Summary

Table of Content

America SLI Battery Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

America SLI Battery Market Size

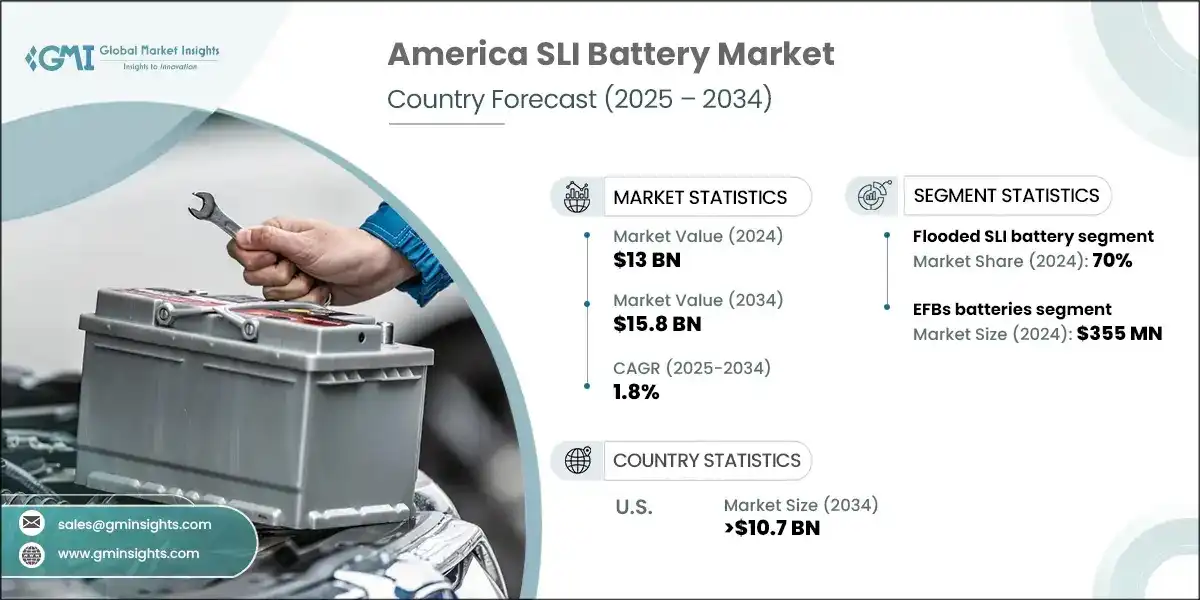

The America SLI battery market was estimated at USD 13 billion in 2024. The market is expected to grow from USD 13.4 billion in 2025 to USD 15.8 billion in 2034, at a CAGR of 1.8%.

To get key market trends

- The expansion in automobile production throughout Latin American nations such as Brazil, Argentina, and Mexico is one of the major drivers for SLI battery demand. The batteries are required to start and provide power to vehicle electronics. For example, Brazil manufactured more than 2.3 million vehicles in 2023, showing a robust rebound and growth in its automotive industry.

- Increased application of start-stop systems in U.S. and Canadian vehicles is driving demand for sophisticated SLI batteries such as AGM and EFB, which can handle frequent engine restarts. For instance, the United States Department of Energy emphasizes start-stop technology as one of the major fuel economy benefits of current vehicles.

- SLI batteries are increasingly applied in farming vehicles like harvesters and tractors. Due to the growth of agro-industries in nations such as Paraguay and Argentina, demand for reliable battery solutions is on the rise. For example, Argentina's INDEC announced a rise in sales of agricultural machinery by 8% in 2023, signaling higher battery consumption in rural industries.

- Government initiatives in Colombia, Peru, and Chile to reduce emissions and modernize fleets of vehicles are driving demand for SLI batteries with high efficiency. For instance, Colombia's Ministry of Transport initiated a vehicle renewal program in 2022 that promoted replacement of aged vehicles and batteries.

- Urban growth and expanding middle-class populations in nations such as Mexico, Ecuador, and the Dominican Republic are fueling vehicle ownership. This phenomenon fuels aftermarket demand for SLI batteries. For example, Mexico's INEGI registered more than 35 million vehicles in 2023, demonstrating robust market potential for battery replacements.

- Environmental laws throughout North America are stimulating the recycling of batteries, and this aids sustainable SLI battery manufacturing and disposal. For instance, Canada's Call2Recycle program encourages responsible lead-acid battery recycling in line with national sustainability targets.

