Summary

Table of Content

Aircraft Window Frame Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Aircraft Window Frame Market Size

Aircraft Window Frame Market size valued at over USD 135 million in 2018 and is estimated to exhibit around 4% CAGR from 2019 to 2025.

To get key market trends

To get key market trends

Increasing aircraft production owing to rising air travel along with improving disposal income per capita are driving the aircraft window frame market share over the projected timeframe. Improving tourism along with increasing demand from low cost carriers are expected to significantly improve the industry demand. Advancements in manufacturing technologies along with usage of lightweight materials for lowering the overall aircraft weight are providing a positive outlook for the industry expansion.

Aircraft Window Frame Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2018 |

| Market Size in 2018 | 135 Million (USD) |

| Forecast Period 2019 - 2025 CAGR | 4% |

| Market Size in 2025 | 180 Million (USD) |

What are the growth opportunities in this market?

Government organisations across the globe are focussed on promoting domestic aircraft production for ensuring economic development along with expansion of the overall aviation industry. Moreover, multiple government organisations across the globe are also offering tax incentives and benefits to aircraft manufacturers to enhance their manufacturing facilities and increase aircraft production output. For instance, in January 2019, Indian government announced the development of a blueprint with a focus on encouraging and promoting the domestic manufacturing of aircrafts and components by offering financing assistance to industry players.

Advancements in manufacturing technologies, including the advent of additive manufacturing in aviation industry are providing a positive outlook for the market share expansion. The benefits offered by the technology including rapid prototyping, lower manufacturing time, and reduced material wastage are further expanding the market size. For instance, in 2017, GKN Aerospace announced the launch of its 3D printed components for Boeing 737 aircrafts.

Industry players are continuously investing in R&D for developing advanced manufacturing technologies for window frames. For instance, Nordam along with Hexcel Corp. are offering composite aircraft window frames, that are manufactured using the innovative HexMC technology. This play a major role in improving the frame corrosion resistance, durability, and lowers maintenance significantly.

Aircraft Window Frame Market Analysis

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

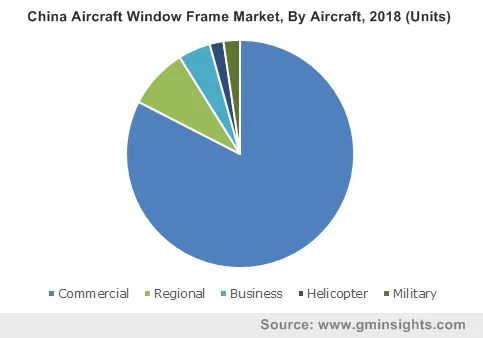

Commercial aircraft will account for the maximum volume in the aircraft window frame market share over the forecast timeframe. This can be attributed to the rising demand for narrow and wide body aircrafts globally. The proliferating demand for low cost carriers along with improving network routes with low cost fares are driving the segment share over the projected timeframe. Moreover, aircraft manufacturers are focussing on increasing the production for meeting the overall growing aircraft demand. For instance, in January 2019, Boeing announced its plans to ramp up the 787 Dreamliner production to around 14 planes per month.

Helicopters will account for a considerable share in the market over the forecast timeframe. This can be credited to the rising demand for helicopters for a wide range of applications including tourism, emergency rescue, and specialized combat missions, among others. Moreover, the ability of these helicopters to perform a wide range of operations including vertical take-off and landing, along with the ability to manoeuvre across areas further accentuates the segment share.

The cabin will account for the highest share in the market over the study timeframe. This can be attributed to the increasing focus of aircraft manufacturers to increase passenger seating capacities for utilizing maximum aircraft floor area. This results in incorporating additional window frames along with seats in aircrafts to improve operational efficiency. The increasing demand for double storeyed widebody aircrafts with passenger seating in two floors further accentuates the market demand over the study timeframe.

