Summary

Table of Content

Alternative Protein Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Alternative Protein Market Size

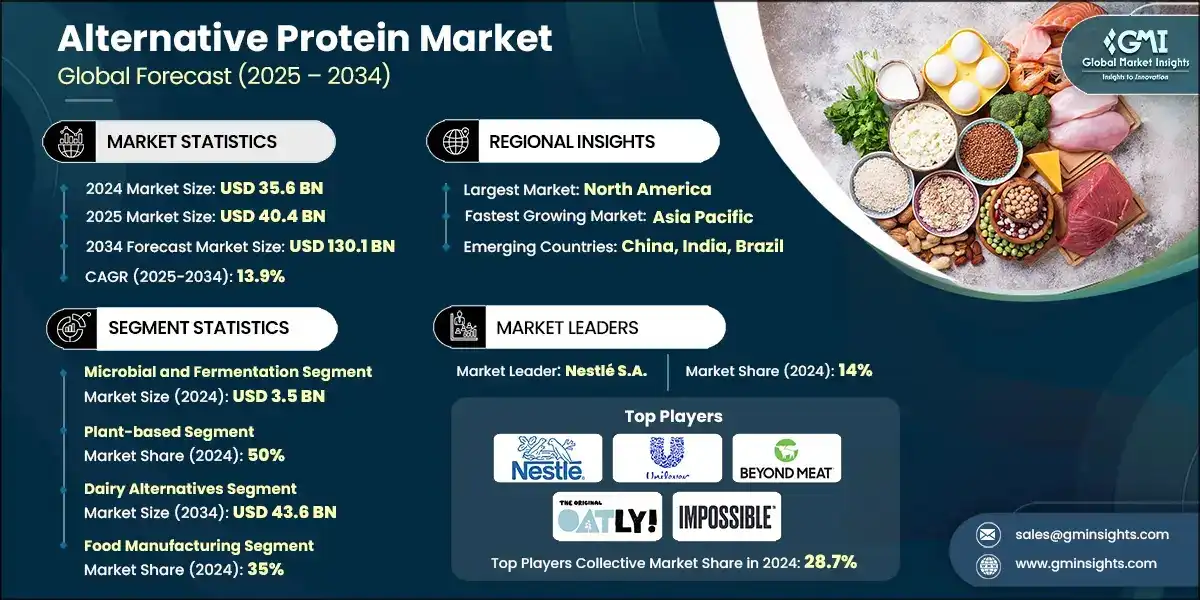

The global alternative protein market size was estimated at USD 35.6 billion in 2024. The market is expected to grow from USD 40.4 billion in 2025 to USD 130.1 billion in 2034, at a CAGR of 13.9% according to latest report published by Global Market Insights Inc.

To get key market trends

- Major factors in the market progress include changing consumer preferences, the need for sustainability, and fast biotechnological innovation. Alternative proteins are now perceived as one of the solutions to the problem of global protein security, as the traditional meat and dairy industries are under environmental and ethical pressures. Unexpected regulatory support, growing venture capital investments and rising retail presence are the factors that will contribute to the market's long-term growth potential.

- The plant-based proteins sector was the largest with a 40% market share in the year 2024, mainly due to their functional versatility and ability to be produced on a large scale. The use of new legumes, algae, and fermentation feedstocks is creating more possibilities for formulation diversity. Functional additives, such as emulsifiers, flavoring systems, and binding agents are projected to grow at the fastest rate of 15.9% among all the mentioned categories in the forecast period,

- Plant protein processing cultivated meat production, and fermentation platforms together represent nearly 85% of the market. Companies working in hybrids that bring together different technologies are getting noticed for their ability to enhance the texture, reduce the cost and improve the nutrient content of the final product. Besides, new technologies like 3D food printing and AI-driven molecular farming are thought to improve manufacturing efficiency, product customization, and scaling-up capabilities in the coming years.

- Plant-based alternatives to meat and dairy are leading in consumer availability and adoption, while dairy proteins produced by precision fermentation as well as cultivated seafood are getting regulatory approval. The food manufacturing space was valued at USD 12.4 billion in 2024, allowing for initial industrial scaling using supply to large food producers and food contract manufacturers. Fast food outlets and institutional catering are deploying plant-based menus more frequently in order to get more consumer exposure. Retail channels, particularly e-commerce, are making it easier for consumers to access products.