- Though SLI batteries find most of their applications in internal combustion engines, hybrid vehicles also make use of them for secondary purposes. Increased sales of hybrid vehicles in nations such as the U.S. and Brazil are driving the demand for SLI batteries. For example, according to the IEA, sales of hybrid vehicles across the Americas increased by 25% during 2023, and this is driving sustained use of SLI batteries.

- Commercial fleets such as delivery vans, taxis, and buses need SLI batteries. In Panama and El Salvador, growth in fleets is propelling battery demand. For instance, commercial vehicle registrations rose 12% in 2023, according to Panama's Autoridad del Tránsito, signaling increasing SLI battery demand.

America SLI Battery Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 13 Billion |

| Forecast Period 2025 - 2034 CAGR | 1.8% |

| Market Size in 2034 | USD 15.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Burgeoning expansion in the automotive industry | Increased vehicle production and ownership across the Americas directly boost demand for SLI batteries, especially in OEM and aftermarket segments, driving volume growth and regional market penetration. |

| Rising investment toward the research & development activities across automobile sector | Enhanced R&D spending fosters innovation in vehicle systems, increasing the need for advanced SLI batteries compatible with modern automotive technologies like start-stop and hybrid platforms. |

| Ongoing advancements across battery technologies | Technological improvements in battery chemistry and design improve performance, lifespan, and efficiency of SLI batteries, attracting OEMs and consumers seeking reliable solutions for diverse vehicle applications. |

| Pitfalls & Challenges | Impact |

| Increasing penetration of alternative battery chemistries | The growing adoption of lithium-ion and solid-state batteries in hybrid and electric vehicles reduces reliance on traditional lead-acid SLI batteries, potentially shrinking market share and prompting manufacturers to diversify or upgrade their product offerings. |

| Stringent government regulations | Tightening environmental and safety regulations across the Americas, especially regarding lead usage and recycling, increase compliance costs for SLI battery producers and may limit production flexibility, affecting profitability and market competitiveness. |

| Opportunities: | Impact |

| Expansion of Aftermarket Services | Growing vehicle ownership and aging fleets across Latin America present opportunities for aftermarket SLI battery sales. This boosts demand for replacement batteries, enabling manufacturers to expand distribution networks and improve service accessibility in underserved regions. |

| Integration with Hybrid Vehicle Platforms | SLI batteries remain essential in hybrid vehicles for auxiliary functions. As hybrid adoption rises in countries like the U.S. and Brazil, manufacturers can capitalize on supplying dual-battery systems, sustaining relevance amid the shift to electrification. |

| Public Fleet Electrification Programs | Government-led fleet modernization in countries like Colombia and Chile includes auxiliary battery upgrades. SLI battery makers can benefit by supplying reliable solutions for buses, taxis, and municipal vehicles undergoing partial electrification or hybridization. |

| Market Leaders (2024) | |

| Market Leaders |

20% Market Share in 2024 |

| Top Players |

Collective market share in 2024 is 50% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | U.S. |

| Fastest Growing Market | Argentina |

| Emerging Countries | Argentina, Brazil, Mexico |

| Future outlook |

|

What are the growth opportunities in this market?

America SLI Battery Market Trends

- The Americas SLI battery industry is witnessing a trend towards standardized battery forms and manufacturing processes, which is being prompted by integration into global supply chains and cost-effectiveness objectives. Manufacturers are being encouraged by this development to simplify logistics and cut down on variability in manufacturing. According to the International Energy Agency (IEA), in 2025, world battery markets were shifting away from regional fragmentation to large-scale, standardized production, which increases competitiveness and scalability in regions such as North and South America.

- Sustainability needs and regulatory imperatives are promoting the utilization of sustainable material in SLI battery manufacturing. Producers are investigating recycled lead, low-emission technology, and green packaging. The trend is consistent with wider decarbonization aims throughout the Americas, particularly in Canada and Chile, where there are growing incentives for green manufacture.

- Public fleet modernization programs are incorporating battery upgrades by governments in Latin America. The programs usually involve the procurement of SLI batteries for municipal fleets, emergency vehicles, and buses. Public tenders by the government in Panama and Uruguay have incorporated into vehicle upgrading requirements for strong, maintenance-free battery systems, driving demand.

