Summary

Table of Content

AMI Gas Meter Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

AMI Gas Meter Market Size

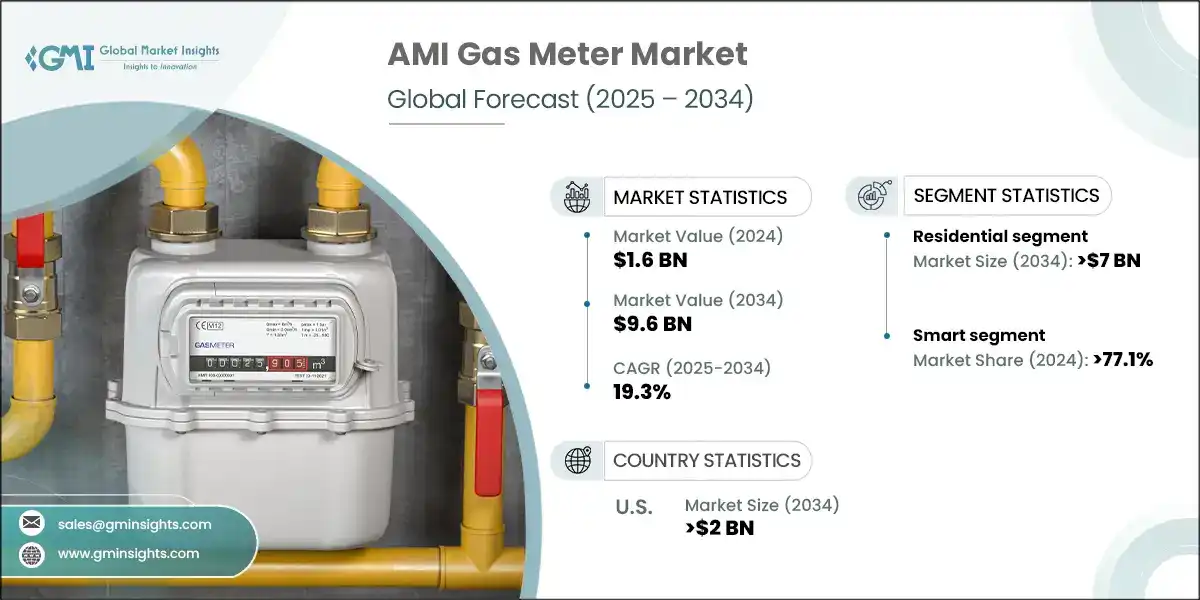

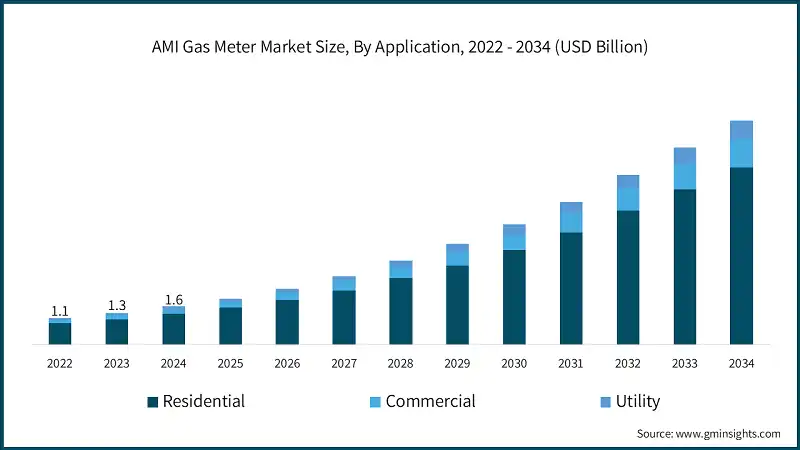

The global AMI gas meter market was estimated at USD 1.6 billion in 2024. The market is expected to grow from USD 1.9 billion in 2025 to USD 9.6 billion in 2034, at a CAGR of 19.3%.