- North America is projected to have the largest market share at 38.7% in 2025, while Europe is the most innovative with strong regulations and advanced R&D support. Asia Pacific is the area with the highest growth rate, having a CAGR of 20% due to rising population and protein demand.

Alternative Protein Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 35.6 Billion |

| Market Size in 2025 | USD 40.4 Billion |

| Forecast Period 2025–2034 CAGR | 13.9% |

| Market Size in 2034 | USD 130.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing global protein demand amid population growth | Rising population intensifies protein demand, accelerating innovation and adoption of sustainable alternative protein sources worldwide. |

| Environmental sustainability & climate change mitigation urgency | Heightened sustainability awareness compels investment in low-emission protein technologies, driving eco-friendly and resource-efficient production systems. |

| Government investment & policy support acceleration | Increased public funding and supportive policies enhance R&D capacity, regulatory clarity, and commercialization speed across global markets. |

| Pitfalls & Challenges | Impact |

| High production costs & manufacturing scale-up barriers | Elevated production costs restrict scalability and limit market accessibility, delaying cost parity with conventional protein sources. |

| Consumer acceptance & taste perception gaps | Sensory inconsistencies and unfamiliarity reduce repeat purchases, slowing mainstream adoption despite growing awareness of sustainable options. |

| Opportunities: | Impact |

| Emerging market penetration & LMIC expansion potential | Expanding into low- and middle-income countries unlocks significant demand, supporting affordable, localized protein innovation initiatives. |

| B2B ingredient market & food service integration | Partnerships with large manufacturers and food chains strengthen distribution networks and drive mass-market adoption of alternative proteins. |

| Hybrid product development & technology convergence | Combining plant, cell, and fermentation platforms enables superior texture, cost reduction, and accelerated consumer acceptance globally. |

| Market Leaders (2024) | |

| Market Leaders |

14% |

| Top Players |

Collective Market Share 28.7% in 2024 |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

Alternative Protein Market Trends

- Precision fermentation is changing the game of protein production, allowing the scalable production of high-purity, functional dairy, egg, and specialty proteins. Entrepreneurs and incumbent manufacturers are expanding their use of engineered microbes to match the nutritional value of animal proteins. Technology also enables value-added customization of amino acid profiles in an economically sustainable manner, while promoting cleaner labels and sourcing an alternative protein source that is less resource-intensive than traditional agricultural inputs.

- The concept of hybrid protein systems that combine plant, cell-based and fermentation sources is taking shape and emerging as the most practical strategy toward sensory and economic optimization. These systems achieve improved economics, palatability and nutritional balance. Gradually moving consumers toward sustainable alternatives from traditional meat will be both valuable for consumers and allow manufacturers to vary their risk and benefit from regulatory flexibility across their product offerings.

Alternative Protein Market Analysis

Learn more about the key segments shaping this market

Based on raw material, the alternative protein market is segmented into plant based, microbial & fermentation, cell culture, and functional additives.

- Plant-based sources such as soy, pea, and wheat commanded approximately 40% of total market share in 2024. Newer sources of legumes, grains, and tubers such as mung, fava, and potato, are gaining market share as they are synonymous with being lower allergenic and for their versatility across geographies.

- The market value of microbial and fermentation inputs yielded USD 3.5 billion in 2024, where the production of proteins here and tailored profiles is lucrative for the market.

- Cell culture materials used for cultivated meat development will come from scaffolds, cell lines, and enhanced growth media. Functional additives improve the functionality and acceptance of alternative proteins among consumers by mimicking animal products in texture, mouthfeel, taste, and overall realism.

Learn more about the key segments shaping this market

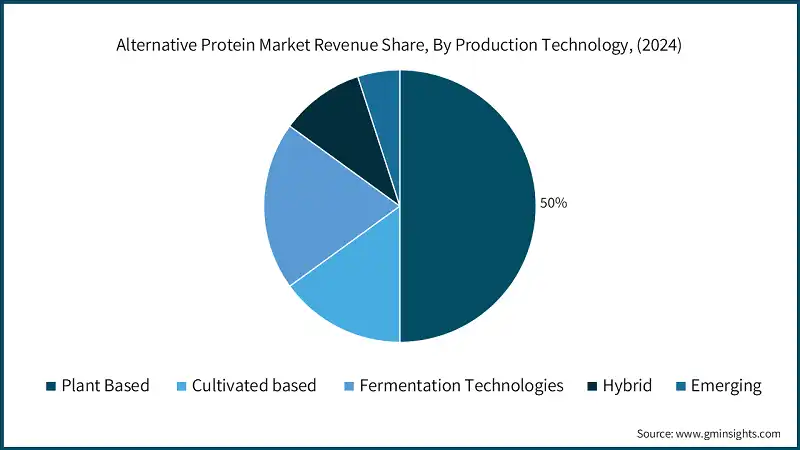

Based on production technology, the alternative protein market is segmented into plant based, cultivated based, fermentation, hybrid, and emerging technologies.

