Summary

Table of Content

Aircraft Seating Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Aircraft Seating Market Size

The global aircraft seating market was valued at USD 8.3 billion in 2024 with a volume of 651.9 thousand units. The market is expected to grow from USD 8.7 billion in 2025 to USD 11.5 billion by 2030 and USD 14.9 billion by 2034 with a volume of 1,133.7 thousand units, growing at a value CAGR of 6.1% and volume CAGR of 5.8% during the forecast period of 2025-2034, according to Global Market Insights Inc.

To get key market trends

- The demand for aircraft seating market is expanding significantly due to the growing air passenger traffic, and the adoption of digital integration and smart seating solutions.

- The global increase in air passenger traffic volumes is a primary factor for the increase in the demand for aircraft seating. According to the industry forecast by Airports Council International, International passenger traffic is expected to expand over the forecast period of 2024-2043, reaching a staggering 17.7 billion passengers. Air travel recovery and growth is triggering heightened investments in new aircraft and cabin servicing to address growing need. The sustained increase in passenger numbers is anticipated to boost demand for new and replacement seating in all classes in emerging economies and on high-density routes.

- The in-flight experience is being transformed as digital technologies are being adopted, driven by the expectations of modern, tech-savvy travelers. Airlines are providing smart seating systems that offer comfort, convenience, and connectivity. In May 2025, Flynas, a Saudi low-cost carrier, announced the replacement of the older interiors on 60 A320neo aircraft with new Safran Z200 seats. These seats include smart cushions, holders for electronic devices, and USB A and USB C power outlets, thus, improving passenger comfort and embracing the growing trend of digital personalization. These changes exemplify the growing smart seating technology integration into airline differentiation strategies.

- In 2024, North America accounted for 35.2% share of the aircraft seating industry. This region remains at the forefront because of the development of the aviation industry and the growing need for aircraft modernization. According to Airports Council International, airports in North America recorded a 4.5% increase in passenger traffic, cargo volumes, and aircraft movements in 2024. The continuing growth is fueling persistent investment spending in advanced aircraft seating systems designed for improved passenger comfort, optimized cabin space, and enhanced next-generation in-flight services.

Aircraft Seating Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 8.3 Billion |

| Forecast Period 2025 - 2034 CAGR | 6.1% |

| Market Size in 2034 | USD 14.9 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing air passenger traffic | Drives aircraft seating industry demand by over 30% due to the need for enhanced capacity and traffic flow management amid rising air traffic and congestion. |

| Increasing demand for premium cabin seats | Accelerates market growth by over 25% as airlines invest in enhanced passenger comfort and differentiation in business and first-class offerings. |

| Growth of low-cost carriers and regional airlines | Expands demand by nearly 20% through high-volume procurement of cost-efficient, lightweight, and modular seating solutions. |

| Growth in business and private jet segments | Boosts premium seating demand by over 15% driven by rising deliveries of business jets and growing HNWI travel demand. |

| Digital integration and smart seating solutions | Stimulates innovation-led demand by over 18% as airlines adopt connected seating for passenger personalization, monitoring, and service optimization. |

| Pitfalls & Challenges | Impact |

| High cost of advanced seating systems | Limits adoption among low-cost carriers and price-sensitive airline segments due to the high cost of advanced seating systems. |

| Stringent regulatory and certification requirements | Delays time-to-market for new aircraft seating technologies because of stringent regulatory and certification requirements. |

| Opportunities: | Impact |

| Surge in demand for urban air mobility and eVTOL aircraft seating | Accelerates innovation in lightweight and modular seat designs to address the needs of urban air mobility and eVTOL aircraft. |

| Advancements in 3D printing for seat customization and prototyping | Enables faster product development and tailored passenger experiences through advancements in 3D printing for seat customization and prototyping. |

| Development of smart textiles and temperature-controlled seats | Enhances passenger comfort and supports premium cabin differentiation with the development of smart textiles and temperature-controlled seats. |

| Growing focus on disability-friendly and accessible seating designs | Promotes inclusivity and compliance with evolving accessibility standards by focusing on disability-friendly and accessible seating designs. |

| Market Leaders (2024) | |

| Market Leaders |

Top 2 players held 25.7% market share |

| Top Players |

Collective market share in 2024 is 36.2% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | Mexico, India, Brazil, Indonesia, South Africa |

| Future Outlook |

|

What are the growth opportunities in this market?