To get key market trends

- The AMI gas meter industry is experiencing significant growth driven by technological advancements, regulatory shifts, and increasing demand for efficient energy management. Advanced metering infrastructure gas meters are smart devices that facilitate real-time data collection, two-way communication, and remote monitoring of gas consumption, offering substantial benefits over traditional meters.

- One of the primary drivers of AMI gas meter market growth is the global push toward energy efficiency and smart city initiatives. Governments worldwide are investing heavily in upgrading their infrastructure to optimize energy use, reduce wastage, and meet sustainability goals. In 2024, China's clean energy investment was more than USD 625 billion, almost doubling since 2015.

- Moreover, technological innovations are making AMI gas meters more sophisticated and cost-effective. Integration of IoT (Internet of Things) technology allows for seamless data transmission and enhanced analytics, providing utility companies with actionable insights. These advancements improve operational efficiency, reduce maintenance costs, and enhance customer service through accurate billing and proactive leak detection.

- The rising adoption of smart meters in residential, commercial, and industrial sectors also fuels AMI gas meter market growth. Consumers are becoming more conscious of their energy consumption and are demanding transparent, real-time data to manage their usage better. Utilities are incentivized to deploy AMI solutions to meet these customer expectations and comply with evolving regulatory frameworks requiring smart metering deployment.

- The countries are investing heavily in the energy sector, thereby driving the demand for industries including oil & gas, mining, and chemicals. As per the IEF report, the oil & gas industry is seeing increased investment in 2024, with upstream investments expected to rise by 7% to USD 570 billion, driven by the Middle East and Asia.

- The countries including U.S., Canada, China and UK are stepping ahead in the investments, growing the demand for AMI gas meter. For instance, UK is significantly investing in smart grid technology, with National Grid alone planning a USD 35 billion investment in transmission networks over the next five years. This investment is part of a broader strategy to modernize the UK's energy infrastructure and support the transition to a low-carbon economy.

- The AMI gas meter market is on a robust growth trajectory, fueled by technological innovations, regulatory support, increasing consumer demand for transparency, and the global focus on energy efficiency. As the infrastructure for smart energy management continues to evolve, the adoption of AMI gas meters is expected to accelerate, shaping the future of utility management worldwide.

AMI Gas Meter Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 1.6 Billion |

| Forecast Period 2025 – 2034 CAGR | 19.3% |

| Market Size in 2034 | USD 9.6 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing adoption of smart meters | Facilitates real-time monitoring, leading to enhanced accuracy and customer engagement. |

| Rising demand for energy efficiency | Promotes integration of advanced AMI gas meters to optimize gas consumption and reduce operational costs. |

| Digital transformation in utilities | Accelerates deployment of connected gas meters for remote diagnostics, data analytics, and predictive maintenance. |

| Pitfalls & Challenges | Impact |

| High initial investment costs | Deters adoption among smaller utilities and limits market penetration, slowing growth. |

| Opportunities: | Impact |

| Integration with IoT & AI | Opens avenues for advanced analytics, predictive maintenance, and smarter energy management solutions. |

| Expansion into emerging markets | Presents growth opportunities due to increasing infrastructure development and rising energy demands. |

| Development of hybrid energy systems | Drives demand for versatile gas meters compatible with renewable and biogas sources, supporting energy transition. |

| Market Leaders (2024) | |

| Market Leaders |

10% market share |

| Top Players |

Collective market share in 2024 is 25% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Middle East & Africa |

| Emerging Country | UK, France, China, India, UAE |

| Future outlook |

|

What are the growth opportunities in this market?

AMI Gas Meter Market Trends

- The advanced metering infrastructure (AMI) gas meter market is experiencing significant transformation driven by technological advancements, regulatory changes, and evolving consumer needs. One of the most prominent trends is the increasing integration of Internet of Things (IoT) and smart communication technologies.