- In 2024, plant-based proteins accounted for 50% of the market, employing various advances in extraction, extrusion, and texturization to create animal-like textures. Cultivated meat technologies utilized bioreactors, pre-formulated media, and structured cell differentiation processes to produce real animal tissue, completely sidestepping traditional livestock production.

- Fermentation, from both biomass and precision formats, provides a high yield with lower resource use for protein and lipid synthesis. Hybrid processing is forecasted to grow 15% CAGR in the projected year as it brings different processing formats together to achieve the best possible flavor, texture and nutritional profile.

- Disruptive technologies, such as 3D food printing, AI-based design for proteins, and smart manufacturing and/or bioprocess control will continue to provide scalability and efficiencies while working to minimize waste. Continued innovations in downstream purification and quality control protocols will ensure compliance and consistent sensory quality.

- The firms that can leverage automation, digital technologies for monitoring, and modular manufacturing will be able to build speed to scale up and/or better efficiency of cost. Combining biotechnology and food science focuses on protein production for a sustainable industrial ecosystem aligned to global food security initiatives.

Based on product category, the alternative protein market is segmented into protein ingredients & intermediates, meat alternatives, dairy alternatives, seafood alternatives, egg alternatives, pet food alternatives, and nutritional supplements & protein powders.

- Meat substitutes, which include ground meat, whole-cut meats and processed meats, will have the largest share, representing 30% of the market in 2024 as adoption spreads into mainstream retail and food service channels.

- Dairy alternatives are also evolving through plant-based and precision fermentation technologies, yielding milk, cheese, and yogurt alternatives with true sensory attributes. The dairy alternatives market is expected to reach USD 43.6 billion by 2034.

- Emerging seafood alternatives are also addressing sustainability concerns and overfishing e.g., algae-based or cultivated seafood. Egg alternatives will take the form of both liquid and powdered options and offer functional alternatives for the bakery and prepared food categories.

- Pet food is projected at a 17% CAGR throughout the forecast period with innovation being at the core of insect, plant and cultured protein alternatives in pet food, reflecting the ethical and environmental views of pet owners. Nutrition supplements and protein powders continue to drive interest among fitness and wellness consumers due to convenience and performance advantages.

Based on end user, the alternative protein market is segmented into food manufacturing/B2B, food service, retail/consumer, and industrial applications.

- The food manufacturing industry maintains its top position as the largest end user in 2024 with 35% of the market, as they are adopting alternative proteins for their existing reformulated and new product offerings. Plant-based menus in quick-service and full-service restaurants are becoming more popular, as consumer preferences shift toward sustainable restaurants and dining options.

- Consumers typically interface with retail entities like groceries, and e-commerce for their household consumption needs. Institutional food services such as schools, hospitals, corporations, etc. are also beginning to adopt alternative proteins in response to sustainability mandates.

- Proteins are also utilizing functionality biomaterials in more industrial applications like cosmetics, pharmaceuticals, and biotechnology as this area has the potential to grow at a 16.1% CAGR through the forecasting period.

- Alternative proteins are versatile, affecting food service, retail, and industrial applications, which gives companies options to implement alternative proteins while also meeting new sustainability goals and managing new revenue sources.

Looking for region specific data?

In 2024, North America has a market value of USD 14.2 billion, and a CAGR of 10%.

- The North American market continues to thrive owing to its highly developed R&D infrastructure, strong support from investors, and receptivity of consumers for sustainable derivatives of food.

- The U.S. has positioned itself as the leading country in North America regarding alternative protein markets due to significant government support, new advancements in technology, and a developed food industry. The USDA and FDA's regulations on plant and cell cultured as well as fermentation proteins encourages innovations and market entry. Besides, this country has some of the largest alternative protein companies and investment in research and development facilities which substantiates the country’s dominance in this sector.