Aircraft Seating Market Trends

- There is an emerging trend of ultra-high-density seating arrangements in the aircraft seating industry, especially with budget airlines looking to increase the number of passengers per aircraft. Solutions such as Aviointeriors’ Skyrider 2.0, a saddle-type seat that supports semi-standing positions, are ideal for short haul budget airlines as they reduce the required pitch and seat weight. These seats are proposed to be implemented in the budget airlines as of 2026. This shift in the airline industry is anticipated to grow from 2026 to 2030, especially in regions where low-cost travel is in high demand.

- Airlines are moving toward more customizable seat layouts that feature adjustable seating, integrated controls for in-flight entertainment (IFE) systems, and improved ergonomic design. This development aids in differentiation and enhances customer satisfaction, particularly in the premium economy and business seating classes. Growth acceleration is anticipated between 2025 and 2031 as airlines compete on passenger experience.

- OEMs are focusing on more sustainable seat construction by using lightweight, recyclable composites and sustainable materials. Circular design techniques, such as modular parts that facilitate reuse, repair, and recycling, are gaining prominence amid regulatory and consumer pressure. This development is expected to drive change in the supply chain between 2025 and 2032.

- The seats on the next-generation aircraft are being designed to include sensors, biometric interfaces, and health monitoring systems capable of digitally interacting with the passenger, thus adjusting the passenger’s position and interfacing with various digital services. Airlines are perceiving this as a vivid opportunity to enhance long-haul travel experience. The wide-body and business jets segments are anticipated to experience growth in the intelligent seating systems market between 2025 and 2031.

Aircraft Seating Market Analysis

Learn more about the key segments shaping this market

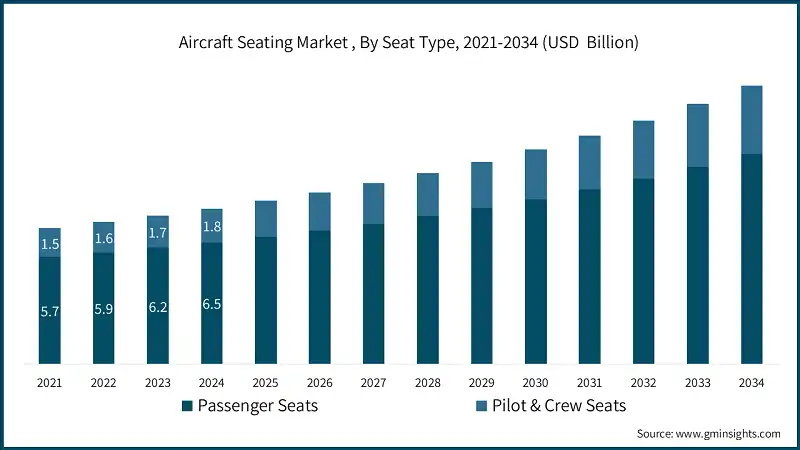

On the basis of seat type, the market is segmented into passenger seats and pilot & crew seats.

- The passenger seats segment is anticipated to reach USD 11.2 billion by 2034. The evolution of the passenger seats segment is centered around comfort, ergonomics, and health monitoring features. Moreover, airlines seek modular and lightweight seats to improve fuel efficiency and the passenger experience, including the premium and economy cabins.

- To satisfy growing airline demands for passenger comfort and operational efficiency, aircraft seat manufacturers should give priority to development of lightweight, customizable seats with integrated smart technologies.

- The pilot & crew seats segment is anticipated to grow at a CAGR of 7.3% during the forecast period 2025 - 2034. Pilot and crew seats emphasize safety, ergonomics, and comfort to withstand long flight hours and varying flight conditions. Advancements include adjustable lumbar support, controllable shock absorption as well as systems that enhance pilot performance and reduce fatigue. These features help in complying with tough regulatory requirements.

- To strengthen position in the supply chain of pilot and crew seats, aircraft seat manufacturers need to focus on regulatory compliance and invest in ergonomic design innovations.