Cockpit will account for a considerable growth rate in the aircraft window frame market share over the projected timeframe. This can be attributed to the requirement for highly durable and strong window frames to withstand higher temperatures and altitudes. Moreover, advancements in cockpit windows along with polarizing capabilities for offering pilots improved vision during diversified climatic conditions further expands the segment size over the suggested timeframe.

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

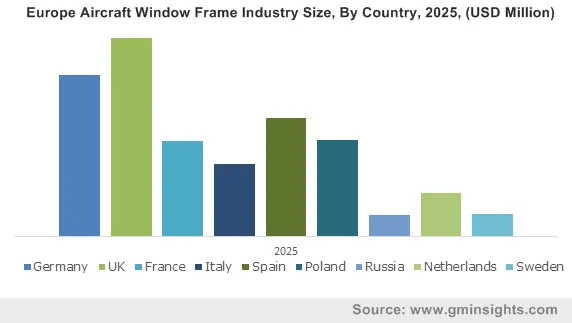

Europe aircraft window frame market will account for a considerable share owing to the increasing demand for low cost carriers across the region. The availability of low fare rates along with expansion of travel routes further enhances the regional share over the study timeframe. Rising prevalence of business jets are further expanding the regional share. The prevalence of innovative private jet ownership programs including the fractional jet ownership along with the availability of jet charter services are positively influencing the regional demand.

North America will account for a significant share in the market size. This can be attributed to the presence of multiple aircraft manufacturers across the region including Boeing, Airbus, and Lockheed Martin, among others focussing on wide range of aircrafts targeting different customers. Moreover, rising aircraft production and deliveries are playing a major role in boosting the regional share over the forecast timeframe. For instance, in 2019, Boeing announced the total aircraft deliveries for 2018 accounted for 806 aircrafts. Moreover, the company also announced the growth in its order book accounting for around 893 net orders.

Aircraft Window Frame Market Share

Few of the prominent players in the aircraft window frame market share include

- SIFCO Industries

- LMI Aerospace

- Nordam Group

- PPG Industries Inc

- ACE Advanced Composite Engineering GmbH

- GKN Aerospace

Joint ventures and partnerships are among the key strategies adopted by industry participants to increase their market share. For instance, in June 2013, Nordam Group in association with Boeing announced the manufacturing of 20,000 composite window frames for the 787 Dreamliner.

Industry Background

Aircraft window frames offers superior sturdiness and rigidity to the windows for operating in diversified altitudes and climatic conditions. Rising aircraft production along with order delivery backlogs from major aircraft manufacturers including Boeing and Airbus are driving the market share. The aircraft window frame industry share is set to witness significant growth owing to the rising demand for large sized aircraft windows and increasing emphasis on the development of light weight aircraft window frames. Rising emphasis on improving fuel economy and reduce carbon emissions are some of the major focus areas of aircraft manufacturers for improving their sales. Growing demand for commercial and regional owing to reduced air fares along with increasing adoption of low-cost carriers are further escalating the market size over the study period.

Frequently Asked Question(FAQ) :

Which aircraft window frame product will witness increased installation in the coming years?

Cockpits require a high durability and strong window frames to tolerate high temperatures and altitudes, along with ensuring an improved vision in adverse climatic conditions.

Why will the commercial segment create a rising demand for aircraft window frames?

With an escalating demand for low cost carriers and enhanced network routes, the production of aircraft window frames shall grow on account of wide and narrow body airplane demand.

What is the expected growth rate for aircraft window frame industry share during the forecast timespan?

The industry share of aircraft window frame is estimated to exhibit around 4% CAGR from 2019 to 2025.

How are government organizations fueling aircraft window frame market outlook?

Many governments worldwide have been offering financial benefits to the aircraft manufacturers for helping them improve their manufacturing facilities and aircraft production.

What was the size of the global aircraft window frame market in 2018?

The market size of aircraft window frame was valued at over USD 135 million in 2018.

Aircraft Window Frame Market Scope

Related Reports