Summary

Table of Content

Aircraft Lavatory Systems Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Aircraft Lavatory Systems Market Size

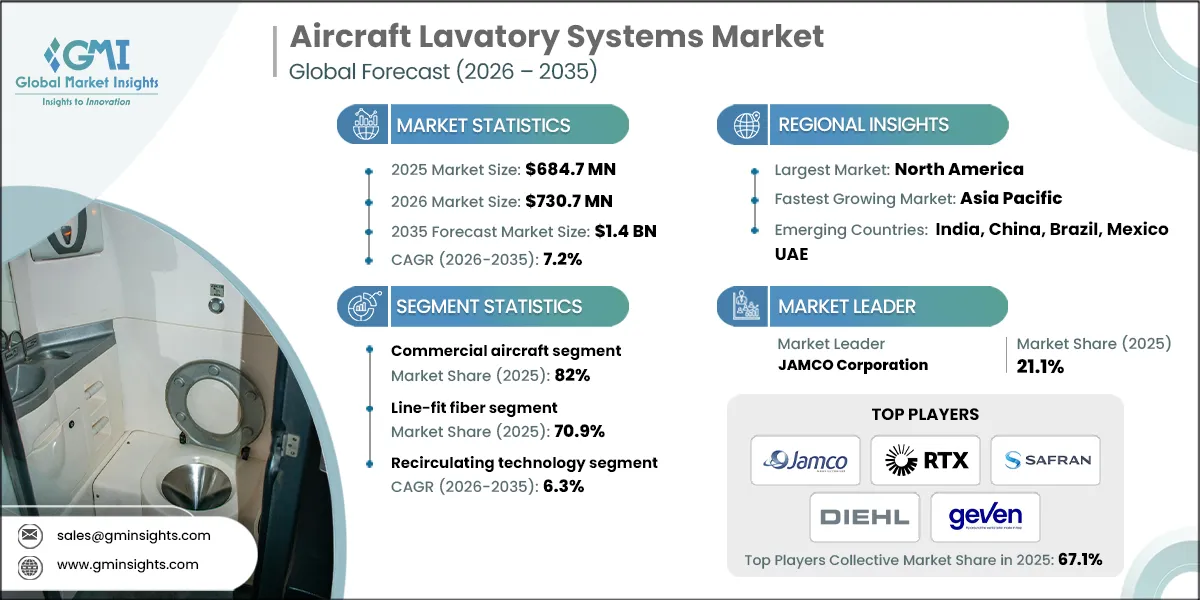

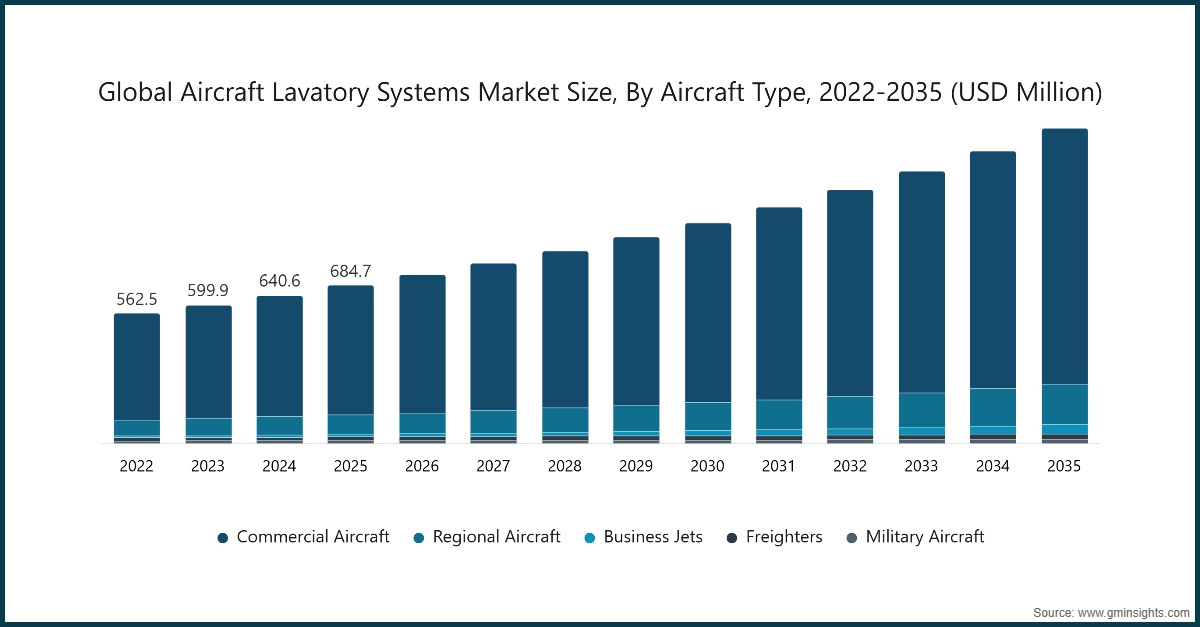

The global aircraft lavatory systems market was valued at USD 684.7 million in 2025. The market is expected to grow from USD 730.7 million in 2026 to USD 1 billion in 2031 and USD 1.4 billion in 2035, growing at a CAGR of 7.2% during the forecast period according to the latest report published by Global Market Insights Inc.

To get key market trends

The growth of the aircraft lavatory systems industry is attributed to growth in global aircraft deliveries, aftermarket demand in retrofit and modernization, stringent regulatory and safety standards, and increase in long-haul and widebody operations.

Growth in global aircraft deliveries is a primary driver for the aircraft lavatory systems market, as each new aircraft requires multiple fully integrated lavatory systems at the line-fit stage. The increasing air passenger traffic, as well as the expansion of low-cost and full-service airlines, and the replacement of aging aircraft, are accelerating production rates across the narrow-body, wide-body, and regional aircraft. According to Boeing, the global commercial aircraft fleet is expected to grow to nearly 50,000 aircraft by 2044, which means that there will be a long-term demand for new installations of cabin monuments, including lavatory systems, across all major airframe programs.

The growth of long-haul air travel also increased the demand for the deployment of wide-body aircraft, which require more lavatory systems per aircraft compared to narrow-body aircraft. This will directly lead to an increase in the demand for units and the total system value per aircraft delivery. In 2025, Airbus delivered 93 aircraft from the A330 and A350 wide-body family, which indicates that there is a sustained airline investment in long-range capacity expansion.