- Declining global prices of battery minerals, particularly lead and lithium, are making SLI batteries cheaper to purchase throughout the Americas. The trend is being evidenced by increased adoption in cost-sensitive economies such as Ecuador and El Salvador. For example, the IEA revealed in 2025 that the price of lithium decreased by more than 85% from its 2022 high, driving down the cost of battery packs as well as their accessibility.

- Battery-as-a-Service (BaaS) schemes are being launched in major cities throughout North America and selected parts of Latin America, enabling fleet operators to rent SLI batteries with maintenance. This reduces initial expenses and guarantees uniform battery performance, particularly for logistics and taxi fleets in metropolises such as Bogotá and São Paulo.

- Mexico and Colombia are investing in indigenous battery recycling facilities to minimize environmental footprints and increase material recovery. Such initiatives contribute to circular economy objectives and decrease dependence on imported raw materials. Government-initiated programs are encouraging manufacturers to implement closed-loop systems of lead-acid battery recycling.

- The Americas SLI battery market is experiencing more consolidation, where major players acquire local manufacturers to increase their presence and simplify operations. This is motivated by requirements for economies of scale and regulatory compliance. In 2024, a number of mergers were sanctioned by national competition authorities in Brazil and Argentina, foretelling a trend toward fewer but more efficient producers.

America SLI Battery Market Analysis

Learn more about the key segments shaping this market

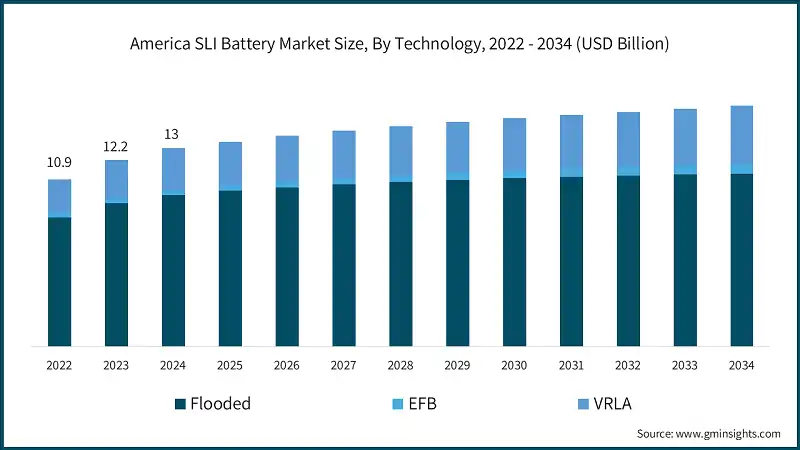

- Based on technology, the industry is segmented into flooded, EFB and VRLA. The America SLI battery market was valued at USD 10.9 billion, USD 12.2 billion, and USD 13 billion in 2022, 2023 and 2024 respectively. The flooded SLI battery segment dominated the Americas market accounting for 70% in 2024 and is expected to grow at a CAGR of 1.4% through 2034.

- Flooded batteries are a popular option in the price-sensitive markets of Latin America as they are cheap and readily available. With their straightforward design and low production cost, they are suitable for mass-market vehicles and agricultural uses. This affordability helps sustain their adoption in nations such as Paraguay, Ecuador, and El Salvador, where vehicle electrification is in nascent stages.

- The increased number of aging vehicles in North and South America continues to drive demand for flooded batteries in the replacement market. Such batteries are widely used in cars older than 10 years, which are predominantly driving roads in most Latin American nations. In 2024, the average age of a vehicle in the U.S. surpassed 12 years, as reported by the U.S. Bureau of Transportation Statistics, supporting the applicability of flooded batteries in replacement cycles.

- Flooded batteries are easily compatible with conventional internal combustion engine (ICE) vehicles, which continue to dominate the vehicle population in the Americas. Their high cranking power delivery capability and ability to perform well in moderate climates guarantee ongoing demand, particularly in areas where hybrid and electric vehicle penetration is low.

- Americas EFBs batteries market size was USD 355 million in 2024 and is expected to grow at a CAGR of 5.4% through 2034. Such batteries are used more in cars with start-stop systems that are now common in mid-size and premium cars. These batteries have better charge acceptance and cycling performance than traditional flooded types. The United States Department of Energy promotes start-stop systems as a major fuel-saving technology, indirectly increasing demand for EFBs.

