Summary

Table of Content

Airport Security Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Airport Security Market Size

The global airport security market was estimated at USD 19.9 billion in 2025. The market is expected to grow from USD 21.4 billion in 2026 to USD 45 billion by 2035, at a CAGR of 8.6% during the forecast period of 2026–2035 according to latest report published by Global Market Insights Inc. Growth is driven by rising global air travel, increasing threats that require advanced surveillance and screening technologies, and strong investments in modernizing airport infrastructure. The rise in automated security lanes, biometric verification, AI-powered threat detection, and cybersecurity solutions further fuels adoption.

To get key market trends

- Growing international and domestic air travel is driving airports to upgrade their security systems to manage high passenger volumes efficiently. Increasing tourism, expanding airline networks, and recovering post-pandemic traffic fuel investments in screening, scanning, and surveillance technologies to maintain safety while minimizing delays and operational bottlenecks. For instance, in May 2025, Leidos has signed a $350 million Memorandum of Understanding (MoU) with Saudi Arabia’s National Security Services Company (SAFE) to enhance the country’s security screening capabilities. The partnership focuses on deploying advanced scanning technologies, improving threat detection, and strengthening national security infrastructure, supporting Saudi Arabia’s broader efforts to modernize and elevate its security ecosystem.

- Airports are increasingly implementing next-generation security systems such as 3D computed tomography scanners, millimeter-wave body scanners, explosive trace detectors, and AI-based anomaly detection. These innovations improve accuracy, reduce false alarms, and enable faster passenger throughput, encouraging continuous modernization of airport checkpoints and baggage handling security infrastructure worldwide. For instance, in January 2025, Smiths Detection has expanded its partnership with Fukuoka Airport to strengthen security infrastructure by deploying advanced 3D X-ray scanning technologies, enabling clearer, more detailed baggage imaging, faster screening processes, and higher threat detection accuracy, supporting the airport’s efforts to modernize its security systems and enhance overall passenger safety.

- Between 2022 and 2024, the airport security market experienced significant growth, rising from USD 16.2 billion in 2022 to USD 18.6 billion in 2024. A major trend during this period was Governments and airport operators are adopting facial recognition, iris scanning, and fingerprint identification to create seamless, touch-free passenger journeys. These biometric systems enhance identity verification accuracy, support faster boarding, and reduce human error. Growing demand for secure, hygienic, and automated processes is accelerating the deployment of biometric-based airport security solutions. For instance, in December 2025, Idemia Public Security has signed a strategic MoU with Matarat Holding, the operator of 27 airports across the Kingdom, to advance airport security and passenger management systems through enhanced biometric identification, smart screening technologies, and digital security solutions, supporting Saudi Arabia’s goal of modernizing and streamlining airport operations.

- Digital transformation in airports such as automated check-ins, smart gates, connected sensors, and cloud systems has heightened cybersecurity risks. As cyberattacks targeting aviation infrastructure escalate, airports are investing heavily in firewalls, intrusion detection, encryption, and real-time threat intelligence to safeguard critical systems, protect passenger data, and ensure operational continuity. For instance, in November 2025, SriLankan Airport and Ground Services expanded its self-check-in services to customer airlines at Bandaranaike International Airport (BIA), enhancing passenger convenience, reducing wait times, and streamlining airport operations through automated check-in solutions.

- Stricter aviation safety standards issued by global and national regulatory bodies drive significant upgrades in airport security systems. Mandates for advanced baggage screening, real-time tracking of security incidents, and enhanced perimeter surveillance push airports to adopt compliant technologies, ensuring adherence to global aviation security frameworks and improving overall safety. For instance, in November 2025, Leidos partnered with Quadridox to develop advanced checked baggage screening technology, aiming to enhance threat detection, improve operational efficiency, and strengthen airport security through next-generation screening solutions.

- The shift toward smart airports is accelerating demand for integrated, automated security systems. Technologies such as IoT sensors, AI-enabled video analytics, autonomous patrolling robots, and automated security lanes enhance surveillance and streamline operations. This digital evolution drives investment in intelligent security infrastructure capable of supporting future-ready airport environments. For instance, in December 2025, IBM partnered Riyadh Air have announced plans to launch the first AI-native airline, leveraging artificial intelligence to enhance customer travel experiences, optimize operational efficiency, and deliver personalized services throughout the passenger journey.