Between 2022 and 2025, the market witnessed considerable growth, increasing from USD 562.4 million in 2022 to USD 684.7 million in 2025 due to rising commercial aircraft deliveries, post-pandemic recovery in air travel, accelerated cabin retrofit programs, increased production of widebody and long-range aircraft, and growing regulatory focus on hygiene, accessibility, and replacement of aging lavatory systems across global airline fleets.

Aircraft Lavatory Systems Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 684.7 Million |

| Market Size in 2026 | USD 730.7 Million |

| Forecast Period 2026-2035 CAGR | 7.2% |

| Market Size in 2035 | USD 1.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growth in global aircraft deliveries | Drives 22% growth as increasing production of commercial, regional, business, and military aircraft directly expands line-fit installation of lavatory systems. |

| Aftermarket demand in retrofit and modernization | Supports 20% growth through cabin refurbishment programs, hygiene upgrades, and replacement of aging lavatory modules across in-service fleets. |

| Stringent regulatory and safety standards | Contributes 18% growth as compliance with sanitation, accessibility (PRM), and waste management regulations necessitates system upgrades and certified replacements. |

| Increase in long-haul and widebody operations | Adds 15% growth since widebody aircraft require higher lavatory density per aircraft, raising total system value per delivery and retrofit. |

| Focus on lightweight and space-efficient cabins | Accounts for 13% growth driven by airline efforts to improve fuel efficiency and cabin layout optimization, encouraging adoption of advanced integrated lavatory systems. |

