Summary

Table of Content

Airport Cabin Baggage Scanner Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Airport Cabin Baggage Scanner Market Size

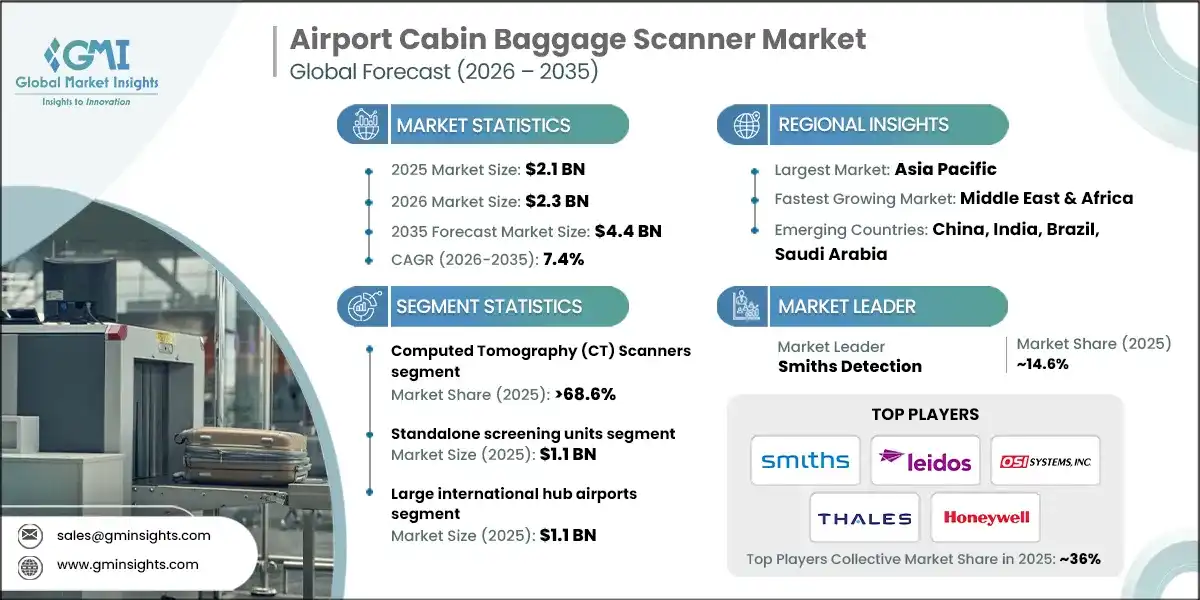

The global airport cabin baggage scanner market was estimated at USD 2.1 billion in 2025. The market is expected to grow from USD 2.3 billion in 2026 to 3.5 billion in 2031 and USD 4.4 billion by 2035, at a CAGR of 7.4% during the forecast period of 2026–2035, according to the latest report published by Global Market Insights Inc. The airport cabin baggage scanner industry is increasing due to rising air passenger traffic, stricter aviation security regulations, adoption of advanced imaging technologies, and growing investments in airport infrastructure modernization worldwide.

To get key market trends

- The market growth for airport cabin baggage scanner points towards a replacement cycle more than new installations, as airports are redesigning checkpoints to handle higher volumes while tightening detection performance. One of the significant driving factors in the market is the shift towards synchronized push from regulators, technological advances in CT and AI, and practical throughput demands from airports coping with sustained passenger growth. For instance, in August 2024, Smiths Detection, a global leader in threat detection and security screening, has announced a significant advancement in aviation security technology. This development strengthens the capabilities of modern baggage scanners by using more intelligent detection systems, faster image analysis, and enhanced automation.

- AI-enabled CT baggage scanners are significantly improving airport security operations by reducing false alarm rates and accelerating image review processes. According to analyses by the Transportation Security Administration and EUROCONTROL, these systems shift human operators from routine, universal image inspection to focused exception handling.

- The transformation increases checkpoint throughput, lowers staffing pressure, and enhances detection consistency. Demand for AI-driven CT scanners is rising as airports aim to strike a balance between increasing passenger loads and operational efficiency. This is expected to promote further investment in cutting-edge screening technology and hasten the replacement of outdated systems across international aviation hubs. effectively mandate 3D CT with automated threat detection, which is accelerating the swap-out of legacy 2D X-ray systems, as per the European Union Aviation Safety Agency and the U.S. Department of Homeland Security. For instance, the shift from 2D X-ray scanners to a more advanced CT technology is boosting checkpoint lane income. Growth is being fueled by higher average selling prices as well as increased expenditure on software, networking, and automated lanes, particularly at large airports using remote screening and integrated automation systems.