- EFBs are an affordable substitute for AGM batteries with improved performance at a lower cost, making them desirable to automakers and consumers alike who want the balance between performance and price. Their increasing applications in mid-range cars in the U.S., Mexico, and Brazil are a testament to this positioning. Ongoing advancements in EFB technology, including improved grid alloys and state-of-the-art separators, are lengthening battery life and performance. Such improvements are putting EFBs on more equal footing in both OEM and aftermarket markets.

- AGM batteries are being widely adopted in high-electrification vehicles like luxury vehicles and hybrids. Their sealed construction, vibration tolerance, and deep cycling life make them perfect for future automotive applications. The U.S. DOE holds AGM batteries as appropriate to advanced vehicle technologies like regenerative braking and start-stop systems.

- GEL batteries, which are deep discharge tolerant and low maintenance, are becoming popular for off-road vehicles and remote use throughout South America. Their performance in high-temperature and rough environments makes them ideal for mining, agriculture, and rural transportation in Chile and Argentina.

- Tighter environmental and safety regulations are supporting the use of sealed, maintenance-free batteries such as AGM and GEL. These batteries minimize acid leakage hazards and meet transport and recycling regulations. Under Canadian Environmental Protection Act frameworks in Canada, regulatory structures promote public and commercial fleet use of sealed lead-acid batteries.

Learn more about the key segments shaping this market

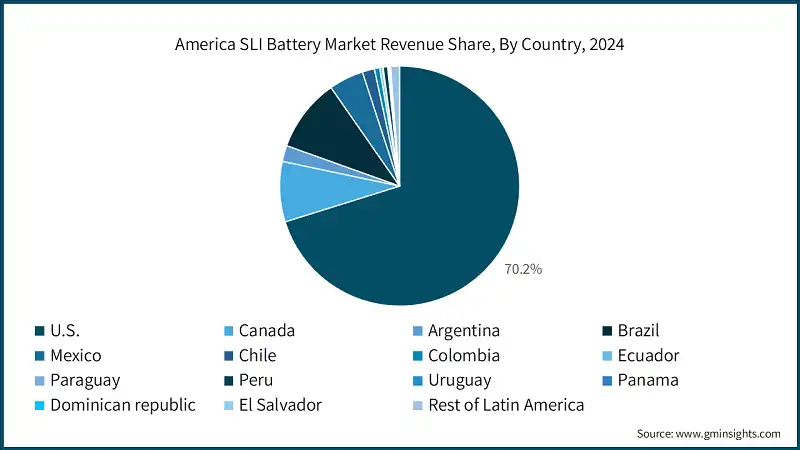

- Based on country, the Americas SLI battery market is segmented into U.S., Canada, Argentina, Brazil, Mexico, Chile, Colombia, Ecuador, Paraguay, Peru, Uruguay, Panama, Dominican Republic, El Salvador and others. The U.S. holds a market share of 70.2% in 2024 and is anticipated to grow over USD 10.7 billion by 2034.

- Canada's harsh winter environment requires SLI batteries with high cold-cranking amps (CCA) to sustain viable ignition of vehicles. The demand driven by climate ensures steady aftermarket sales, particularly in provinces such as Alberta and Quebec. Vehicles in these provinces tend to need battery replacement more frequently because of temperature-driven deterioration, placing cold-weather performance high on the agenda for battery manufacturers planning to target the Canadian market.

- Canada's environmental regulations are in full favor of battery recycling and environmentally friendly disposal processes. Lead-acid battery recycling is promoted by provincial programs and industry alliance under the Canadian Environmental Protection Act (CEPA). This regulatory encouragement enables the increased usage of sealed, recyclable SLI batteries such as VRLA types, facilitating manufacturers' compliance with national sustainability targets alongside increasing their presence in the market.

- Mexico's automotive industry continues to grow, fueled by high export demand and domestic sales of vehicles. Large production centers in Puebla, Guanajuato, and Nuevo León manufacture millions of cars each year, generating strong OEM demand for SLI batteries. This manufacturing activity further fosters nearby suppliers and aftermarket distributors, which positions Mexico as an attractive market for battery manufacturers.

- Aftermarket distribution channels in Mexico are becoming more developed to enhance access to SLI batteries in urban and rural areas. With increased vehicle ownership and older cars still on the road, replacement battery demand increases. Local service centers and distributors are stocking different types of batteries, such as flooded and EFB, to cater to different consumer preferences.