Airport Security Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 19.9 Billion |

| Market Size in 2026 | USD 21.4 Billion |

| Forecast Period 2026-2035 CAGR | 8.6% |

| Market Size in 2035 | USD 45 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising global air passenger traffic driving demand for efficient and advanced security screening. | Advanced screening technologies drive approximately 35% of market demand due to increasing adoption across international and domestic airports. AI-enabled 3D X-ray scanners, biometric systems, and automated screening platforms enhance threat detection, operational efficiency, and passenger safety, driving widespread implementation of advanced airport security solutions. |

| Increasing threats from terrorism and criminal activities necessitating enhanced surveillance and screening solutions. | Increasing government regulations and aviation security standards contribute around 30% to market growth. Mandatory compliance, standardized security protocols, and the need for faster, safer passenger processing encourage airports to implement advanced screening and monitoring technologies. |

| Stringent government regulations and mandatory aviation security standards enforcing infrastructure upgrades. | Expansion and modernization of airport infrastructure fuels roughly 20% of market growth, as advanced security systems reduce reliance on manual checks, improve operational efficiency, and allow seamless integration into both new and existing terminals. |

| Technological advancements in 3D X-ray scanners, AI-based threat detection, and automated screening systems. | Technological advancements in AI, IoT, and automated surveillance enable about 15% market improvement, enhancing threat detection accuracy, real-time monitoring, predictive risk analysis, and passenger flow management, thereby boosting adoption of smart airport security solutions. |

| Growing investments by airport authorities and private players in integrated, smart security solutions. | Rising awareness of passenger safety and efficiency drives approximately 10% of market growth, as travelers increasingly expect faster, contactless, and reliable screening processes, motivating airports to deploy modern security systems to enhance overall passenger experience and operational productivity. |

| Pitfalls & Challenges | Impact |

| High capital and installation costs of advanced security systems limiting adoption. | High capital and installation costs are limiting adoption of advanced airport security systems. Airports face significant expenditures for purchasing, deploying, and maintaining AI-enabled scanners, 3D X-ray machines, and biometric platforms. These upfront investments, along with ongoing operational and training expenses, create financial barriers, particularly for smaller or regional airports. |

| Challenges in integrating new technologies with legacy airport infrastructure. | Challenges in integrating new technologies with legacy infrastructure hamper market growth. Existing airport layouts, older screening systems, and incompatible IT frameworks make deployment of modern security solutions complex. Integration delays, workflow disruptions, and additional customization requirements increase operational risks and costs, slowing adoption of advanced security technologies across both established and developing airports. |

| Opportunities: | Impact |

| Adoption of AI, machine learning, and IoT-based airport security solutions. | Adoption of AI, machine learning, and IoT-based airport security solutions presents a significant opportunity. Advanced analytics, predictive threat detection, automated surveillance, and real-time monitoring enhance security efficiency, reduce false alarms, and optimize passenger flow. Airports implementing AI-driven systems can improve safety and operational effectiveness while reducing human intervention. |

| Expansion of airport infrastructure in emerging economies driving demand for modern security solutions. | Expansion of airport infrastructure in emerging economies is fueling demand for modern security solutions. New and upgraded airports require state-of-the-art screening technologies, including 3D X-ray scanners, biometric systems, and automated baggage handling. Growing air traffic, government investments, and infrastructure modernization initiatives create a favorable environment for deploying advanced security systems across emerging markets. |

| Market Leaders (2025) | |

| Market Leaders |

18.3% market share. |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Airport Security Market Trends

- A key trend shaping the airport security industry is the rising demand for automated, contactless, and flexible screening solutions that offer faster deployment and high reliability. Advanced 3D X-ray scanners, biometric identification systems, and automated security checkpoints reduce operational complexity and enhance passenger throughput across global airports.

- For instance, in 2025, Smiths Detection expanded partnerships with major airports to deploy advanced 3D scanners and automated screening systems, enabling faster threat detection, improved passenger safety, and enhanced operational efficiency.

- The growth of smart airports, digital infrastructure, and connected aviation facilities is accelerating adoption of automated security technologies. These solutions support scalable networks, real-time threat detection, and personalized security protocols, making them essential in high-traffic airports where speed, safety, and efficiency are critical.

- As security requirements become more advanced, airport screening solutions are incorporating AI-driven threat analysis, cloud connectivity, and high-performance hardware. Innovations in imaging resolution, sensor accuracy, and system reliability are enhancing detection precision, operational durability, and passenger satisfaction.

- Integration with cloud-based security management systems is becoming a major focus for solution providers. Cloud connectivity enables remote monitoring, predictive maintenance, analytics, and reporting, making airport security systems smarter, easier to manage, and scalable across multiple terminals and regions.

- The adoption of AI and data analytics in airport security is gaining momentum. Intelligent algorithms enhance threat detection, optimize passenger flow, reduce false alarms, and provide actionable insights, improving overall operational efficiency, safety, and traveler experience at airports worldwide.

- Ongoing collaborations between security equipment manufacturers, software developers, and airport authorities are supporting innovation and standardization. These partnerships improve interoperability, regulatory compliance, and accelerate acceptance of automated security solutions across international airports.

- With increasing emphasis on passenger safety, operational efficiency, and digital transformation, the airport security industry is poised for steady growth. Its integration into modern airports is redefining security operations, enabling faster screenings, enhanced threat detection, and more efficient airport management.