Learn more about the key segments shaping this market

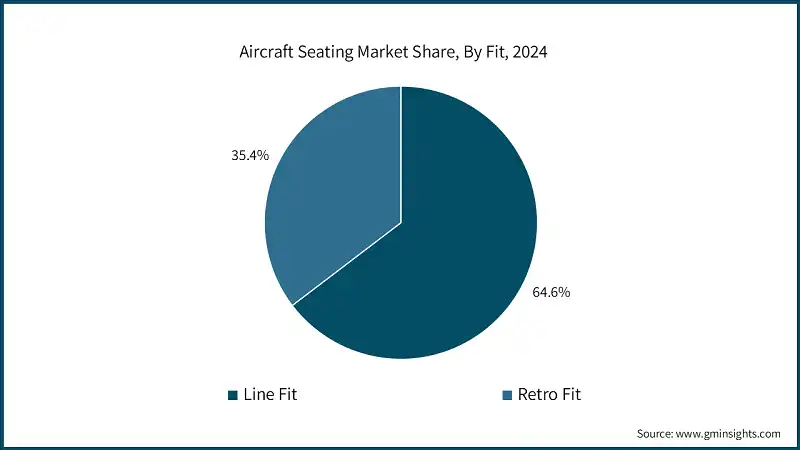

On the basis of fit, the aircraft seating market is divided into line fit and retro fit.

- The line fit segment dominated the market with a market share of 64.6% in 2024. The line fit segment benefits from aircraft manufacturers emphasis on the integration of new and innovative aircraft seats to enhance the seating layout and certification timelines. There is focus on seamless design integration, weight reduction, as well as streamlined production in conjunction with the aircraft’s delivery.

- To enhance growth in the line fit segment, aircraft seat manufacturers should strengthen collaboration with OEMs as well as concentrate on modular and easy-to-integrate seating solutions.

- The retro fit market is anticipated to grow at a CAGR of 6.8% during the forecast period 2025 - 2034. The retrofit demand is improving as airlines enhance their fleets to boost passenger comfort level and comply with new regulations without purchasing new aircraft. Focus areas include seat replacement with modern, lighter designs, and amplified with an expansion of modern aircraft cabin amenities to improve operational efficiency and reduce costs.

- To capitalize on opportunities presented by fleet modernization projects, aircraft seat manufacturers should create adaptable retrofit kits and offer efficient installation services that reduce fleet downtime.

On the basis of end use, the aircraft seating market is segmented into OEMs (original equipment manufacturers), and aftermarket.

- The OEMs (original equipment manufacturers) market is anticipated to reach USD 8.1 billion by 2034. To enhance fuel economy and the overall experience for passengers, OEMs are persistently focusing on the incorporation of new designs such as lightweight seating into newly-developed aircrafts. Collaboration with seat manufacturers ensures compliance with changing safety regulations and advancements in cabin design technology.

- Aircraft seat manufacturers must align their research and development activities to the innovation cycles and regulatory timelines set by the OEMs in order to gain long term contracts and co-development opportunities.

- Aftermarket segment is anticipated to grow at a CAGR of 7.4% during the forecast period 2025 - 2034. The aftermarket segment is expanding due to heightened aftermarket activities, including MRO services, as well as competing demands for more replacement parts. The growing emphasis on quicker turnaround times and cost-effective solutions is driving the use of modular seat components and digital inventory systems.

- Aircraft seat manufacturers should enhance aftermarket service capabilities, including predictive maintenance and spare part availability, to create competitive differentiation and recurring revenue streams.

Looking for region specific data?

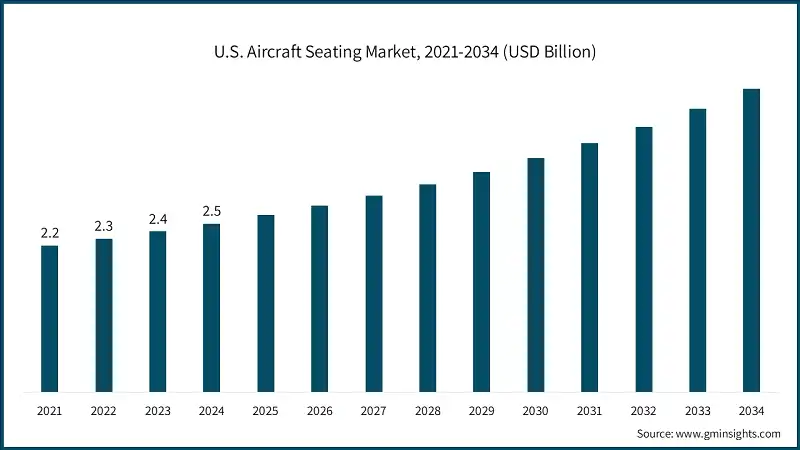

North America held a market share of 35.2% in 2024 and is anticipated to grow at a CAGR of 5.9% during the forecast period 2025 - 2034. The market for aircraft seats is dominated by North America due to the region's fleet modernization efforts and steady increase in passenger volume. The region's aviation ecosystem and proactive investments in improving aircraft fleets enable the consistent development of advanced seating systems.