- The airport cabin baggage scanner industry is experiencing distinct upgrade cycles due to regulatory constraints. In Europe, ECAC Standard 3 requirements triggered early adoption of CT scanners, while the U.S. is now following a phased rollout aligned with the TSA roadmap for Category X and I airports through 2030. Together, these regions represent thousands of screening lanes shifting from 2D X-ray to CT and AI-enabled systems. This transition is driving steady demand for new hardware while also increasing recurring revenues from software, image analytics, and fleet uptime management solutions.

Airport Cabin Baggage Scanner Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 2.1 Billion |

| Market Size in 2026 | USD 2.3 Billion |

| Forecast Period 2026 - 2035 CAGR | 7.4% |

| Market Size in 2035 | USD 4.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising regulatory mandates on CT-based cabin baggage scanner adoption | Security requirements from ECAC in Europe and the TSA in the U.S. are creating non-discretionary replacement cycles at major airports, particularly large hub and Category X and I airports. These mandates force airports to upgrade from 2D X-ray systems to CT-based, AI-enabled scanners within set timelines. As a result, demand becomes predictable rather than optional, supporting long-term procurement planning. This regulatory push is expected to add around 3.2% to the projected growth, with the highest impact seen in the U.S. and Europe. |

| Passenger traffic growth is driving checkpoint capacity expansion | Rising global passenger traffic is increasing pressure on airport security checkpoints, driving demand for higher-throughput lanes and additional baggage scanners. Airports are expanding checkpoint capacity to control wait times, directly boosting equipment procurement and adding an estimated 2.8% to projected growth. The Asia-Pacific region contributes the largest incremental volumes due to rapid growth in air travel, airport expansion, and rising domestic and international passenger traffic. |

| AI and automation are driving operational efficiency | AI and automation in cabin baggage scanners reduce false alarms, cut labor requirements, and improve screening consistency. Airports with larger fleets or remote screening readiness benefit the most, encouraging broader adoption. This trend is driving higher equipment demand and contributing around 1.8% to the projected growth as operators seek efficient, reliable, and scalable security solutions. |

| Government and multilateral funding are accelerating market growth | Government and multilateral funding are enabling airport security projects that might otherwise be delayed due to high costs. Such financial support is particularly strong in APAC and the Middle East, allowing for accelerated deployment of advanced baggage scanners. This funding-driven adoption is contributing approximately 1.4% to the projected growth, supporting infrastructure expansion and technology modernization. |

| Passenger-centric initiatives fuel security equipment demand | Airports are increasingly prioritizing passenger experience, emphasizing shorter wait times, smoother security screening, and minimal disruptions. To meet these expectations, operators are investing in faster, more efficient cabin baggage scanners with integrated automation and AI-assisted workflows. This focus on convenience and throughput is driving steady equipment upgrades, supporting market growth and contributing to long-term increases in scanner adoption worldwide. |

| Pitfalls & Challenges | Impact |

| High Capital Requirements Restrain Market Growth | The significant investment needed for CT scanners and automated lanes can slow adoption at smaller and regional airports, particularly in MEA and Latin America. This financial barrier is expected to impact market growth in the short to medium term, reducing projected growth by approximately 1.6%. Targeted grants, vendor financing, and phased rollouts help mitigate these challenges |

| Checkpoint Infrastructure Constraints Restrain Scanner Expansion | Integrating new CT and automated scanners into space-constrained checkpoints often requires civil works and IT system upgrades, particularly at mature European hubs. These challenges can slow deployment and temporarily disrupt operations, impacting short-term market growth with an estimated 0.9% reduction in projected growth. Modular designs and night-shift installations help minimize operational disruption. |

| Opportunities: | Impact |

| Expansion in Emerging Markets | Rapid growth in air travel across emerging regions, particularly in Asia-Pacific, the Middle East, and Latin America, is creating opportunities for new airport infrastructure and modern security systems. Airports in these regions are increasingly investing in CT and AI-enabled baggage scanners to handle rising passenger volumes, offering hardware manufacturers and service providers significant market expansion potential. |

| Integration with Smart Airport Ecosystems | Airports are increasingly investing in connected, data-driven ecosystems to optimize operations. Integrating baggage scanners with IoT, cloud analytics, and automated passenger flow management offers opportunities for technology providers to deliver end-to-end solutions, improve operational efficiency, and generate recurring revenue through software, maintenance, and system upgrades. |

| Market Leaders (2025) | |

| Market Leaders |

~14.6% market share. |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Middle East & Africa |

| Emerging countries | China, India, Brazil, Saudi Arabia |

| Future outlook |

|

What are the growth opportunities in this market?