- Argentina's large agricultural industry is built around heavy equipment like tractors and harvesters, which need tough SLI batteries to start them up and power auxiliary systems. These machines tend to work in remote locations with poor maintenance access, so battery reliability is very important. INDEC stated that agricultural equipment sales went up 8% in 2023, demonstrating increased demand for tough battery solutions.

- Government policies to cut emissions and upgrade fleets of vehicles are driving demand for cost-effective SLI batteries. Initiatives on older cars in cities such as Buenos Aires encourage battery replacement and upgrading. These initiatives support growth in the aftermarket and promote take-up of maintenance-free technologies such as VRLA batteries.

- Brazil's auto industry is the biggest in Latin America, with more than 2.3 million units manufactured in 2023. Such a large production level creates high OEM demand for SLI batteries in passenger, commercial, and agricultural markets. Local production also serves regional supply chains and minimizes imports.

- Brazil is investing in electrifying public transport fleets, such as hybrid buses and municipal fleets. These platforms continue to need SLI batteries to power auxiliary functions, continuing demand for sophisticated battery technologies. Government initiatives by the Ministry of Infrastructure facilitate these shifts, opening up market opportunities for battery suppliers to address changing fleet requirements.

Looking for region specific data?

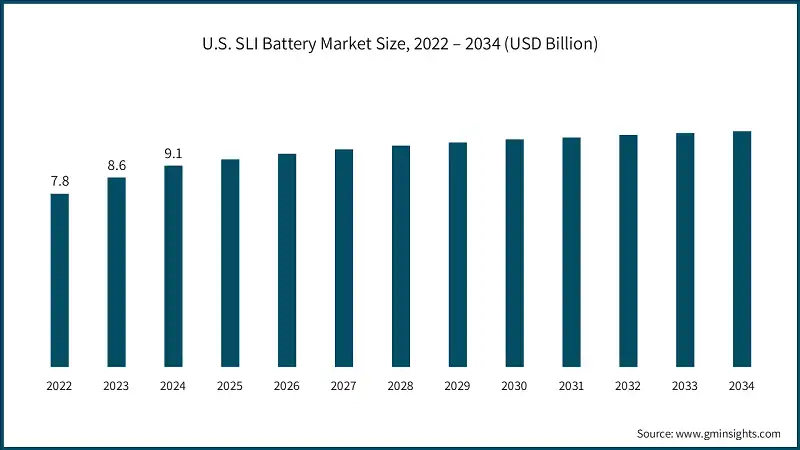

- The U.S. SLI battery market was valued at USD 7.8 billion, USD 8.6 billion and USD 9.1 billion in 2022, 2023 and 2024 respectively. The country held a market share of 70.2% in 2024 and is further poised for substantial growth in the coming years.

- Increasing demand for light-duty trucks and SUVs in the U.S. is fueling the demand for high-performance SLI batteries. It is common for such vehicles to need higher reserve capacity and cold-cranking amps batteries. As per the U.S. Energy Information Administration (EIA), light-duty trucks had over 75% of new vehicle sales in 2024, further setting in place the demand for strong battery solutions within the segment.

- The U.S. government is actively supporting domestic battery production through grants and incentives under the Bipartisan Infrastructure Law. While much focus is on EV batteries, lead-acid battery manufacturers also benefit from supply chain investments and workforce development programs, strengthening the SLI battery industry’s resilience and competitiveness.

- The increasing RV market in the U.S. is fueling demand for SLI batteries, particularly auxiliary power and ignition. As more Americans are adopting mobile lifestyles and outdoor vacations, RV sales have increased. RVs use dual battery systems, which involve SLI batteries, for onboard equipment and engine start.

- As electrification moves forward, there are still numerous hybrid and electric government fleets that utilize SLI batteries for ancillary purposes. The U.S. General Services Administration (GSA) continues to buy hybrid vehicles for federal fleets, supporting demand for AGM and EFB batteries used for lighting, ignition, and backup applications.

- The mining sector of Chile, which is one of the largest in Latin America, depends on industrial vehicles and machinery that utilize SLI batteries for starting and illumination. The tough operating conditions in mining areas call for robust battery technologies. Government-supported mining development schemes in areas such as Antofagasta are indirectly increasing demand for heavy-duty SLI batteries.

- Growing middle-class populations and rapid urbanization in nations such as Peru, Colombia, and the Dominican Republic are driving motor vehicle ownership. This trend fuels the demand for aftermarket SLI batteries, particularly for older vehicles. Latin America experienced a 9% boost in vehicle registrations in 2023, as reported by OICA, boosting battery replacement cycles.