- U.S. dominated the aircraft seating market, accounting for USD 2.5 billion in the year 2024. U.S. carriers moved close to 83.3 million passengers in December 2024, indicative of increased activity in major airport hubs and a clear push for increased utilization of the fleet and cabin refurbishment programs.

- Manufacturers of aircraft seats should provide lightweight, scalable, and adaptable seating options for high-turnaround fleets in order to take advantage of this growth.

- Canada is anticipated to grow at a 3.7% CAGR during the forecast period 2025 - 2034. Modernization and expansion of the fleet and infrastructure directly impact Canada's market outlook. The newly adopted renewal strategy of Air Canada which involves the reintroduction of Boeing 767s and acquiring 90 new aircraft by 2029 will increase the need for newly developed, operationally efficient and passenger-centric next-generation seats.

- Aircraft seat manufacturers must proactively engage Canadian airlines and OEMs to develop custom seat solutions in order to satisfy evolving aircraft designs, sustainability goals.

Europe accounted for 22.2% of the global aircraft seating market in 2024 and is anticipated to grow with a CAGR of 5.4% during the forecast period 2025 - 2034. Ongoing fleet renewal, increase in intra-regional air travel, and advancing differentiated cabin products continue to position Europe as a vital market for aircraft seating. To modernize, airlines are actively improving their seating arrangements to provide a better overall passenger experience. This also enables airlines to stay relevant in a rapidly evolving market and customer landscape.

- Germany is anticipated to grow at a 6.9% CAGR during the forecast period 2025 - 2034. Seat innovation in medium-haul segments is accelerating in Germany. In June 2025, Eurowings launched the "Premium BIZ" seat on a selected number of medium-haul routes operated by their A320neo aircraft. This seat is positioned within the BIZclass offering and is indicative of the ongoing segmentation and premiumization trend in single-aisle aircraft cabins.

- Aircraft seat manufacturers ought to prioritize developing premium seating configurations that can be effortlessly fitted into narrow-body fleets to allow airlines such as Eurowings to diversify their products without extensive cabin reconfiguration.

- UK's market is anticipated to grow at a 6.3% CAGR during the forecast period. The UK market is showing positive momentum, supported by the recovery in aviation revenue. According to Statista, the revenue of the UK aircraft market is anticipated to reach USD 3.59 billion by 2025, indicating an active investment cycle in fleet and cabin upgrades.

- Aircraft seat manufacturers should align product offerings with UK carriers' push for premium and eco-efficient seating by offering sustainable materials, modular components, and short lead times to meet refurbishment and new fitment needs.

Asia-Pacific held a share of 29.6% in the global aircraft seating market and is the fastest-growing region with a 7.3% CAGR during the forecast period. Asia Pacific is emerging as the fastest-growing region in the market, driven by rising middle-class air travel, expansion of low-cost carriers, and increasing airline orders for narrow-body and wide-body aircraft.

- The aircraft seating industry in China is anticipated to reach USD 2 billion by the year 2034. China is broadening its commercial aviation footprint, while major airlines are modernizing fleet interiors to keep pace with industry competition. The focus is on using domestic materials for the seats, enhancing ease of movement for passengers on domestic business and economy seats.

- Aircraft seat manufacturers must localize production and customize seating systems to meet regulations in order to accommodate China's regulatory and design preferences and expedite aircraft deployment schedules.

- Japan's aircraft seating market was valued at USD 374.1 million in 2024. Japan is known for its high standards for passenger services and innovation. Airlines are enhancing premium seating with a focus on aesthetics and high-end technological amenities, particularly in business class and on long-haul flights.

- To suit the needs of Japanese airlines and their focus on passenger experience, aircraft seat manufacturers should emphasize precision engineering and design modification.