Airport Cabin Baggage Scanner Market Trends

- The airport cabin baggage scanners are seeing significant growth as artificial intelligence becomes commonplace in CT-based cabin baggage scanners. This is fueled by deep learning models trained on millions of scans. These systems detect threats automatically with high accuracy, allowing human operators to focus on exceptions. Federal deployments in the U.S. and Europe report marked reductions in false alarms and better detection consistency. As AI use spreads worldwide, airports can improve security operations while maintaining high passenger flow and meeting evolving regulatory standards.

- For instance, in October 2024, the Department of Homeland Security Science and Technology Directorate and the Transportation Security Administration showcased SeeTrue’s AI-powered security screening technology integrated with CT scanners at the Innovation Checkpoint at Harry Reid International Airport in Las Vegas. This field assessment showed that AI-based systems could automatically identify prohibited items during baggage screening. The goal was to improve efficiency and the effectiveness of security while enhancing the passenger experience.

- The growing integration of AI with remote screening workflows is changing checkpoint operations. Staffing per lane decreases by about 25% to 30%, while false alarm rates in mature setups drop to single digits. This efficiency allows airports to handle increasing passenger numbers without adding labor costs. Software updates, analytics, and data governance are key to ensuring steady performance. By reallocating human resources to deal with advanced threats, airports improve operational reliability and overall security effectiveness.

- As imaging applications continue to grow, airport cabin baggage scanners are using AI techniques to reconstruct depth and process data in real time with high-performance sensors. This improves image quality, operational durability, and data quality for industrial, scientific, and entertainment applications compared to older airport cabin baggage scanners.

- Automated screening lanes boost quantity, and efficiency of automated screening lanes (ASLs) which are becoming standard at active airport checkpoints. They integrate processes such as parallel divestment, tray tracking, and automatic tray return to eliminate bottlenecks. When combined with CT scanners, ASLs increase throughput by 40 to 55% per lane while reducing staffing needs by 30 to 40% where layouts are optimized. Ongoing adoption is driven by labor constraints and limited terminal space. This shift expands the procurement unit from a single scanner to a complete lane ecosystem, benefiting vendors that offer integrated hardware, software, and support. ASLs improve operational efficiency, passenger experience, and long-term airport security performance.

- For instance, in July 2024, the TSA installed new automated screening lanes (ASLs) with CT scanners at checkpoints at Baltimore/Washington International Thurgood Marshall Airport (BWI). These ASLs include multiple divestment points, automated conveyor rollers, and larger bins to boost throughput, reduce wait times, and improve security accuracy.

Airport Cabin Baggage Scanner Market Analysis

Learn more about the key segments shaping this market

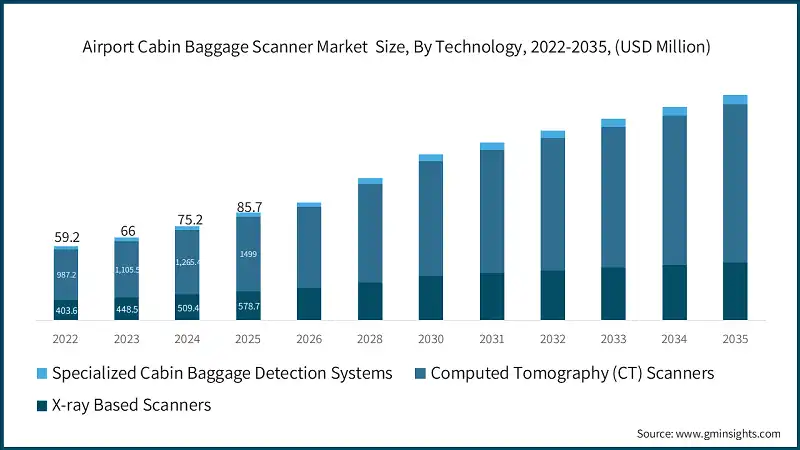

The airport cabin baggage scanner market was valued at USD 1.5 billion and USD 1.6 billion in 2022 and 2023, respectively. The market size reached USD 2.1 billion in 2025, growing from USD 1.9 billion in 2024.