- Latin American nations are adopting more stringent automotive reliability and safety standards, promoting certified and high-performance SLI battery usage. These standards are especially important in commercial fleets and public transportation, where battery failure can affect operational safety. Ecuador and Panama, for example, have established new vehicle inspection procedures that cover battery performance testing.

America SLI Battery Market Share

- The top 5 companies in the America SLI battery industry are Clarios, East Penn Manufacturing, Exide Technologies, EnerSys, and ACDelco, collectively contributing around 50% of the market in 2024.

- Clarios dominates the Americas SLI battery market through its extensive OEM relationships, supplying batteries to top automakers across the region. Its advanced AGM and EFB technologies support modern vehicle systems, including start-stop and energy recovery. With manufacturing facilities strategically located in the U.S., Mexico, and Brazil, Clarios ensures efficient distribution and responsiveness to regional demand, reinforcing its leadership in both original equipment and aftermarket segments.

- Clarios also benefits from a strong aftermarket presence, supported by retail partnerships and a wide distribution network. Its brands—VARTA, OPTIMA, and Delkor—are trusted across North and South America for performance and reliability. The company’s commitment to sustainability, including closed-loop recycling systems, aligns with environmental regulations and consumer expectations. This combination of technological innovation, brand strength, and operational scale secures Clarios’ substantial market share in the region.

- EnerSys holds a significant position in the Americas SLI battery market by serving commercial, industrial, and specialty vehicle segments. Its Odyssey brand is widely used in fleets, emergency vehicles, and recreational platforms, offering high reserve capacity and deep-cycle performance. EnerSys’ focus on durability and reliability makes it a preferred choice for demanding environments, especially in sectors requiring consistent power delivery and minimal maintenance.

- The company’s vertically integrated operations and advanced manufacturing facilities in the U.S. and Mexico support regional demand efficiently. EnerSys also benefits from its presence in defense and aerospace sectors, where battery reliability is critical. These capabilities enhance its reputation and expand its reach into automotive applications. By combining industrial-grade performance with automotive compatibility, EnerSys continues to grow its footprint in the Americas SLI battery landscape.

America SLI Battery Market Companies

Major players operating in the America SLI battery industry are:

- ACDelco

- Acumuladores Moura

- Banner

- Clarios

- Continental Battery Systems

- Crown Battery

- Discover Battery

- Dyno Battery

- East Penn Manufacturing

- EnerSys

- ETNA

- Exide Industries

- Exide Technologies

- FIAMM Energy Technology

- GS Yuasa

- Hankook & Company

- Interstate Batteries

- Leoch International

- MEBCO Batteries

- MOLL Batterien

- Clarios consolidated its position as the top player in the Americas SLI battery market in 2024 with USD 10.6 billion revenue and more than 154 million batteries sold. With 80% aftermarket sales, Clarios increased its AGM capacity and made USD 1 billion investments in U.S. operations. Its chemistry-agnostic solutions, circular recycling network, and smart battery technologies integration enable it to dominate the low-voltage energy transition in North and South America.

- EnerSys posted robust 2024 fiscal results on the back of its Odyssey line of batteries and industrial-grade SLI solutions. The company diversified its offerings with Odyssey Pro Batteries providing 10% greater reserve capacity through next-generation carbon additives. EnerSys' vertically integrated facilities and bases in the U.S. and Mexico help manage regional demand effectively. Its reliability and durability reputation in commercial and specialty vehicle markets further solidifies its position in the market.

- East Penn Manufacturing is a major presence in the Americas SLI battery market through its best-selling Deka battery brand and robust domestic manufacturing footprint in the U.S. East Penn's vertically integrated business—lead smelting to battery assembly—assures quality assurance and supply chain stability. East Penn continues to expand in sustainable manufacturing and recycling, meeting environmental regulation requirements and bolstering its reputation for dependability in both OEM and aftermarket markets.

- Exide Technologies remains positioned in the Americas SLI battery market with a wide product range and robust aftermarket footprint. Exide has concentrated on growth in its AGM and EFB lines to address the requirements of newer vehicles. Exide's investment in recycling facilities and adherence to environment standards underlines its commitment to sustainability. Its established brand reputation and distribution system in Latin America provide support for its competitive advantage in replacement and industrial battery markets.