| Pitfalls & Challenges | Impact |

| High system cost and certification complexity | Restrains potential growth due to high development, customization, and certification expenses, particularly for widebody and military platforms. |

| Cyclicality of aircraft production | Limits growth as fluctuations in airframe manufacturing rates and airline capex cycles directly affect line-fit demand. |

| Opportunities: | Impact |

| Growing retrofit and replacement cycle | Contributes 17% growth as the expanding global fleet ages and undergoes periodic cabin reconfiguration and system replacement. |

| Rising demand from emerging markets | Adds 14% growth driven by fleet expansion in Asia-Pacific, Middle East, and Latin America, increasing both new installations and aftermarket demand. |

| Market Leaders (2025) | |

| Market Leader |

Market share of JAMCO Corporation is 21.1% in 2025 |

| Top Players |

Collective Market Share is 67.1% in 2025 |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, China, Brazil, Mexico, UAE |

| Future outlook |

|

What are the growth opportunities in this market?

Aircraft Lavatory Systems Market Trends

- The market have experienced a rise in demand for modernizing and retrofitting current aircraft. To enhance passenger comfort, accessibility, and hygiene, airlines are modernizing their restrooms. This makes it a significant retrofit market in the developed aircraft markets of North America, Europe, and the Asia-Pacific area. In order to prolong the life of these assets and give suppliers and manufacturers around the world a consistent source of income, these retrofits include replacing the current restroom modules, utilizing touchless or environmentally friendly technology, and rearranging the cabins.

- Airlines and manufacturers are turning towards light-weight, miniaturized, and modular lavatory systems to enhance fuel burn, cabin utilization, and overall system performance. The application of new materials, modularization, and cabin integration enables weight reduction while maintaining functionality. These systems enable improved passenger flow, the possibility of adding more seats, and lower operating costs. This trend is most evident in wide-body and long-haul aircraft, where weight and space savings have a direct impact on profitability and environmental regulations.

- The emerging markets are becoming key drivers for the growth of the aircraft lavatory systems market. The fast-growing aviation market, growth in fleets, and emergence of new airlines in the Asia-Pacific, Middle East, and Latin American markets are fueling demand for line-fit and retrofit sales. Suppliers and manufacturers are forming partnerships, improving service networks, and improving retrofit capabilities to access these high-growth markets. This is fueled by the need to address growing passenger demands, regulatory needs, and investments in new cabin designs with advanced lavatory systems.

Aircraft Lavatory Systems Market Analysis

Learn more about the key segments shaping this market

Based on aircraft type, the market is segmented into commercial aircraft, regional aircraft, business jets, freighters, and military aircraft.

- The commercial aircraft segment dominated the market in 2025 and accounted for 82% of the market share because of high production volumes, increasing global air travel demand, and extensive widebody and narrowbody fleet expansions. Airlines’ focus on passenger comfort, hygiene, and regulatory compliance drives both line-fit and retrofit lavatory installations, supporting sustained growth and high system adoption globally.

- The business jets segment is expected to grow at a CAGR of 13.1% during the forecasted period because of rising demand for private travel, increasing fleet deliveries, and preference for modern, space-efficient, and high-comfort cabins. Owners are investing in customized lavatory solutions with advanced hygiene and touchless features, driving both new installations and retrofit opportunities.

Based on fit type, the global aircraft lavatory systems market is divided into line-fit and retrofit.

- The line-fit fiber segment accounted for 70.9% of the market in 2025 because of high volumes of new aircraft deliveries and OEM contracts. Airlines prioritize installation of certified, high-quality lavatory systems during production to ensure compliance with hygiene, safety, and accessibility standards, as well as to integrate lightweight, modular, and space-efficient designs efficiently.

- The retrofit segment is anticipated to grow at a CAGR of 7.8% during the forecast period because aging fleets require modernization and replacement of outdated lavatory modules. Airlines are increasingly adopting touchless, eco-friendly, and space-efficient systems to enhance passenger comfort, operational efficiency, and regulatory compliance, creating recurring demand for aftermarket installations across commercial, business, and regional aircraft.