Based on technology, the market is segmented into into X-ray Based Scanners, Computed Tomography (CT) Scanners, and Specialized Cabin Baggage Detection Systems. The Computed Tomography (CT) Scanners segment is estimated to register a significant growth rate of over 68.6% of the market in 2025.

- The Computed Tomography (CT) Scanners segment hold the largest share in the airport cabin baggage scanner market, as CT systems, differentiation is now software-driven, including multi-energy reconstruction, spectroscopic analysis, and AI models trained on extensive image datasets. Premium solutions integrate lane automation and remote screening, while compact CT scanners address regional airports and private aviation. Certification approvals, such as ECAC and TSA listings, accelerate market entry. Consequently, procurement is shifting from single scanners to complete lane ecosystems, favoring vendors that provide integrated hardware, software, and lifecycle support, enhancing operational efficiency and long-term adoption.

- Manufactures should focus on 3D volumetric imaging and automated threat recognition that improve detection while reducing false alarms. X-ray systems remain for low-volume or secondary lanes, while specialized solutions such as millimeter-wave and explosive trace detection complement CT in high-security zones. Lifecycle advantages, including reduced staffing needs and higher throughput in automated setups, make CT the preferred choice for major airports, driving steady market expansion globally.

- The specialized cabin baggage detection systems segment in the airport cabin baggage scanner market is expected to witness strong growth, registering a CAGR of 9.9% during the forecast period. This growth is driven by rising security threats, stricter aviation safety regulations, and increasing deployment of advanced detection technologies at airports. These systems improve threat identification, reduce manual inspection, and support faster passenger screening. In addition, growing air passenger traffic and ongoing airport expansion projects further support demand for specialized detection solutions.

- Manufacturers should focus on developing advanced detection technologies with higher accuracy, faster processing, and compliance with evolving security regulations. Investing in AI-based analytics, compact system design, and seamless integration with existing airport infrastructure will help meet rising demand and enhance competitive positioning.

Based on integration level, the airport cabin baggage scanner market is segmented into standalone screening units, integrated automated screening lane systems, and networked/remote screening-capable systems. The standalone screening units segment dominated the market in 2025 with a revenue of USD 1.1 billion.

- The standalone screening units segment holds the largest share of the market, as high-volume international airports are increasingly adopting automated screening lanes, combining parallel divestment, tray tracking, and automatic tray return with CT scanners. These systems significantly increase the number of passengers processed per hour and reduce inspection backlogs, addressing congestion challenges.

- Manufacturers should focus on designing high-throughput standalone screening units with reliable automation, seamless CT scanner integration, and minimal downtime. Emphasis on modular design, easy maintenance, and compatibility with automated screening lanes will help airports improve passenger flow and manage peak traffic efficiently.

- Network-capable scanners enable remote analyst centers, ensuring consistent quality and scalability across checkpoints. As labor costs rise and terminal space remains limited, the operational efficiency and throughput gains offered by automated lanes make them the primary growth engine for the airport cabin baggage scanner market, attracting investment from major airports worldwide.

- Deployment strategies vary by airport size and operational priorities. Large international hubs prioritize full CT integration with automation and remote screening for maximum throughput and consistency. Regional and domestic airports focus on compact CT units with selective automation to balance cost and performance. Government and military facilities emphasize premium detection stacks and multilayer screening, prioritizing assurance over speed.

- Whereas private aviation terminals value compact footprint, aesthetics, and rapid processing. This segmentation drives demand for varied scanner configurations and integrated lane ecosystems, encouraging vendors to offer flexible solutions that meet diverse operational and budgetary requirements globally.

Learn more about the key segments shaping this market

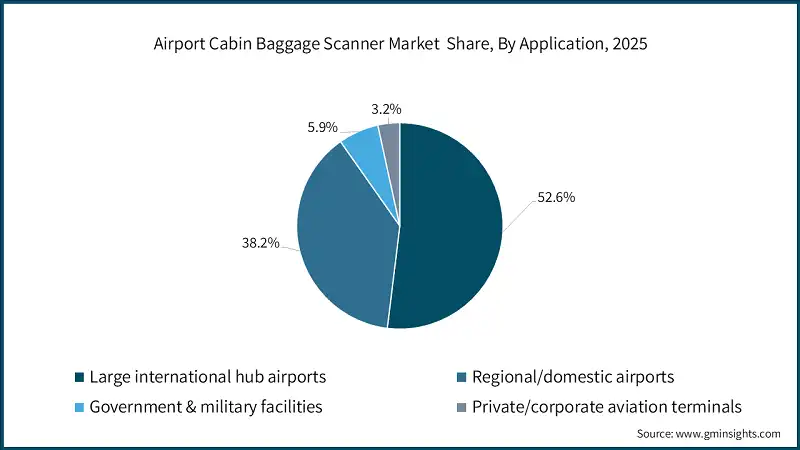

Based on the application, the airport cabin baggage scanner market is segmented into large international hub airports, regional/domestic airports, government & military facilities, and private/corporate aviation terminals. The large international hub airports segment dominated the market in 2025 with a revenue of USD 1.1 billion.