- Modern AMI gas meters are equipped with wireless communication modules such as RF, LTE, or LPWAN, enabling real-time data transmission and remote monitoring. This connectivity enhances the efficiency of gas distribution networks by providing accurate, real-time consumption data, facilitating rapid detection of leaks, and enabling proactive maintenance.

- The rising preference for solar energy is also driving the overall demand for the AMI gas meter all over the world. For instance, in 2024, the U.S. solar energy sector experienced a record-breaking year, adding more new capacity than any other energy technology in the past two decades. Utility-scale solar generation reached 218.5 terawatt-hours, with total solar generation, including small-scale, estimated at 303.2 TWh.

- Similarly, wind energy is also growing tremendously, driving the AMI gas meter market. In 2024, Europe installed 16.4 GW of new wind power capacity, with 13.8 GW coming from onshore and 2.6 GW from offshore wind. The EU-27 accounted for 12.9 GW of this new capacity. Despite this growth, Europe's wind power expansion is not on track to meet its 2030 renewable energy targets.

- Another key trend is the shift towards highly automated and intelligent systems that support data analytics and predictive maintenance. Advanced AMI gas meters now come with embedded sensors and data processing capabilities that allow utilities to analyze consumption patterns, detect anomalies, and forecast demand more accurately. This not only improves operational efficiency but also helps in reducing non-technical losses and improving overall safety.

- The adoption of digital twin technology and cloud-based platforms is also gaining momentum in the AMI gas meter market. These technologies enable utilities to simulate and optimize their networks virtually, making maintenance and expansion more cost-effective. Cloud integration facilitates centralized data management, simplifies updates, and enhances cybersecurity measures, which are critical given the increasing cyber threats targeting critical infrastructure.

- Regulatory frameworks are also influencing market trends on a large scale. Governments worldwide are mandating the deployment of smart meters to improve energy efficiency and reduce greenhouse gas emissions. Incentives and subsidies are encouraging utilities to accelerate their AMI rollouts, especially in emerging markets where modernization efforts are gaining pace.

- Furthermore, the market is witnessing a rising interest in multi-utility meters that can measure not just gas but also electricity and water, providing comprehensive resource management solutions. This convergence trend simplifies infrastructure and offers utilities a unified platform for billing and data management.

AMI Gas Meter Market Analysis

Learn more about the key segments shaping this market

- Based on applications, the industry is segmented into residential, commercial, and utility. The residential segment is anticipated to exceed USD 7 billion by 2034 owing to increasing government initiatives and regulations aimed at modernizing energy infrastructure and promoting energy efficiency. The segmentation of the AMI gas meter market into residential, commercial, and utility applications is critical for understanding the diverse needs and growth opportunities within the industry.

- The residential sector is one of the largest markets for AMI gas meters due to the widespread adoption of smart metering technology in households. The importance of this segment lies in its contribution to energy efficiency. As per the survey conducted in December 2024, millions of smart meters were deployed in the EU region with growth at a steady rate. This number will further increase due to rising demand across the region.

- Smart meters enable households to monitor their gas consumption in real-time, helping consumers identify wastage and manage their energy use more effectively. This increased awareness encourages energy conservation and supports regulatory goals aimed at reducing greenhouse gas emissions.

- Additionally, the residential segment benefits from the automation of billing processes, reducing human errors, and providing more accurate and timely bills. Governments and utilities are increasingly mandating smart meters in residential areas as part of modernization initiatives, making this segment vital for market growth. The Indian Government reported 3.46 crore smart meters installed across India, with 20.33 crore sanctioned under RDSS scheme.

- The commercial sector encompasses a wide range of facilities such as offices, hospitals, hotels, and retail outlets. This segment is crucial because commercial entities typically have higher and more variable gas consumption compared to individual households. Accurate and real-time measurement provided by AMI gas meters helps businesses optimize their energy usage, reduce operational costs, and improve sustainability efforts.

- Automated remote meter readings reduce the need for manual checks, minimizing operational disruptions and enhancing efficiency. The commercial segment's importance also stems from its role in supporting energy management systems and facilitating demand response strategies, which are vital for balancing supply and demand on the grid.