Learn more about the key segments shaping this market

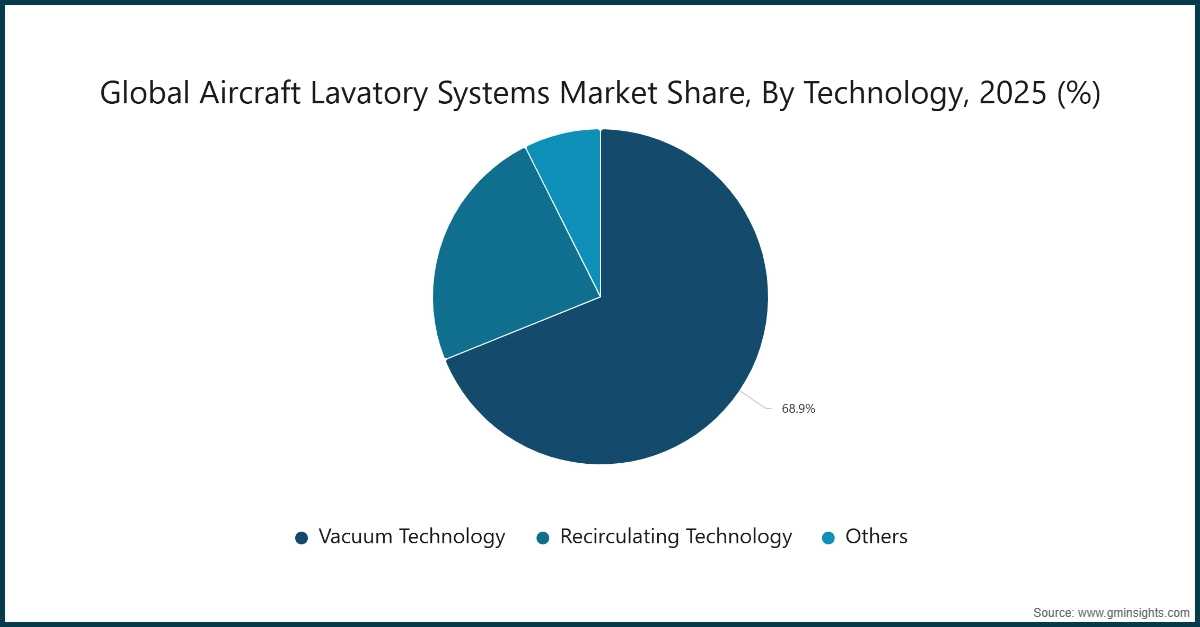

Based on technology, aircraft lavatory systems market is classified into vacuum technology, recirculating technology, and others.

- Recirculating technology segment is expected to grow at a CAGR of 6.3% during the forecast period due to the technology’s lower water consumption, ease of maintenance, and compatibility with smaller aircraft and regional jets. The airlines are attracted to these systems owing to their cost-effectiveness, simplicity of operation, and compliance with environmental and cleanliness requirements, particularly for short-range flights and smaller capacity aircraft.

- The vacuum technology segment accounted for a market share of 68.9% in 2025 because of high efficiency, minimal water usage, and suitability for widebody and long-haul aircraft. OEMs and airlines prefer vacuum systems for reliability, hygiene, and reduced maintenance requirements, making them the dominant choice in commercial and business aircraft globally.

Looking for region specific data?