- The large international hub airports represent the fastest-growing application segment in the airport cabin baggage scanner industry, due to sustained passenger volumes and congestion pressure. These airports increasingly deploy CT scanners integrated with automated screening lanes featuring parallel divestment, tray tracking, and automatic return. Such configurations significantly increase passengers processed per hour while reducing inspection backlogs.

- Network-capable CT systems further enable centralized and remote image analysis, ensuring consistent screening quality across multiple checkpoints. Rising labor costs and limited terminal expansion options strengthen the business case for fully automated, high-throughput screening environments at major global hubs.

- In large hub airports, procurement decisions favor fully integrated screening ecosystems rather than standalone scanners. Operators prioritize CT platforms combined with automation and remote screening to maximize throughput, standardize operations, and improve resilience during peak travel periods.

- Remote analyst centers allow flexible staffing and better use of skilled operators, while automation reduces dependency on manual processes. As regulatory requirements tighten and passenger expectations rise, large hubs continue to invest in premium, software-driven CT systems. This segment drives demand for end-to-end solutions, long-term service contracts, and continuous software upgrades, reinforcing its role as a core growth engine of the market.

Looking for region specific data?

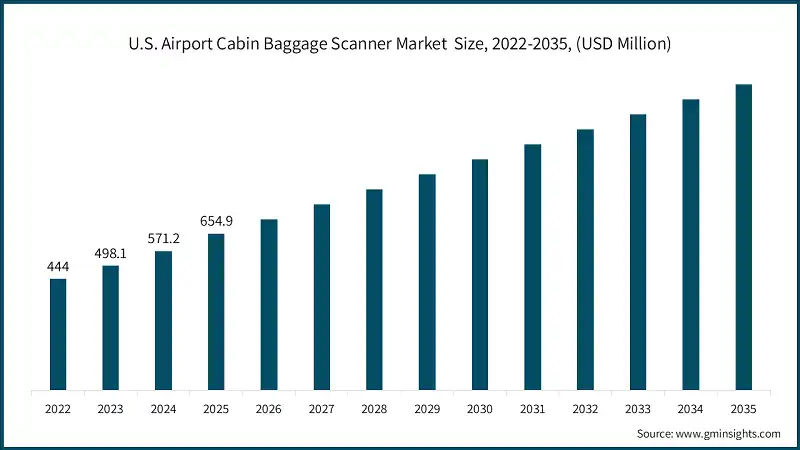

The North America airport cabin baggage scanner market dominated with a market share of 38.8% in 2025.

- North America represents one of the most advanced markets for airport cabin baggage scanners. The market is experiencing robust growth due to strong regulatory alignment and funding support. TSA-led CT mandates in the U.S. have accelerated large-scale replacement of legacy X-ray systems, setting the pace for the region.

- Airports are increasingly deploying CT scanners, integrated with automated screening lanes and remote image review to sustain throughput during peak travel periods. Canada is moving in parallel through CATSA programs, while labor availability and security compliance continue to push airports toward automation, making North America a mature yet steadily expanding market.

- Market growth in North America is supported by coordinated modernization across both major hubs and secondary airports. Canadian airports such as Toronto, Vancouver, and Montreal are upgrading cabin baggage screening systems alongside staffing, IT, and cybersecurity enhancements to support remote screening models. In Mexico, private airport concessionaires are investing in CT scanners and automated lanes at high-traffic airports like Mexico City and Cancun to improve passenger flow and security performance. Across the region, rising passenger volumes, constrained terminal space, and predictable funding cycles are reinforcing long-term demand for integrated CT-based screening solutions.

The U.S. airport cabin baggage scanner market was valued at USD 444 million in 2022 and USD 498.1 million in 2023, reaching USD 654.9 million in 2025, up from USD 571.2 million in 2024.

- The U.S. dominates the North American airport cabin baggage scanner industry, due to TSA funding programs, clear CT adoption timelines, and large checkpoint volumes. Domestic manufacturing expansion has shortened procurement lead times, supporting faster deployment of CT scanners, automation, and remote screening systems across Category X and I airports.

