder

- Granular

- Liquid

Market, By Enzyme Type

- Phytases

- 3-Phytase

- 6-Phytase

- Consensus Phytase

- Proteases

- Carbohydrates

- Starch-degrading enzymes (amylases)

- Non-starch polysaccharide (NSP) enzymes

- Lipases

- Others

Market, By Livestock

- Poultry

- Broilers

- Layers

- Turkeys

- Others

- Swine

- Piglets & weaners

- Growers & finishers

- Sows

- Ruminants

- Dairy cattle

- Beef cattle

- Sheep & goats

- Others

- Aquaculture

- Fish

- Shrimp & crustaceans

- Marine species

- Others

- Pet food

- Equine

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Who are the key players in the animal feed enzymes industry?

Key players include BASF SE, AB Enzymes, Adisseo, Alltech, Cargill, Inc., Elanco Animal Health, Foodchem International Corporation, International Flavors & Fragrances, Inc., Kemin Industries, and Kerry Group.

What are the upcoming trends in the animal feed enzymes market?

Key trends include improved enzyme engineering for heat and pH stability, regulatory moves toward natural inputs, increased use of digital production tools, and a growing role for enzymes in cutting emissions and pollution.

What is the growth outlook for the North American animal feed enzymes sector?

The North American market is set to expand at a CAGR of approximately 7.2% till 2035, The market is led by increased consumer awareness of environmental impact, animal welfare, and innovations in enzyme formulations tailored to specific livestock needs.

What was the market share of phytases in 2025?

Phytases held the largest market share of 44.9% in 2025, primarily due to their ability to address phosphorus deficiency in livestock diets and reduce the need for inorganic phosphorus supplements.

What was the market share of the dry form segment in 2025?

The dry form segment dominated the market with an approximate share of 54.9% in 2025 and is expected to grow at a CAGR of 7.1% through 2035.

What was the market size of the animal feed enzymes in 2025?

The market size was valued at USD 1.8 billion in 2025, with a CAGR of 7.2% expected through 2035. The growth is driven by increasing demand for efficient feed conversion, enhanced livestock productivity, and environmental sustainability.

What is the projected value of the animal feed enzymes market by 2035?

The market is poised to reach USD 3.6 billion by 2035, fueled by advancements in enzyme engineering, regulatory shifts towards organic inputs, and the adoption of precision livestock farming practices.

What is the expected size of the animal feed enzymes industry in 2026?

The market size is projected to reach USD 1.9 billion in 2026.

Animal Feed Enzymes Market Scope

Related Reports