Airport Security Market Analysis

Learn more about the key segments shaping this market

The airport security industry was valued at USD 16.2 billion and USD 17.4 billion in 2022 and 2023, respectively. The market size reached USD 19.9 billion in 2025, growing from USD 18.6 billion in 2024.

Based on security type, the market is segmented into access control, cyber-security, perimeter security, screening, surveillance, emergency response systems, and others. The screening segment is estimated to register a significant growth rate of over 27.4% of the market in 2025.

- The screening segment holds the largest share in the market, driven by the increasing need for thorough and efficient passenger and baggage checks. Advanced technologies, including 3D X-ray scanners, metal detectors, millimeter-wave body scanners, and automated baggage screening systems, are being widely deployed to enhance threat detection accuracy and operational efficiency. Growing security regulations, rising passenger traffic, and the emphasis on contactless, rapid screening processes are fueling adoption, making this segment a critical revenue contributor within the market.

- Manufacturers should focus on developing high-precision, reliable, and fast screening technologies that can handle increasing passenger volumes while maintaining strict security standards. Investing in AI-driven threat detection, automated anomaly identification, and integration with airport management systems can enhance efficiency and accuracy. Additionally, emphasis on compact, energy-efficient, and user-friendly designs will support widespread adoption, reduce operational costs, and improve passenger experience, ensuring that screening solutions remain competitive and aligned with evolving regulatory and technological requirements in the market.

- The cyber-security segment is the fastest growing within the airport security market, projected to expand at a CAGR of 10.8% during the forecast period. Rising cyber threats targeting airport IT infrastructure, passenger data, and operational systems are driving demand for advanced cybersecurity solutions. Airports are increasingly deploying AI-enabled threat detection, network monitoring, secure access management, and data encryption technologies to safeguard critical systems. Growing reliance on digital operations, automated check-in, and cloud-based platforms further fuels investment in robust cybersecurity measures, making this segment a key growth driver.

- Manufacturers should focus on developing comprehensive cybersecurity solutions tailored for airport environments, including AI-driven threat detection, real-time network monitoring, secure access control, and advanced data encryption. Emphasis on integrating these solutions with existing airport IT and operational systems will enhance resilience against cyberattacks. Additionally, offering scalable, cloud-compatible platforms and continuous software updates can help airports maintain regulatory compliance, safeguard passenger data, and ensure uninterrupted operations, positioning manufacturers as trusted partners in securing increasingly digitized airport infrastructures.

Based on the system, the airport security market is segmented into metal detectors, fiber optic perimeter intrusion, backscatter x-ray systems, cabin baggage screening systems, full-body scanners, chemical detection systems, explosive trace detectors, video surveillance systems, access control systems, cybersecurity systems, and others. The video surveillance systems segment dominated the market in 2025 with a revenue of USD 3.3 billion.

- The video surveillance systems segment holds the largest share of the airport security industry, driven by the growing need for continuous monitoring of passenger areas, baggage handling zones, and critical infrastructure. Advanced technologies, including IP cameras, high-definition (HD) imaging, AI-powered analytics, facial recognition, and remote monitoring platforms, are widely adopted to enhance threat detection, situational awareness, and operational efficiency. Rising security regulations, increasing passenger traffic, and the focus on real-time incident response are further fueling adoption, making video surveillance a key revenue contributor in the market.

- Manufacturers should focus on developing advanced video surveillance solutions that integrate AI-powered analytics, facial recognition, and high-definition imaging to enhance real-time threat detection and situational awareness. Emphasis on scalable, cloud-enabled, and remote monitoring platforms can improve operational efficiency and compliance with evolving security regulations. By offering interoperable, user-friendly, and cost-effective systems tailored for airports, manufacturers can address rising passenger traffic, increasing security demands, and the need for rapid incident response, thereby strengthening their market position and driving adoption across global airport security networks.

- The cybersecurity systems segment in the airport security market is anticipated to witness significant growth at a CAGR of 12.4%, reaching USD 11.5 billion by 2035. This growth is driven by the rising frequency and sophistication of cyberattacks targeting airport IT infrastructure, passenger data, and operational systems. Increasing reliance on digital operations, automated check-in, cloud-based platforms, and interconnected airport networks is fueling demand for advanced cybersecurity solutions, including AI-enabled threat detection, secure access management, network monitoring, and data encryption technologies.

- Manufacturers should focus on developing robust, AI-enabled cybersecurity solutions tailored for airport environments, emphasizing real-time threat detection, secure access control, data encryption, and network monitoring. Investing in scalable, cloud-compatible platforms and advanced software tools can help airports safeguard critical IT infrastructure, ensure passenger data privacy, and maintain operational continuity, addressing the growing demand for resilient, next-generation cybersecurity systems.