The European market accounted for USD 390 million in 2025 and is anticipated to witness significant growth over the forecast period.

- Europe holds a significant share of the airport cabin baggage scanner market, as the market is strongly shaped by ECAC Standard 3 compliance timelines, which are accelerating the shift from legacy X-ray systems to CT-based screening. Major aviation markets such as Germany, France, and the UK are leading adoption at large international hubs, supported by coordinated EU-level security frameworks.

- Airports are prioritizing CT scanners that enable higher detection accuracy and improved passenger flow. As compliance deadlines approach, replacement demand remains steady across core European hubs, reinforcing Europe’s position as a mature but structurally growing market for advanced cabin baggage screening systems.

- European airports are increasingly pairing CT scanners with automated screening lanes and remote screening architectures to improve throughput and operational consistency. Early adopters such as Heathrow and Schiphol have demonstrated the benefits of centralized image review and automated lane operations, encouraging expansion to other airports as network infrastructure and security operations centers mature.

- Germany and France are integrating CT deployments with broader terminal modernization programs, while Southern European markets like Spain and Italy emphasize throughput gains to manage tourism-driven seasonal peaks. These trends support sustained demand for integrated, software-driven screening ecosystems across the region.

- The UK airport cabin baggage scanner market stands out for its early adoption of lane automation and remote screening models. Major airports, led by Heathrow, have deployed CT scanners alongside automated lanes to increase passenger throughput and reduce manual inspection workloads. Clear regulatory direction and early investment have positioned UK airports ahead of many peers in operational maturity. Ongoing upgrades focus on expanding automated lanes across terminals, improving network resilience, and standardizing remote screening workflows, making the UK a key reference market for advanced cabin baggage screening solutions in Europe.

The Asia-Pacific airport cabin baggage scanner market is expected to grow at the highest CAGR of 8.9% during the forecast period.

- The Asia-Pacific market is experiencing rapid growth, driven by large-scale airport additions, capacity expansions, and rising air passenger traffic. Governments across the region are investing heavily in aviation infrastructure to support economic growth and regional connectivity. This expansion is creating sustained demand for new screening lanes, particularly CT-based cabin baggage scanners. Airports increasingly prioritize higher throughput and modern security standards, making CT and automated screening solutions central to new terminal developments and major airport upgrade programs across the region.

- Major aviation hubs in Japan, Singapore, South Korea, and Australia are leading technology adoption within the Asia Pacific. These airports are early adopters of AI-enabled CT scanners, automated screening lanes, and remote screening architectures to improve efficiency and consistency.

- Emphasis is placed on passenger experience, operational resilience, and compliance with global security standards. Mature hubs are moving beyond standalone scanners toward integrated lane ecosystems, combining hardware, software, and networking. This technology-led approach supports higher throughput during peak travel periods and sets operational benchmarks for emerging airports across the region.

The Chinese airport cabin baggage scanner market is estimated to grow at a significant CAGR of 10.5% from 2026 to 2035.

- China represents the largest single growth engine within the Asia Pacific airport cabin baggage scanner industry. National civil aviation plans call for extensive airport construction and expansion, resulting in a significant increase in screening lanes.

- The market favors locally manufactured CT scanners, supported by domestic supply chains and policy alignment. Large hub airports prioritize high-capacity CT systems and automation to manage growing passenger volumes efficiently. As new airports and terminals come online, demand for modern cabin baggage screening equipment remains strong and highly predictable.

The Indian airport cabin baggage scanner market is estimated to grow at a significant CAGR of 8% from 2026 to 2035.

- India’s market is expanding rapidly as new airports and terminals are developed under national connectivity initiatives. Rising domestic air travel and regional airport upgrades are driving demand for modern screening infrastructure.

- Airports are increasingly adopting CT scanners to improve detection accuracy and manage growing passenger flows. While cost sensitivity remains, selective automation and compact CT systems are gaining traction. Continued investment in aviation infrastructure positions India as a key long-term growth market within the Asia Pacific region.

The Latin America airport cabin baggage scanner market, valued at USD 243.4 million in 2025, is driven by steady growth, supported by airport modernization programs at major hubs and rising international passenger traffic.