Europe held alternative protein market value of USD 8.9 billion in 2024, led specifically by the trend toward sustainability, government funding, and consumer environmental beliefs.

- Europe still acts as a regulatory hub for innovation, with an emphasis on sustainability, food safety, and ethical sourcing. Key countries are Germany, and U.K., are leading the charge toward advancing precision fermentation and plant-based product portfolios.

- Consumer demand for transparency and reduction of environmental impact will dictate public policy support. Finally, regional collaborations and green investment funds are further aiding the scalability and competitiveness of the industry.

In 2025, Asia Pacific is projected to reach USD 37.1 billion and is estimated to hold 20% of the market share in 2034.

- China, India, and Japan will be manufacturers and bio processors of innovation, while support from their governments will enhance alternative proteins focused on government food sustainability programs. An increasing population of middle-class consumers and changing dietary preferences will strengthen the outlook for market demand and further attract investment in this sector.

Latin America alternative protein market is incrementally increasing and is anticipated to achieve an approximate value of USD 3.5 billion by 2024.

- Latin American markets are starting to develop from accessibility to agricultural resources and awareness for sustainable practices. Brazil and Mexico are at the front of regional innovation, particularly soybean and pea production for plant based. Spending on fermentation, as well as hybrid and customization technologies, are on the upswing. Local start-ups and global business partnerships also provide means to expand export potential and build out localized, diversified, and cost-effective protein production ecosystems throughout the continent.

MEA is increasing its footprint and was expected to account for 5% of market share in 2025.

- Gulf nations continue to invest heavily in food-tech incubators, however cultivated meat is becoming increasingly feasible. Similarly, South Africa is leading the adoption of this in sub-Saharan Africa due to their retail sector model, in addition to structural support via the government's systematic policies that aim to support import substitution policies and investing in capital markets and infrastructure that sustainably support localized protein production and self-sufficiency.

Alternative Protein Market Share

The top 5 companies in the alternative protein are Nestle, Unilever, Beyond Meat, Oatly, And Impossible Foods.[SQ1] These are significant players in their respective areas and represent 28.7% of the total market share.

Mergers and collaborative rhetoric are driving knowledge acquisition and penetration into the alternative protein market. The competitive position of the companies is increasingly focused on existing R&D intensity, patent ownership, and regulatory preparedness. Companies with sustainability metrics, transparency in labeling, and digital traceback have specific advantages in the marketplace. The market will reinforce further consolidation while options for differentiation or competitive advantage will be adoption of hybrid technology, the ability to manufacture regionally, and co-manufactured branded products.

- Nestlé is regarded as one of the world's foremost innovators in the food sector and is actively growing its portfolio of alternative proteins via its various brands. Nestlé is focused on plant-based meats, dairy, and beverage substitutes, and its R&D centers are focused on nutritional optimization, clean-labeling, and hybrid products to capture growing consumer interest in sustainable, high-protein products.

- Unilever has incorporated alternative proteins into its plant-based nutrition business in a deliberate manner through The Vegetarian Butcher and other sustainable food brands. Like Nestlé, Unilever is focused on meat and dairy alternatives, utilizing its vast distribution and marketing resources around the globe. Ongoing innovation is facilitating texture improvement and carbon reductions, consistent with Unilever's stated goal of achieving net-zero food production.

- Beyond Meat has developed the plant-based meat category by creating meat substitutes that are similar to animal-based products in texture. The company’s proprietary blending and extrusion technology creates taste profiles associated with authentic forms of meat. Beyond Meat is focused on partnerships with retailers and restaurants across the globe to achieve establishment of the sustainable alternative protein category as an accepted and preferred protein source.

- Oatly specializes in products that are dairy alternatives made from oats, including milks, ice creams, and yogurts. The company uses proprietary enzymatic processing to optimize nutritional content and sensory properties. Oatly advocates transparency, lower environmental burden, and circularity of production. Oatly is expanding its manufacturing to other parts of the world and has established itself as a leading organization within the plant-based drink and dairy alternative market.

- Impossible foods develops plant-based meat products through the use of precision fermentation to replicate animal proteins, such as heme. Their innovation sits heavily on creating a taste and appearance that is close to real animal meat while reducing resource intensity. The company has partnerships with food service chains and retailers to provide global platform for distribution. They have continued research and development in processes that lower cost and sustainability in plant-based meat products.