Based on the airport model, the airport security market is segmented into Airport 1.0 (Traditional Model), Airport 2.0 (Digital transformation), Airport 3.0 (Smart airport), and others. The airport 2.0 (Digital transformation) segment dominated the market in 2025 with a revenue of USD 7 billion.

- The Airport 2.0 (Digital transformation) segment holds the largest share of the airport security industry, driven by the rising demand for fully integrated, smart airport infrastructures that enhance passenger experience and operational efficiency. Advanced technologies, including automated check-in, biometric authentication, AI-powered surveillance, and IoT-enabled monitoring systems, are widely adopted to streamline security processes. Increasing passenger traffic, stricter regulatory requirements, and the focus on contactless, rapid, and reliable airport operations are further fueling adoption, making the Airport 2.0 segment a key revenue contributor in the market.

- Manufacturers should focus on developing and supplying advanced Airport 2.0 solutions that integrate automated check-in systems, biometric authentication, AI-enabled surveillance, and IoT-based monitoring platforms. Emphasizing seamless interoperability, real-time data analytics, and scalable infrastructure will help airports enhance passenger experience, improve operational efficiency, and comply with stringent security regulations, positioning providers as key partners in the growing smart airport ecosystem.

- The Airport 3.0 segment in the airport security market is anticipated to witness significant growth at a CAGR of 8.9%, reaching USD 12.2 billion by 2035. This growth is driven by the increasing adoption of next-generation, AI-enabled, and fully automated airport infrastructures that enhance operational efficiency, passenger convenience, and security. Integration of advanced technologies such as predictive analytics, robotics-assisted baggage handling, real-time biometric screening, and IoT-enabled monitoring systems is fueling demand, enabling airports to handle growing passenger volumes while ensuring safety and seamless operations.

- Manufacturers should focus on developing and supplying AI-driven, fully automated airport security solutions for the Airport 3.0 segment. Key priorities include predictive analytics platforms, robotics-assisted baggage handling systems, real-time biometric screening technologies, and IoT-enabled monitoring devices. Emphasizing seamless integration, scalability, and operational reliability will help airports manage increasing passenger traffic, enhance security, and improve efficiency.

Based on technology, the airport security market is segmented into biometrics, and Non-biometric. The biometrics segment dominated the market in 2025 with a revenue of USD 11.5 billion

- The biometrics segment holds the largest share of the market, driven by the growing need for accurate, fast, and contactless passenger identification and verification. Technologies such as facial recognition, iris scanning, fingerprint authentication, and palm-vein recognition are widely adopted to enhance security, reduce queues, and streamline boarding processes. Increasing passenger traffic, stricter regulatory requirements, and the emphasis on touchless, efficient, and reliable airport operations are further fueling adoption, making biometrics a critical revenue-generating segment in the market.

- Manufacturers should focus on developing advanced, AI-enabled biometric solutions that offer high accuracy, rapid processing, and seamless integration with airport security systems. Emphasis on touchless authentication, multi-modal biometrics, and scalable deployment can enhance passenger experience, ensure regulatory compliance, and support growing traffic volumes. Investment in software optimization, sensor innovation, and interoperability with existing airport infrastructure will be critical to capitalize on the expanding biometrics segment

- The non-biometrics segment in the airport security industry is anticipated to witness significant growth at a CAGR of 7.2%, reaching USD 16.8 billion by 2035. This growth is driven by increasing adoption of advanced screening technologies, including X-ray scanners, metal detectors, millimeter-wave body scanners, and explosive trace detection systems. Rising passenger volumes, stringent security regulations, and the need for efficient, contactless, and reliable threat detection are fueling demand, making non-biometrics solutions a key contributor to overall airport security market expansion.

- manufacturers should focus on developing advanced non-biometrics security solutions that integrate high-precision X-ray scanners, metal detectors, millimeter-wave body scanners, and explosive trace detection systems. Emphasis should be on enhancing detection accuracy, reducing processing time, ensuring contactless operation, and complying with stringent regulatory standards. Scalable, reliable, and easy-to-deploy systems will help airports manage growing passenger volumes efficiently while maintaining robust security, positioning manufacturers to capture significant market share in the rapidly expanding non-biometrics airport security segment.