- Utilities are the backbone of the gas distribution network, and their adoption of AMI gas meters is critical to system management and infrastructure modernization. The utility segment's significance lies in its role in overseeing large-scale operations, ensuring grid reliability, safety, and efficient resource allocation.

Learn more about the key segments shaping this market

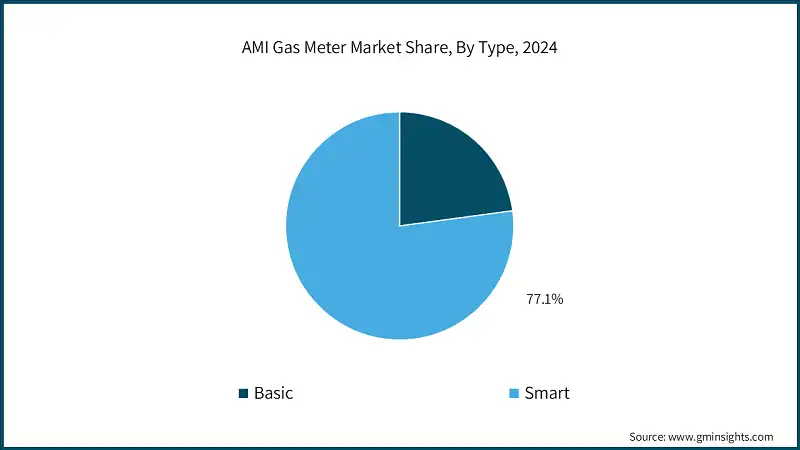

- Based on type, the AMI gas meter market is segmented into basic and smart. The smart segment holds a market share of over 77.1% in 2024 and is expected to grow at a CAGR of over 19% from 2025 to 2034. Increasing regulatory pressure and government initiatives worldwide are pushing for the modernization of gas infrastructure, particularly in residential areas. Many governments are mandating the replacement of traditional, non-communicative meters with smart meters to enhance energy efficiency, safety, and consumer engagement.

- The rising awareness among consumers about energy conservation and cost management is driving demand for smart meters. These meters empower households to monitor their gas usage actively, identify wastage, and adjust consumption patterns accordingly. As consumers become more environmentally conscious, the adoption of smart meters is expected to grow further.

- Electrical consumption is increasing worldwide due to sophisticated grid management. For instance, in 2024, global electricity consumption saw a significant surge, increasing by 4.3% or 1,080 terawatt-hours (TWh). This growth is nearly double the average increase of the past decade. Therefore, utilities might use AMI data to better understand energy usage patterns and offer incentives for energy conservation. This focus on energy management can lead to a broader push for smart metering across all energy types, including gas.

- Additionally, ongoing investments in natural gas infrastructure, along with stricter environmental regulations and policies promoting cleaner energy sources, further drive up its demand. In the context of integrating renewable energy sources, natural gas also plays a crucial role in providing reliable backup power, which sustains its importance in the energy mix. It was reported in 2024 that the U.S. clean energy industry announced USD 500 billion in new investments, spurring the U.S. economy.

- Advancements in IoT and wireless communication technologies have made smart meters more affordable and easier to deploy, facilitating mass adoption in residential neighborhoods. The decreasing costs of sensors, communication modules, and data management platforms make smart meters an attractive investment for utilities aiming for large-scale deployment.

Looking for region specific data?