- Countries such as Mexico, Brazil, Colombia, and Chile are upgrading security infrastructure at high-traffic airports, including Mexico City, Cancun, São Paulo, and Bogotá. CT-based cabin baggage scanners are increasingly adopted to improve detection performance and manage peak travel volumes. While budget sensitivity remains at secondary airports, large hubs are pairing CT deployments with selective automation to improve throughput. Private concession models and phased upgrades continue to support gradual but sustained market growth across the region.

The Middle East and Africa airport cabin baggage scanner market, projected to reach USD 223.3 million by 2035, is driven by large-scale airport expansion projects and strong government-backed security investments.

- Gulf countries such as the UAE, Saudi Arabia, and Qatar are deploying advanced CT scanners with automated lanes and remote screening at major international airports to support global transit traffic. In Africa, growth is concentrated on key international gateways, where modernization programs focus on compliance and passenger flow improvement. While adoption varies by country, rising air traffic, new terminal construction, and long-term aviation strategies are creating steady demand for modern cabin baggage screening solutions across the region.

Airport Cabin Baggage Scanner Market Share

The airport cabin baggage scanner industry remains moderately consolidated, with the top five players, such as Smiths Group plc, Leidos Holdings, Inc., OSI Systems (Rapiscan Systems), Thales Group, and Honeywell International, collectively accounting for approximately 36% of global market share. These companies benefit from strong regulatory certifications, long-standing relationships with aviation authorities, and broad product portfolios covering CT scanners, automated lanes, and integrated security solutions. Their scale allows continued investment in R&D, AI-based threat detection, and global service networks, positioning them as preferred suppliers for major international hubs and government-led procurement programs worldwide.

Despite the presence of established global leaders, the remaining market share is fragmented among regional manufacturers and value-tier competitors. These players compete by offering cost-competitive systems, localized service support, and solutions tailored to regional regulations or airport sizes. Smaller vendors often target regional and domestic airports, retrofit-friendly installations, or niche operational needs where flexibility and proximity matter more than scale. This competitive dynamic encourages innovation, pricing discipline, and customization across the market, ensuring that both premium integrated solutions and lower-cost alternatives continue to coexist and drive overall market growth.

Airport Cabin Baggage Scanner Market Companies

Some of the prominent market participants operating in the airport cabin baggage scanner industry include:

- Smiths Detection (Smiths Group)

- Leidos Holdings, Inc.

- OSI Systems (Rapiscan Systems)

- Nuctech Company Limited

- L3Harris Technologies

- Analogic Corporation

- Astrophysics Inc.

- CEIA S.p.A.

- Autoclear LLC

- Garrett Metal Detectors

- Thales Group

- Vanderlande Industries

- Safeway Inspection Systems

- VOTI Detection

- Aventura Technologies

- Gilardoni S.p.A.

- Surescan Corporation

- Adani Systems, Inc.

- CEIA & Associates

- Unisys Corporation

- NEC Corporation

- Honeywell International

- Bosch Security Systems

- Thruvision

- QinetiQ Group

- Smiths Group plc

Smiths Group plc, through its Smiths Detection division, is a leading player in the airport cabin baggage scanner market, retaining a competitive edge through an end-to-end portfolio that combines CT scanners, automated screening lanes, and integrated software platforms. Its HI-SCAN 6040 CTiX series and iLane ecosystems are widely deployed across large, multi-terminal airports in Europe, the Middle East, and North America. Public disclosures indicate that more than two thousand CT units have been installed globally, backed by a strong global service footprint, Smiths supports Tier-1 hubs with lifecycle support, regulatory compliance, and scalable security solutions.

Leidos Holdings, Inc. is a leading provider of advanced security screening solutions, prominently serving U.S. airports through TSA-aligned programs. Its Reveal CT-80 and automated lane platforms are widely deployed at major domestic hubs, supported by increased local manufacturing that shortens delivery timelines for federal contracts. Leidos stands out by integrating software-driven analytics, SOC tooling, and lifecycle management services, focusing on optimizing total checkpoint performance beyond hardware alone. The company’s data-centric approach enhances threat detection, operational efficiency, and compliance, positioning it as a trusted partner in securing high-volume airports while adapting to evolving regulatory and technological demands globally.

OSI Systems, through its Rapiscan Systems division, is a key player in the airport cabin baggage scanner market, offering a balanced portfolio of CT scanners, X-ray systems, and automated screening solutions. The company leverages local manufacturing partnerships and flexible system configurations to serve cost-sensitive airports across APAC, the Middle East, and Latin America. Rapiscan integrates AI-driven threat detection, real-time analytics, and lifecycle support to enhance checkpoint efficiency and security performance. Its solutions are widely deployed in both commercial and government airports, enabling scalable, high-throughput screening while addressing regional regulatory standards and operational requirements, reinforcing its position as a trusted global security technology provider.