Learn more about the key segments shaping this market

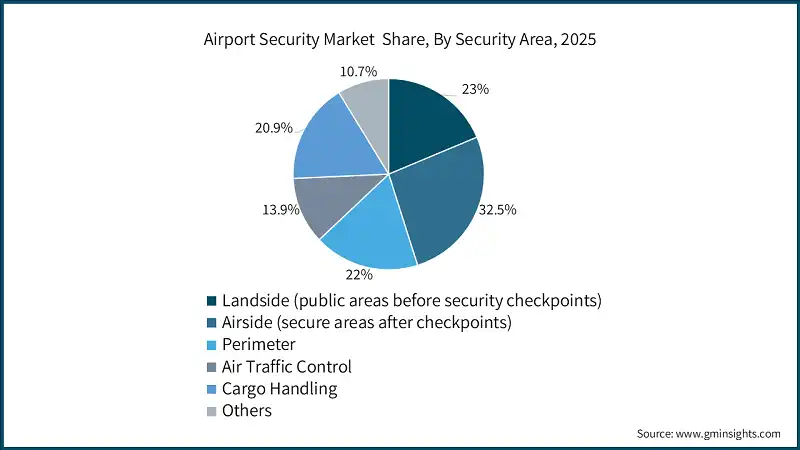

Based on security area, the market is segmented into landside, airside, perimeter, air traffic control cargo handling, and others. The airside segment accounted for a market share of over 32.5% in 2025.

- The airside segment holds the largest share of the airport security market, driven by the critical need to safeguard aircraft, runways, taxiways, and restricted operational areas. Advanced surveillance systems, access control, perimeter monitoring, and intrusion detection technologies are widely deployed to prevent unauthorized access, ensure passenger and staff safety, and maintain uninterrupted airport operations. Rising security regulations, increasing passenger traffic, and the emphasis on proactive threat detection and rapid response are further fueling adoption, making the airside segment a key revenue contributor in the market.

- Manufacturers should focus on developing advanced airside security solutions that integrate AI-powered surveillance, real-time monitoring, automated access control, and predictive intrusion detection. Emphasis on scalable, reliable, and easy-to-deploy technologies will help airports enhance operational safety, comply with stringent regulations, and manage growing passenger traffic efficiently. Solutions that enable rapid threat detection, seamless integration with existing airport systems, and minimal operational disruption will strengthen manufacturers’ competitive positioning and drive adoption within the high-value airside segment of the market.

- The cargo handling segment is the fastest-growing in the airport security market, anticipated to expand at a CAGR of 10.8% during the forecast period. Growth is driven by increasing air cargo volumes, stricter regulatory requirements for secure goods transport, and rising adoption of advanced screening technologies such as X-ray scanners, explosive trace detection, and automated tracking systems. Airports are investing in AI-enabled monitoring, real-time baggage and cargo tracking, and integrated security solutions to ensure safe, efficient, and compliant handling of freight, fueling segment growth.

- Manufacturers should focus on developing advanced, AI-enabled cargo screening and monitoring solutions, integrating real-time tracking, automated threat detection, and compliance tools. Emphasis on scalable, high-throughput systems that streamline freight handling while meeting regulatory standards will be critical. Investments in modular, interoperable technologies can help airports enhance operational efficiency, safety, and reliability, positioning manufacturers to capture growth opportunities in the rapidly expanding cargo handling segment of the market.

Looking for region specific data?

The North America airport security market dominated with a market share of 33.5% in 2025.

- In North America, the market is experiencing robust growth, driven by increasing passenger traffic, stringent government regulations, and rising investments in advanced security infrastructure. Adoption of AI-enabled surveillance, biometric identification, 3D X-ray scanners, and automated baggage handling systems is accelerating to enhance threat detection, operational efficiency, and passenger safety. Airports are focusing on contactless, fast, and reliable screening solutions, while modernization initiatives and expansion projects further fuel demand, making North America a key revenue-generating region in the airport security industry.

- Manufacturers should focus on developing and deploying advanced airport security solutions tailored for the North American market. Key areas include AI-enabled surveillance systems, biometric authentication technologies, 3D X-ray scanners, and automated baggage handling solutions. Emphasis on contactless, high-speed, and reliable screening, along with integration into modernized airport infrastructures, will help meet regulatory requirements, accommodate growing passenger volumes, and enhance operational efficiency. Strategic investments in scalable, user-friendly, and technologically advanced products is expected to enable manufacturers to capture market share and strengthen their presence in this high-growth region.

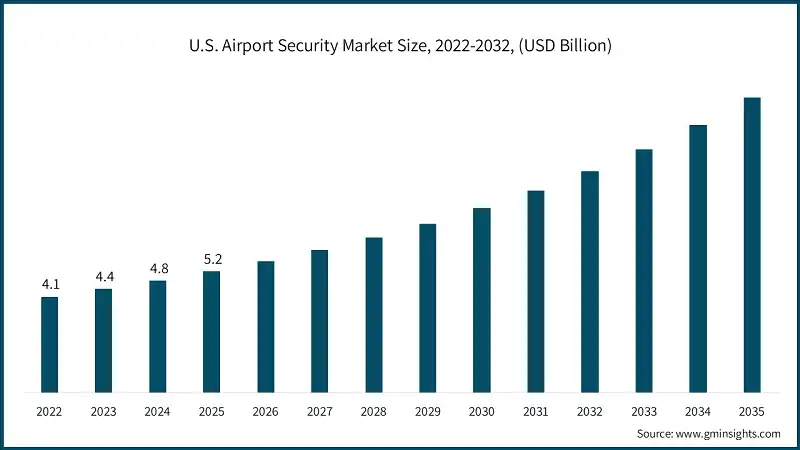

The U.S. airport security market was valued at USD 4.1 billion in 2022 and USD 4.4 billion in 2023, reaching USD 5.2 billion in 2025, up from USD 4.8 million in 2024.