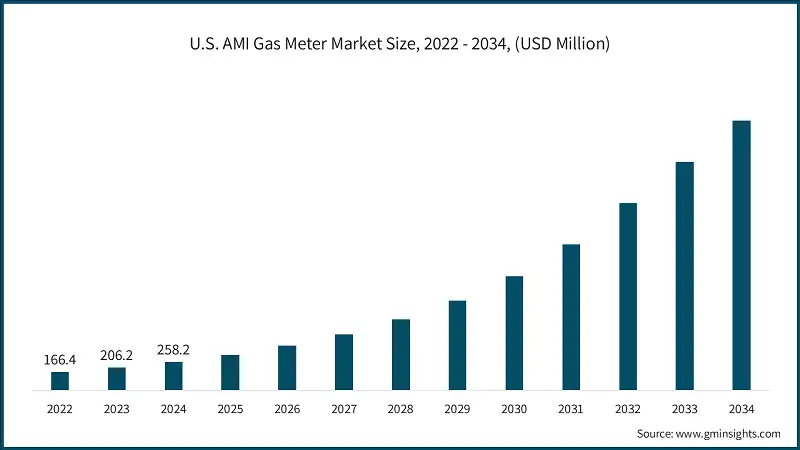

- The U.S. AMI gas meter market is anticipated to exceed USD 2 billion by 2034. The U.S. plays a pivotal role in the advanced metering infrastructure gas meter market due to its large, technologically advanced energy sector and stringent regulatory standards. The country's emphasis on modernizing infrastructure to enhance energy efficiency, reduce emissions, and improve grid reliability drives demand for smart gas meters.

- The rising demand for industries such as oil and gas are significantly creating a demand for AMI gas meters. The U.S., the second largest economy in the world, accounts for 15% of global clean energy investment, and remains a major investor in oil and gas.

- Middle East is also a pivotal region in the AMI gas meter market, driven by their extensive energy needs and technological adoption. It leads due to its strict regulatory frameworks aimed at reducing carbon emissions and enhancing energy efficiency.

- European countries including Germany, the UK, and France are investing heavily in smart grid initiatives, integrating AMI systems to optimize gas consumption, improve safety, and facilitate real-time monitoring. Additionally, Europe's focus on transitioning to renewable energy sources and modernizing infrastructure underscores the importance of advanced metering solutions.

- Asia Pacific AMI gas meter market is experiencing rapid growth owing to its expanding population, urbanization, and increasing energy demand. Countries such as China, India, and Japan are adopting AMI gas meters to improve operational efficiency, reduce losses, and comply with government mandates for smart infrastructure. The region's rising investments in smart city projects and infrastructure modernization further accelerate adoption.

AMI Gas Meter Market Share

- The top 5 companies in the AMI gas meter industry are Itron, Aclara Technologies, Honeywell International, Schneider Electric and Landis+Gyr. They are contributing around 25% of the market in 2024.

- These companies have established themselves as leaders by offering reliable, advanced smart meter solutions that meet the evolving needs of utilities and consumers. Their extensive R&D investments enable them to develop cutting-edge technologies such as remote monitoring, data analytics, and IoT integration, which are critical for modern energy management.

- Moreover, these firms benefit from strategic partnerships, large-scale deployments, and government contracts that boost their market share. Their global footprint allows them to serve diverse markets across regions with varying regulatory requirements, giving them a competitive advantage. Additionally, their established brand reputation and proven track record of successful project implementations foster trust among utilities and regulatory bodies.

- Their combined market contribution reflects their ability to innovate continuously, scale production efficiently, and provide comprehensive solutions that encompass hardware, software, and service offerings. This dominance underscores their importance in shaping the future of smart metering infrastructure, ensuring they remain key players in driving market growth and technological advancement in the AMI gas meter industry.

AMI Gas Meter Market Companies

- In May 2025, Siemens Energy reported USD 17 billion in orders, marking a 52.3% year-over-year increase on a comparable basis, driven by significant growth in Grid Technologies and record-high quarterly order in energy services.

- In November 2023, Honeywell Inc. launched a 100% hydrogen-capable diaphragm EI5 Gas Meter in the Netherlands. The initiative has been taken to align with the region’s goals outlined in the European Green Deal. The new gas meter is capable of measuring both hydrogen and natural gas. The meter requires less maintenance and eliminates the need for future replacements.

- Landis+Gyr is the industry leader in the smart gas meters sector. In 2024, the company earned revenue of USD 1.72 million. The company’s leadership is attributed to its dominant global marketing presence and advanced metering infrastructure services offered, as well as strong alliances with the utilities. The company’s innovations and market reliability have made it a trusted preferred provider in this part of the industry.