North America Aircraft Lavatory Systems Market

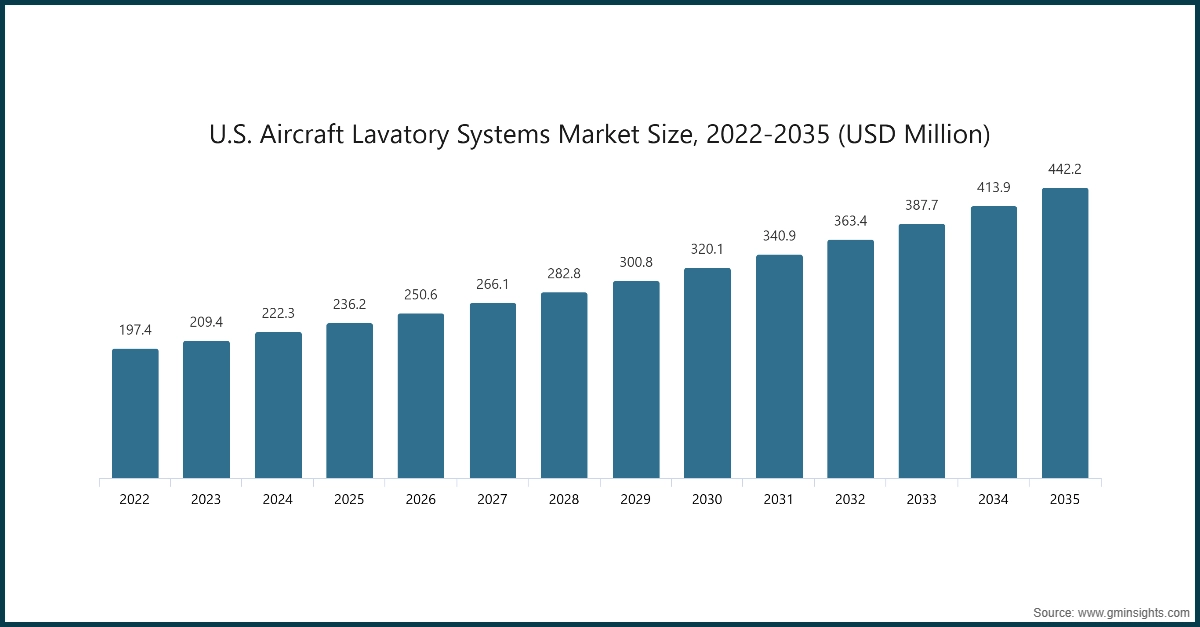

North America dominated the market with a market share of 38.9% of aircraft lavatory systems industry in 2025.

- North America’s market is driven by high commercial aircraft deliveries, fleet modernization, and retrofit programs across major airlines. The FAA's strict sanitation and accessibility regulations, combined with investments in widebody and regional aircraft, support the ongoing demand for lavatory system upgrades and replacements, guaranteeing both line-fit and aftermarket expansion.

- The region is witnessing increased adoption of lightweight, modular, and touchless lavatory technologies. Airlines prioritize fuel efficiency, cabin optimization, and passenger comfort. Retrofit opportunities in aging fleets, especially across narrowbody and regional aircraft, are expanding. North America also leads in technology innovation and integration with digital cabin systems, giving OEMs a competitive advantage in both new installations and modernization programs.

The U.S. aircraft lavatory systems market was valued at USD 197.4 million and USD 209.4 million in 2022 and 2023, respectively. The market size reached USD 236.2 million in 2025, growing from USD 222.3 million in 2024.

- The U.S. market is driven by a robust airline sector and a consistent flow of aircraft deliveries, led by Boeing. Because of the expanding wide-body fleet, longer long-haul operations, and strict regulations, line-fit restrooms will always be necessary. Airlines are also encouraging cabin upgrades to enhance accessibility and cleanliness.

- Touchless, space-efficient lavatory modules are being adopted rapidly. Retrofits for existing aircraft are driving improvements in operating efficiency and cabin upgrades. U.S. airlines are integrating lavatories with digital monitoring, predictive maintenance, and more efficient lavatory module designs. This enhances maintenance cycles, reduces downtime, and provides a sound recurring revenue stream for suppliers.