- The U.S. continues to lead the market, driven by increasing passenger traffic, stringent federal security regulations, and substantial investments in modern airport infrastructure. Adoption of advanced technologies, including AI-enabled surveillance, biometric screening, 3D X-ray scanners, and automated baggage handling systems, is accelerating to enhance threat detection, operational efficiency, and passenger safety. Expansion and modernization initiatives across major airports, coupled with a focus on contactless, high-speed security solutions, further strengthen the U.S. position as a key revenue-generating and innovation-driven market.

- Manufacturers should focus on developing and supplying advanced, AI-enabled surveillance systems, biometric authentication technologies, 3D X-ray scanners, and automated baggage handling solutions to meet the growing demand in the U.S. market. Emphasizing contactless, high-speed, and reliable security systems that integrate seamlessly with modern airport infrastructure will help capitalize on expansion and modernization projects, enhance operational efficiency, ensure passenger safety, and strengthen market presence in this innovation-driven and high-revenue region.

The Europe airport security market accounted for USD 4.8 billion in 2025 and is anticipated to witness strong growth over the forecast period.

- Europe holds a significant share of the market, driven by stringent regulatory standards, rising passenger traffic, and continuous investments in modern airport infrastructure. Adoption of advanced security technologies, including AI-powered surveillance, biometric screening, 3D X-ray scanners, and automated baggage handling systems, is increasing to enhance threat detection, operational efficiency, and passenger safety. Expansion of smart airports, focus on contactless and high-speed security processes, and integration of digital monitoring platforms further support market growth, making Europe a key region in the global airport security landscape.

- Manufacturers should focus on developing advanced AI-powered surveillance systems, 3D X-ray scanners, and automated baggage handling solutions tailored for European airports. Emphasis on compliance with stringent regulatory standards, integration with digital monitoring platforms, and support for contactless, high-speed security processes will help providers meet rising passenger traffic demands, enhance operational efficiency, and strengthen passenger safety, positioning their offerings for competitive advantage and strong adoption in Europe’s evolving airport security industry.

Germany dominates the Europe airport security market, showcasing strong growth potential.

- Germany holds a substantial share of the market, driven by rising passenger traffic, stringent security regulations, and investments in modern airport infrastructure. The country’s advanced technological ecosystem and focus on smart airport initiatives facilitate the adoption of AI-powered surveillance, biometric screening, 3D X-ray scanners, and automated baggage handling systems, enhancing threat detection, operational efficiency, and passenger safety. These factors make Germany a key contributor to Europe’s airport security industry growth.

- Manufacturers should focus on developing AI-enabled surveillance systems, biometric screening solutions, 3D X-ray scanners, and automated baggage handling technologies for Germany. Leveraging the country’s advanced infrastructure, regulatory support, and focus on smart airports will help improve operational efficiency, strengthen passenger safety, and meet growing demand for high-speed, reliable, and contactless airport security solutions.

The Asia-Pacific airport security market is anticipated to grow at the highest CAGR of 10.1% during the analysis period.

- The Asia-Pacific airport security industry is experiencing rapid growth, driven by increasing passenger traffic, rising security regulations, and expanding airport infrastructure. Adoption of advanced security technologies, including AI-enabled surveillance, biometric screening, 3D X-ray scanners, and automated baggage handling systems, is accelerating to improve threat detection, operational efficiency, and passenger safety. Government initiatives promoting smart airports, digital monitoring, and contactless security solutions are further fueling market expansion across the region.

- Manufacturers should focus on developing AI- and IoT-enabled airport security solutions in the Asia-Pacific region, including biometric systems, advanced surveillance platforms, 3D X-ray scanners, and automated baggage screening. By leveraging smart airport initiatives, regulatory support, and digital infrastructure, they can enhance operational efficiency, strengthen passenger safety, and meet growing demand for reliable, fast, and contactless airport security solutions.

The China airport security market is estimated to grow at a significant CAGR of 9.6% from 2026 to 2035.

- China dominates the market, driven by rapid expansion of airport infrastructure, increasing passenger traffic, and rising security regulations. Adoption of advanced technologies such as AI-enabled surveillance, biometric screening, 3D X-ray scanners, and automated baggage handling systems is growing rapidly. Government investments in smart airports, digital monitoring, and contactless security solutions are further accelerating deployment, making China a key contributor to growth in the Asia-Pacific market.