Alternative Protein Market Companies

Major players operating in the alternative protein industry include:

- Aleph Farms Ltd.

- Beyond Meat Inc.

- Danone S.A.

- Eat Just Inc.

- Givaudan S.A.

- Impossible Foods Inc.

- Ingredion Incorporated

- Mosa Meat B.V.

- Nature's Fynd Inc.

- Nestlé S.A.

- Oatly Group AB

- Perfect Day Inc.

- Planted Foods AG

- Quorn Foods

- Roquette Frères S.A.

- The EVERY Company

- Tyson Foods Inc.

- Unilever PLC

- Upside Foods Inc.

- Wilmar International Limited

Protein Industry News

- In October 2025, The Every Co and Vivici announced plans to build a 4-million-litre alternative protein facility in Abu Dhabi based on precision portfolio proteins from eggs and dairy to develop the UAE’s biotechnology ecosystem and regional food security while servicing global markets.

- In December 2024, Griffith Foods announced the launch of its first Alternative Proteins Portfolio, including plant-based solutions and vegan recipes across seasonings, sauces and binds as well as all-in-one powders focused on scaling sustainable proteins, improving nutrition value, and supporting regenerative agriculture initiatives across the globe.

This alternative protein market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Tons) from 2025 to 2034, for the following segments:

Market, By Raw Material

- Plant based

- Soy based

- Pea protein

- Wheat gluten & cereal protein

- Legume (mung, fava, chickpea)

- Novel plant

- Microbial & fermentation

- Culture media

- Microorganisms strains

- Fermentation substrates

- Cell culture

- Functional additives & ingredients

- Emulsifiers & stabilizers

- Flavoring & seasoning

- Binding & texturing

- Nutritional fortification

- Others

Market, By Production Technology

- Plant based

- Cultivated

- Fermentation

- Hybrid processing

- Emerging technologies

- 3D food printing systems

- Novel extraction

- Advanced bioprocessing

Market, By Product Category

- Protein ingredients & intermediates

- Protein isolates & concentrates

- Functional protein ingredients

- Specialty protein

- Meat alternatives

- Ground meat

- Whole cut meat

- Processed meat (sausages, nuggets, patties)

- Dairy alternatives

- Milk

- Cheese

- Yoghurt & ice cream

- Precision fermentation dairy proteins

- Seafood alternatives

- Egg alternatives

- Pet food alternatives

- Nutritional supplement & protein powders

Market, By End Use

- Food manufacturing

- Food service

- Quick service

- Full service

- Institutional food service (hospitals, schools, corporate)

- Retail/consumer

- Grocery retail

- E-commerce

- Specialty/natural food stores

- Others (cosmetics & personal care, pharmaceuticals)

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Which region leads the alternative protein sector?

North America leads the market with a valuation of USD 14.2 billion in 2024 and a CAGR of 10% till 2034. The market is supported by advanced R&D infrastructure, strong investor backing, and consumer receptivity to sustainable food derivatives.

What are the upcoming trends in the alternative protein market?

Trends include precision fermentation for scalable protein production, hybrid protein systems for sensory and economic optimization, and advancements in plant-based and cultivated meat technologies.

Who are the key players in the alternative protein industry?

Key players include Aleph Farms Ltd., Beyond Meat Inc., Danone S.A., Eat Just Inc., Givaudan S.A., Impossible Foods Inc., Ingredion Incorporated, Mosa Meat B.V., Nature's Fynd Inc., and Nestlé S.A.

What was the market share of plant-based proteins in 2024?

Plant-based proteins accounted for 50% of the market in 2024, led by advancements in extraction, extrusion, and texturization technologies.

What is the expected size of the alternative protein industry in 2025?

The market size is projected to reach USD 40.4 billion in 2025.

How much revenue did the microbial and fermentation inputs segment generate in 2024?

The microbial and fermentation inputs segment generated approximately USD 3.5 billion in 2024, showcasing its lucrative potential in protein production.

What is the market size of the alternative protein in 2024?

The market size was USD 35.6 billion in 2024, with a CAGR of 13.9% expected through 2034. Factors such as changing consumer preferences, sustainability needs, and biotechnological advancements are driving market growth.

What is the projected value of the alternative protein market by 2034?

The market is poised to reach USD 130.1 billion by 2034, driven by innovations in precision fermentation, hybrid protein systems, and increasing retail presence.

Alternative Protein Market Scope

Related Reports