- India's market is anticipated to grow at a CAGR of over 8.7% during the forecast period. India's aviation sector is witnessing significant growth due to rising traffic volumes as well as expansion plans from both full-service and low-cost carriers. Indian airlines focus on cost-effective seat configurations and maximizing passenger capacity in the cabin.

- Aircraft seat manufacturers should offer lightweight, durable, and high-density seating systems optimized for short- and medium-haul operations, while also providing cost efficiency to support the price-sensitive Indian airline landscape.

Latin America held 3.6% aircraft seating market share in 2024 and is anticipated to grow with a 4.1% CAGR during the forecast period. The aviation industry in Latin America is expanding steadily due to rising passenger volume and modernization initiatives at airports. Airports are upgrading their airside infrastructure to manage increasing traffic and improve operational efficiency.

In 2024, the Middle East and Africa held a share of 9.4% and is anticipated to grow at a 5% CAGR during the forecast period 2025 - 2034. MEA is strategically important owing to regional investments in aviation infrastructure and aggressive fleet expansion by local airlines.

- Saudi Arabia accounted for an 24.7% market share in 2024. Under national transformation initiatives, Saudi Arabia is scaling the aviation sector resulting in increased procurement of modern aircraft as well as a rising demand for sophisticated aircraft interiors. Airlines are focusing on class segmentation with a mix of premium and high-density economy seating to serve numerous types of travelers.

- Aircraft seat manufacturers should build strategic partnerships with Saudi carriers to co-develop cabin configurations that balance capacity with premium service, while aligning with national aviation growth targets.

- The South Africa market is anticipated to grow at a CAGR of 3.1% during the forecast period. South Africa’s aircraft seating requirements are tied to the regional airlines’ modernization of fleets and efforts to expand intra-African connectivity. Replacing older seating configurations with more contemporary, comfortable, and ergonomic seats designed for medium-distance travel is a major area of focus.

- Aircraft seat manufacturers should support South African carriers with cost-effective retrofit programs and seating solutions built for durability and lower total cost of ownership.

- The UAE accounted for a share of 30.7% in the market in 2024. The UAE continues to be a center for high-end aviation as major airlines are upgrading cabins to reinforce positioning and improve services. Focus areas include lie-flat business class seats, improved economy layouts, and personalized passenger experiences.

- Aircraft seat manufacturers should prioritize high-end, customized seating designs with integrated technologies that support UAE carriers’ emphasis on passenger luxury and global service leadership.

Aircraft Seating Market Share

The key players in the aircraft seating industry are Safran SA, Collins Aerospace, Recaro Aircraft Seating GmbH & Co. KG, Thompson Aero Seating, and Jamco Corporation. In 2024, these companies collectively accounted for over 36.2% of the market share.

- Safran lead the market with 14.8% share in 2024. The company prioritizes improving passenger and airline efficiency while enhancing comfort through the use of smart technologies and advanced ergonomic design, in line with trends in airline modernization.

- Collins Aerospace held 10.9% of the market share in 2024. Collins Aerospace delivers new advanced aircraft seating solutions that place emphasis on innovation, light weight, and modularity. The company’s seating systems span all cabin classes and are equipped with in-flight entertainment and connectivity systems as well as integration with passenger and airline services.

- Recaro Aircraft Seating held a market share of 5.3% in 2024. Recaro Aircraft Seating emphasizes on lightweight and compact seating in the economy and premium economy categories. Recaro is known for engineering precision and product durability. The company provides customizable seats that enhance comfort while providing cost efficiency to assist airlines in achieving targeted cabin density and improved fuel performance.

- Thompson Aero Seating held a market share of 0.4% in 2024. Thompson Aero Seating designs and manufactures high-end business and first-class seating products. The company prioritizes privacy, premium materials, and custom-made solutions. Thompson's revolutionary flatbed and staggered seats are widely used in the long-haul and widebody fleets of international airlines.

- Jamco Corporation held a market share of 4.8% in 2024. Jamco Corporation provides premium seating products primarily for business and first-class cabins. The business is recognized for its clean design aesthetics, integration of seat structures, and use of composite materials. Jamco airplane seat solutions incorporated for aircraft original equipment manufacturers, or OEMs, and airline customers improves comfort while reducing weight and meeting certification requirements.