Major players operating in the AMI gas meter market are:

- Aclara Technologies

- Ameresco

- Apator

- Azbil Kimmon

- Chint Group

- Core & Main

- Diehl Stiftung & Co. KG

- Holly technology

- Honeywell International

- Itron

- Landis+Gyr

- Neptune Technology Group

- Osaki Electric

- Raychem RPG

- Schneider Electric

- Sensus

- Siemens

- Waltero

- Wasion Group

- Zenner International

AMI Gas Meter Industry News

- In 2024, Wasion Group, a leader in China's smart metering solution provider industry, reported USD 1.2 billion in revenue and USD 420.6 million in gross profit during 2024. The firm provides high-end smart gas meters with enhanced energy efficiency and data management features, cementing its position as a leader in the Asia Pacific market.

- In March 2025, Netmore Group introduced its Metering-as-a-Service offering to accelerate the mass roll-out of smart metering for gas and water utilities. The new service presents a substitute for conventional capital-intensive AMI rollouts by removing the burden of the initial investment requirement. The MaaS solution offers utilities the accessibility to a flexible, subscription-based service that supports quicker roll-out and better operational efficiency.

- In March 2024, Aclara teamed up with Utilidata to implement AI functionality into smart meters through the Karman platform and Jetson hardware by NVIDIA. This provides a leap in programmable intelligence that helps grid operators analyze and control real-time data for distributed energy resources, fostering the deployment of smart grids capable of supporting integrated meters and ancillary devices.

- In January 2024, Terranova Software began a pilot project on smart gas metering with Vitogas, where they manage close to 7,000 meters. The key goals of this initiative are cost optimization, enhanced operational visibility, and compliance with Spain's mandate to replace gas meters by 2028.

The AMI gas meter market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Million) and volume (‘000 Units) from 2021 to 2034, for the following segments:

Market, By Application

- Residential

- Commercial

- Utility

Market, By Type

- Basic

- Smart

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Sweden

- Italy

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Egypt

- Latin America

- Brazil

- Mexico

- Argentina

Frequently Asked Question(FAQ) :

What are the upcoming trends in the AMI gas meter market?

Key trends include integration of IoT and smart communication technologies, adoption of digital twin technology, cloud-based platforms, and development of multi-utility meters for comprehensive resource management.

Who are the key players in the AMI gas meter market?

Key players include Holly Technology, Honeywell International, Itron, Landis+Gyr, Neptune Technology Group, Osaki Electric, Raychem RPG, Schneider Electric, Sensus, Siemens, Waltero.

Which region leads the AMI gas meter market?

Asia Pacific region is experiencing rapid growth in the AMI gas meter market due to factors like population growth, urbanization, energy demand, and smart infrastructure investments.

What is the market size of the AMI gas meter in 2024?

The market size was USD 1.6 billion in 2024, with a CAGR of 19.3% expected through 2034 on account of technological advancements, regulatory shifts, and increasing demand for efficient energy management.

What was the projected valuation of the residential segment by 2034?

The residential segment is anticipated to exceed USD 7 billion by 2034, fueled by increasing government initiatives and regulations aimed at modernizing energy infrastructure.

What is the growth outlook for the U.S. AMI gas meter market by 2034?

The U.S. AMI gas meter market is anticipated to exceed USD 2 billion by 2034, driven by infrastructure modernization, regulatory standards, and investments in clean energy technologies.

How much market share did the smart segment hold in 2024?

Smart gas meters dominated with 77.1% market share in, driven by regulatory pressure and consumer awareness.

What is the projected value of the AMI gas meter market by 2034?

The AMI gas meter market is expected to reach USD 9.6 billion by 2034, propelled by smart city initiatives, IoT integration, and the global push toward energy efficiency and sustainability goals.

AMI Gas Meter Market Scope

Related Reports