Airport Cabin Baggage Scanner Industry News

- In August 2025, Berlin Brandenburg Airport (BER) expanded its computed tomography security technology, bringing all lanes in Terminal 1’s Control Area 1 online with CT scanners. This upgrade, completed ahead of schedule, enables passengers to pass through security without removing electronics or liquids. BER now operates 24 CT-equipped lanes, reflecting the broader European trend toward advanced 3D screening deployment.

- In July 2024, The U.S. Transportation Security Administration installed new automated screening lanes equipped with computed tomography (CT) scanners at numerous airport checkpoints, designed to improve security efficiency and passenger throughput. These lanes feature enhanced bin handling, RFID tagging, and automated diversion of prohibited items, enabling faster screening and clearer 3D imaging that reduces manual bag checks. To date, over 205 ASLs have been installed nationwide as part of ongoing modernization efforts.

- In March 2025, London Gatwick Airport completed its transition to advanced CT-based security scanners across all 19 security lanes, allowing passengers to keep electronic devices and liquids inside carry-on baggage during screening. Supplied by Smiths Detection, these systems provide high-resolution 3D images for improved threat detection and streamlined checkpoint flow, significantly enhancing passenger experience while meeting evolving UK security requirements.

The airport cabin baggage scanner market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD million) from 2022 to 2035, for the following segments:

Market, By Technology

- X-ray Based Scanners

- Single-view X-ray

- Dual-view X-ray

- Multi-view X-ray

- Computed Tomography (CT) Scanners

- Standard-resolution CT

- High-resolution CT (EDS-CB compliant)

- Specialized Cabin Baggage Detection Systems

- Liquid Explosive Detection Systems (LEDS)

- Explosive Trace Detection (ETD)

- Others

Market, By Integration Level

- Standalone Screening Units

- Integrated Automated Screening Lane Systems

- Networked/ Remote screening capable systems

Market, By Application

- Large international hub airports

- Regional/domestic airports

- Government & military facilities

- Private/corporate aviation terminals

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- ANZ

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- MEA

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

Frequently Asked Question(FAQ) :

What are the upcoming trends in the airport cabin baggage scanner market?

Key trends include regulatory-driven adoption of AI-enabled CT scanners, wider use of automated screening lanes to increase throughput, and remote screening to reduce staffing needs.

Which region leads the airport cabin baggage scanner market?

North America held 38.8% market share in 2025, driven by TSA-led CT mandates, large-scale replacement of legacy X-ray systems, and strong regulatory alignment supporting checkpoint modernization across major U.S. airports.

What is the growth outlook for specialized cabin baggage detection systems from 2026 to 2035?

Specialized cabin baggage detection systems are projected to grow at a CAGR of 9.9% till 2035, due to rising security threats, stricter aviation regulations, and increasing deployment of advanced liquid explosive and trace detection technologies.

What is the current airport cabin baggage scanner market size in 2026?

The market size is projected to reach USD 2.3 billion in 2026.

How much revenue did the Computed Tomography (CT) Scanners segment generate in 2025?

CT Scanners held 68.6% market share in 2025, leading the market due to their 3D volumetric imaging capabilities, automated threat recognition, and superior detection accuracy compared to traditional X-ray systems.

What was the valuation of the standalone screening units segment in 2025?

Standalone screening units generated USD 1.1 billion in 2025, dominating the integration level segment as high-volume airports deploy these systems with CT scanners and selective automation features.

What is the projected value of the airport cabin baggage scanner market by 2035?

The airport cabin baggage scanner market is expected to reach USD 4.4 billion by 2035, propelled by CT scanner deployment, AI integration, automated screening lane adoption, and strict aviation security regulations.

What is the market size of the airport cabin baggage scanner in 2025?

The market size was USD 2.1 billion in 2025, with a CAGR of 7.4% expected through 2035 driven by rising regulatory mandates on CT-based scanner adoption, increasing air passenger traffic, and airport infrastructure modernization worldwide.

Who are the key players in the airport cabin baggage scanner market?

(Rapiscan Systems), Nuctech Company Limited, L3Harris Technologies, Analogic Corporation, Astrophysics Inc., CEIA S.p.A., Autoclear LLC, Garrett Metal Detectors, Thales Group, Vanderlande Industries.

Airport Cabin Baggage Scanner Market Scope

Related Reports