- Safran SA, Collins Aerospace, Recaro Aircraft Seating GmbH & Co. KG, Thompson Aero Seating, and Jamco Corporation are recognized as leaders in the aircraft seating market. These companies have extensive product portfolios covering economy, premium economy, and business class seats. Their leadership stems from strong OEM partnerships, innovation in lightweight materials, ergonomic designs, and advanced passenger comfort technologies. They consistently drive market trends through high R&D investments and global certification expertise.

- Thompson Aero Seating, Geven, Jamco Corporation, Martin-Baker Aircraft, and Ipeco Holdings are considered challengers, with significant technical capabilities and growing influence. These companies offer competitive seating solutions focusing on lightweight designs, retrofit programs, and modular configurations. While their global footprint may be smaller than leaders, they are strengthening their position through innovation and targeted market expansion.

- Aviointeriors, Zim Aircraft Seating, LifePort, and Hong Kong Aircraft Engineering Company (HAECO) fall under followers. These companies maintain a stable presence with a focus on regional markets, retrofit services, and niche segments. Their product offerings tend to be narrower, and they participate actively in specific market pockets without broad innovation or scale comparable to leaders or challengers.

- Expliseat, Mirus Aircraft Seating, Unum Aerospace, Elevate Aircraft Seating, and Acro Aircraft Seating are niche players providing specialized or emerging solutions. Known for ultra-lightweight seats, sustainable materials, or tailored designs for regional and low-cost carriers, these companies focus on innovation and agility. While their market share is limited, their disruptive technologies and focused strategies position them well in emerging segments.

Aircraft Seating Market Companies

Major players operating in the aircraft seating industry are:

- Acro Aircraft Seating

- Aviointeriors

- Collins Aerospace

- Elevate Aircraft Seating

- Expliseat

- Geven

- Hong Kong Aircraft Engineering Company

- Ipeco Holdings

- Jamco Corporation

- LifePort

- Martin-Baker Aircraft

- Mirus Aircraft Seating

- Recaro Aircraft Seating

- Zim Aircraft Seating

Aircraft Seating Industry News

- In April 2025, All Nippon Airways (ANA) unveiled its revolutionary new business class seat, "THE Room FX", designed for its Boeing 787-9 Dreamliner fleet. This innovative suite, touted as the largest in its class on a mid-sized aircraft, prioritizes comfort and privacy.

- In July 2025, Mirus Aircraft Seating is launching a new recline economy seat called "Hawk Duo" at the Aircraft Interiors Expo in Hamburg. The Hawk Duo is designed for single-aisle aircraft and offers increased passenger comfort and living space.

The aircraft seating market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) & Volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Seat Type

- Passenger seats

- First class seats

- Business class seats

- Premium economy class seats

- Economy class seats

- Pilot & crew seats

Market, By Aircraft Type

- Narrow-body aircraft

- Wide-body aircraft

- Regional aircraft

- Business jets

Market, By Standard

- 9G

- 16G

- 21G

Market, By Fit

- Line fit

- Retro fit

Market, By End Use

- OEMs (original equipment manufacturers)

- Aftermarket

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- Uk

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

What was the valuation of the line fit segment in 2024?

The line fit segment dominated the market with a market share of 64.6% in 2024.

Who are the key players in the aircraft seating market?

Key players include Safran, Collins Aerospace, Recaro Aircraft Seating, Thompson Aero Seating, and Jamco Corporation.

What are the upcoming trends in the aircraft seating industry?

Key trends include ultra-high-density seating for low-cost carriers, smart seating with health monitoring, sustainable materials, and customizable layouts.

Which region leads the aircraft seating market?

North America held 35.2% market share in 2024, supported by fleet modernization and advanced aviation infrastructure.

What is the growth outlook for the retrofit segment from 2025 to 2034?

The retrofit segment is projected to grow at a 6.8% CAGR till 2034.

How much revenue did the passenger seats segment generate in 2024?

The passenger seats segment generated USD 8.3 billion in 2024.

What is the projected value of the aircraft seating market by 2034?

The market size for aircraft seating is expected to reach USD 14.9 billion by 2034, driven by premium cabin demand, lightweight materials, and integration of digital technologies.

What is the market size of the aircraft seating in 2024?

The market size was USD 8.3 billion in 2024, with a CAGR of 6.1% expected through 2034 driven by growing air passenger traffic and adoption of smart seating solutions.

Aircraft Seating Market Scope

Related Reports