- Interstate Batteries is still a reliable name in the U.S. aftermarket SLI battery market, buttressed by its large distribution network and retail relationships. The company's emphasis on customer service, battery recycling, and national availability renders it a go-to option for consumers as well as service centers. Interstate continues to broaden its product offerings to encompass AGM and specialty batteries, supporting its continued relevance in a market fueled more and more by sophisticated vehicle technologies and sustainability.

America SLI Battery Industry News

- In October 2024, East Penn Manufacturing became the first US company to earn UL 1973 certification for its advanced lead-acid batteries. This certification, which ensures the safety of batteries used in stationary applications like energy storage, highlights East Penn's commitment to quality and safety standards. The certification is an important milestone, demonstrating East Penn’s dedication to meeting evolving energy storage and safety requirements.

- In July 2024, Crown Battery announced a USD 30 million expansion project at its Ohio manufacturing facility, set to begin in August 2024. The investment will incorporate advanced equipment and automation technologies, boosting production capacity and efficiency to meet the growing demand for energy storage solutions across various sectors, including renewable energy, automotive, and industrial applications. This expansion demonstrates Crown Battery’s commitment to sustainability and high-quality, reliable products. By creating local jobs and focusing on innovation, the company reinforces its leadership in the global battery industry. The project is expected to be completed by late 2025.

- In July 2022, Enersys announced the opening of a 195,000 sq. ft. distribution center as an extension of its Richmond, Kentucky facility. This new center is designed to enhance order fulfillment and delivery capabilities, enabling faster and more reliable service to customers across Kentucky. The facility underscores Enersys' commitment to operational efficiency and customer satisfaction while contributing to job creation in the region. By expanding its infrastructure, the company also strengthens its social responsibility initiatives, supporting economic growth and community development in the years ahead.

- In April 2024, Clarios announced a partnership to supply a leading automaker with its advanced high-performance Absorbent Glass Mat (AGM) battery. This 12V technology enhances fuel economy and reduces CO2 emissions, supporting the automotive industry’s sustainability goals. Designed for modern vehicles with advanced start-stop systems and power-intensive features, the AGM battery improves performance, reliability, and energy efficiency. Its maintenance-free design and durability further minimize environmental impact. This collaboration highlights Clarios’ commitment to sustainable energy storage solutions and solidifies its leadership in automotive battery innovation, reinforcing its role in advancing eco-friendly technologies for the future.

The America SLI battery market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Million) and volume (Million Units) from 2021 to 2034, for the following segments:

Market, By Technology

- Flooded

- EFB

- VRLA

- AGM

- GEL

The above information has been provided for the following countries:

- U.S.

- Canada

- Argentina

- Brazil

- Mexico

- Chile

- Colombia

- Ecuador

- Paraguay

- Peru

- Uruguay

- Panama

- Dominican Republic

- El Salvador

Frequently Asked Question(FAQ) :

What is the growth outlook for the U.S. within the American SLI battery sector?

The U.S. held a 70.2% market share in 2024 and is projected to surpass USD 10.7 billion by 2034, led by advancements in battery technology and increased adoption.

Who are the major players in the American SLI battery industry?

Key players include ACDelco, Acumuladores Moura, Banner, Clarios, Continental Battery Systems, Crown Battery, Discover Battery, Dyno Battery, East Penn Manufacturing, EnerSys, ETNA, Exide Industries, FIAMM Energy Technology, and GS Yuasa.

What are the key trends shaping the American SLI battery market?

Key trends include battery standardization, sustainable materials, fleet upgrades, falling mineral prices, BaaS models, and recycling investments.

What share did flooded SLI batteries hold in 2024?

Flooded SLI batteries dominated the market with a 70% share in 2024 and are expected to witness over 1.4% CAGR through 2034.

What was the valuation of the EFB batteries segment in 2024?

The EFB batteries segment was valued at USD 355 million in 2024 and is anticipated to expand at a CAGR of 5.4% till 2034.

What is the market size of the American SLI battery in 2024?

The market size was USD 13 billion in 2024, with a CAGR of 1.8% expected through 2034. The market growth is driven by increasing automobile production in Latin American countries like Brazil, Argentina, and Mexico.

What is the projected value of the American SLI battery market by 2034?

The market is projected to reach USD 15.8 billion by 2034, supported by trends such as sustainability initiatives, public fleet modernization, and declining battery mineral prices.

America SLI Battery Market Scope

Related Reports