- Manufacturers should focus on deploying AI-enabled surveillance, biometric systems, 3D X-ray scanners, and automated baggage handling solutions in China. By leveraging airport expansion, supportive regulations, smart airport initiatives, and advanced digital infrastructure, they can enhance operational efficiency, passenger safety, and contactless security, driving growth across commercial and civil aviation sectors.

The Latin America airport security market, valued at USD 749.4 million in 2025, is driven by increasing passenger traffic, rising government security regulations, and growing investments in modern airport infrastructure. Adoption of advanced screening technologies, including biometric systems, 3D X-ray scanners, and automated baggage handling, enhances threat detection, operational efficiency, and passenger safety.

The Middle East and Africa market, projected to reach USD 3.1 billion by 2035, is driven by rapid airport infrastructure expansion, increasing passenger traffic, and stringent regulatory requirements. Adoption of advanced screening technologies, biometric systems, AI-powered surveillance, and automated baggage handling enhances security, operational efficiency, and passenger safety across the region.

The Saudi Arabia airport security market is expected to grow significantly in 2025, driven by increasing passenger traffic, stricter regulatory requirements, and rising demand for advanced screening and surveillance technologies. Adoption of AI-powered biometric systems, 3D X-ray scanners, automated baggage handling, and smart airport infrastructure is enhancing security, operational efficiency, and passenger experience.

- Saudi Arabia is emerging as a key growth hub for the market, fueled by rapid airport expansion, modernization initiatives, adoption of AI-enabled security solutions, and government investments in smart infrastructure. Digital transformation programs and regulatory support further accelerate deployment of advanced screening and monitoring systems across airports.

- Manufacturers should focus on developing reliable, scalable, and technologically advanced airport security solutions tailored for passenger screening, baggage handling, surveillance, and access control. Collaborating with local authorities, integrating AI, IoT, and cloud-based monitoring platforms, and aligning with government security initiatives will strengthen market presence and drive adoption in this rapidly growing region.

Airport Security Market Share

The competitive landscape of the airport security industry is witnessing robust growth, driven by increasing demand for advanced, reliable, and scalable security solutions across airports, airlines, and cargo operations. Major players, including Smiths Detection Inc., Thales Group, Safran, Bosch Security Systems, and Honeywell International Inc., collectively hold 43.7% share of the market, driving innovation through partnerships with technology providers, AI developers, and automation solution firms. These collaborations support the integration of AI-enabled surveillance, biometric authentication, 3D X-ray scanners, automated baggage screening, and cloud-based monitoring platforms.

Emerging startups and specialized security solution providers are introducing compact, energy-efficient, and highly reliable screening and surveillance technologies optimized for real-time threat detection, predictive analytics, and seamless integration into airport operations. Advances in AI, IoT, cloud computing, and intelligent sensor systems are enhancing performance, scalability, and operational reliability. Collaborations with airports, airlines, government agencies, and smart airport initiatives are accelerating adoption, improving security efficiency, and supporting the transition toward fully automated, connected, and intelligent airport security infrastructures globally.

Airport Security Market Companies

Some of the prominent market participants operating in the airport security industry include:

- American Science and Engineering Inc

- Axis Communications AB

- Bosch Security Systems

- Cognitec Systems GmbH

- dormakaba Group

- FLIR Systems Inc.

- Genetec Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Honeywell International Inc.

- Indra Sistemas, S.A.

- NEC Corporation

- Nuctech Technology Co, Ltd.

- Rapiscan Systems

- Raytheon Technologies

- Safran group

- Siemens AG

- SITA

- Smiths Detection Inc.

- Thales Group

- Unisys Corporation

- Westminster Group Plc.

- Smiths Detection Inc.

Smiths Detection Inc. is a key player in the market, holding an estimated market share of ~18.3%. The company is widely recognized for its advanced passenger and baggage screening systems, including 3D X-ray scanners, metal detectors, explosive trace detection devices, and automated checkpoint solutions. Its solutions enhance threat detection, operational efficiency, and passenger safety across airports globally. Strong focus on software integration, AI-enabled analytics, and scalable security platforms strengthens its competitive position and supports large-scale deployments worldwide.

Thales Group plays a pivotal role in the market, offering advanced screening technologies, biometric authentication systems, and automated security platforms. The company emphasizes high-performance, secure, and reliable solutions that enable airports to improve threat detection, streamline passenger flow, and enhance operational efficiency. Its offerings support AI-driven surveillance, cloud-based monitoring, and real-time analytics, enabling airports to optimize security management while maintaining regulatory compliance and passenger safety.

Safran holds a significant position in the market by providing comprehensive airport security solutions, including video surveillance systems, automated screening platforms, and access control technologies. The company’s offerings support high passenger volumes, real-time monitoring, and seamless integration with airport operations. Focus on reliability, modular design, and advanced sensor technologies enables airports to enhance threat detection, reduce manual intervention, and ensure consistent safety and efficiency across terminal, airside, and baggage handling operations.

Airport Security Industry News

- In December 2025, Smiths Detection Inc. expanded its partnership with Fukuoka International Airport to supply seven compact HI_SCAN 6040 CTiX 3D X_ray scanners and iLane A20 automatic tray return systems to streamline passenger security lanes and enhance threat detection accuracy.

- In October 2025,_Smiths Detection launched SDX_10080_SCT high_speed computed tomography scanner at inter airport Europe 2025 in Munich designed for high_throughput baggage screening and improved detection performance.

- In September 2025, Smiths Detection launched screening solutions including multiple CT and X_ray scanners plus automated tray systems for the new Heraklion Crete International Airport, enhancing screening efficiency and passenger experience.

- In October 2025, NEC partnered Outsight to integrate 3D LiDAR Spatial AI into airport operational systems to enhance real_time awareness for crowd management, queue monitoring, and behavioral analytics. The solution is deployed at a major North American airport and will be showcased at industry events.

- In August 2025, BigBear.ai partnered with Smiths Detection to integrated their airport security technologies, combining BigBear.ai’s AI-powered Pangiam® Threat Detection with Smiths Detection’s HI_SCAN 6040 CTiX scanners. This tested solution, now trialed at international airports, enhances threat detection, improves passenger flow, and provides airports with flexible, actionable insights, advancing overall security operations efficiently.

The airport security market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD million) from 2022 to 2035, for the following segments:

Market, By Security

- Access Control

- Cyber-security

- Perimeter Security

- Screening

- Surveillance

- Emergency Response Systems

- Others

Market, By System

- Metal Detectors

- Fiber Optic Perimeter Intrusion

- Backscatter X-Ray Systems

- Cabin Baggage Screening Systems

- Full-Body Scanners

- Chemical Detection Systems

- Explosive Trace Detectors

- Video Surveillance Systems

- Access Control Systems

- Cybersecurity Systems

- Others

Market, By Airport Model

- Airport 1.0 (Traditional model)

- Airport 2.0 (Digital transformation)

- Airport 3.0 (Smart airport)

- Others

Market, By Technology

- Biometric

- Facial Recognition

- Fingerprint Recognition

- Iris Recognition

- Voice Recognition

- Palm Vein Recognition

- Gait Analysis

- Other Biometric Methods

- Non Biometric

- Card-based Systems

- PIN-based Systems

- Token-based Systems

- RFID Systems

- QR Code Systems

- Behavioral Analysis Systems

- Other Non-Biometric Systems

Market, By Security Area

- Landside

- Airside

- Perimeter

- Air Traffic Control

- Cargo Handling

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- ANZ

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- MEA

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

Frequently Asked Question(FAQ) :

What are the upcoming trends in the airport security industry?

Key industry trends include increased deployment of AI-driven screening, biometric authentication, automated security lanes, and cloud-integrated security management systems.

What is the growth outlook for the cybersecurity systems segment from 2026 to 2035?

The cybersecurity systems segment is projected to grow at a CAGR of 12.4% through 2035, as airports strengthen digital defenses against cyber threats and expand cloud-based security platforms.

Which region leads the airport security market?

The U.S. market reached USD 5.2 billion in 2025. Growth is driven by stringent federal aviation security regulations, airport expansion programs, and high adoption of advanced screening technologies.

What was the valuation of the biometrics technology segment in 2025?

The biometrics segment was valued at USD 11.5 billion in 2025, driven by growing use of facial recognition and contactless identity verification across the airport security market.

How much revenue did the video surveillance systems segment generate in 2025?

The video surveillance systems segment generated USD 3.3 billion in 2025, leading the airport security industry due to strong demand for continuous monitoring and real-time threat detection.

What is the current airport security market size in 2026?

The market size for airport security is estimated to reach USD 21.4 billion in 2026, supported by increased investments in automated screening, surveillance systems, and biometric security solutions.

What is the projected value of the airport security industry by 2035?

The market size for airport security exceeded USD 19.9 billion in 2025 and is projected to expand at a CAGR of 8.6% from 2026 to 2035, driven by rising global air passenger traffic and demand for advanced security screening systems.

What is the current airport security market size in 2026?

The market size for airport security is estimated to reach USD 21.4 billion in 2026, supported by increased investments in automated screening, surveillance systems, and biometric security solutions.

What is the market size of the airport security industry in 2025?

The market size for airport security exceeded USD 19.9 billion in 2025 and is projected to expand at a CAGR of 8.6% from 2026 to 2035, driven by rising global air passenger traffic and demand for advanced security screening systems.

Who are the key players in the airport security market?

Key market players include Smiths Detection Inc., Thales Group, Safran, Bosch Security Systems, Honeywell International Inc., NEC Corporation, Rapiscan Systems, Siemens AG, SITA, and Axis Communications AB.

Airport Security Market Scope

Related Reports