Europe Aircraft Lavatory Systems Market

Europe market accounted for USD 183.3 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- Europe’s market is driven by high Airbus deliveries and modernization of legacy fleets. Demand for both line-fits and retrofits is driven by regulatory attention to PRM accessibility, sanitation, and safety. The region's widebody operations are growing, which raises the number of restrooms needed per aircraft.

- The region is investing in lightweight, modular lavatory systems to reduce fuel consumption and enhance cabin efficiency. Airlines are focusing on overhauling old aircraft and embracing new and green technologies related to hygiene. Companies such as Safran are using their technological advantage to win contracts in both the commercial and business aviation sectors.

Germany dominates the Europe aircraft lavatory systems market, showcasing strong growth potential.

- The German market for aircraft lavatories is supported by the country’s airline fleet, including Lufthansa and many regional airlines, and a sound foundation of OEM manufacturing. Modernization projects are driving retrofits at the same time as new aircraft are being delivered, to meet EU standards of safety and cleanliness.

- The German suppliers, such as Diehl Stiftung, are encouraging innovation in modular and light lavatories. There is a clear focus on eco-friendly and water-saving technology, with spending increasing. Retrofit projects for aging aircraft create recurring revenue opportunities, while collaborations with global OEMs strengthen Germany’s position as a key European hub for lavatory systems.

Asia Pacific Aircraft Lavatory Systems Market

The Asia Pacific is the fastest growing aircraft lavatory systems industry with a CAGR of 9.8% during the forecasted period.

- Asia-Pacific is witnessing rapid airline expansion, with new aircraft deliveries from both Boeing and Airbus. Fleet modernization and retrofit programs are growing as airlines upgrade cabins to meet hygiene, accessibility, and passenger comfort requirements. Line-fit installations are expanding across commercial and regional fleets.

- The region is adopting lightweight, modular, and touchless lavatory solutions at a fast pace. There are many retrofits available for old narrow-body and wide-body aircraft, particularly in China, India, and Southeast Asia. Original equipment manufacturers and suppliers are entering into partnerships in the region to capitalize on this fast-growing market, driven by growing air travel demand and the expansion of regional fleets.

China aircraft lavatory systems market is estimated to grow with a significant CAGR, in the Asia Pacific market.

- China’s market growth is driven by aggressive fleet expansion and modernization across commercial airlines and regional operators. New aircraft deliveries from Boeing, Airbus, and COMAC are driving line-fit lav installations, while regulatory requirements and cabin refurbishments are driving the aftermarket.

- The installation of touchless, lightweight, and space-efficient restroom modules is growing rapidly. With OEMs concentrating on regional partnerships and service capabilities, retrofit programs are growing across aging narrowbody and widebody fleets. China’s market represents one of the largest growth opportunities globally due to air travel surge and expanding domestic and international route networks.

Latin American Aircraft Lavatory Systems Market

Brazil leads the Latin American market, exhibiting significant growth during the 2026-2034.

- Brazil’s market is driven by increasing regional aircraft deliveries and modernization of aging commercial and business aircraft. The demand for line-fit and aftermarket restrooms is driven by airlines' emphasis on adherence to operational, sanitation, and accessibility standards.

- The retrofit market is gaining momentum for the narrow-body fleet, particularly in the domestic and charter sectors. Airlines are seeking light-weight and modular lavatories to optimize fuel efficiency and cabin space. Suppliers are expanding their support infrastructure to capitalize on new opportunities presented by airport developments and the growing regional fleet.

Middle East and Africa Aircraft Lavatory Systems Market

UAE market to experience substantial growth in the Middle East and Africa market.

- UAE’s market growth is led by rapid expansion of airline fleets, including Emirates, Etihad, and flydubai. New widebody and long-haul aircraft deliveries drive line-fit demand for high-capacity lavatory systems, particularly in premium cabins.

- As airports and airlines seek to improve passenger comfort, hygiene, and efficiency, there is a growing trend toward modular, lightweight, touchless restrooms. Retrofits of older aircraft with upgrade programs and cabin design changes provide opportunities in the aftermarket. The UAE is a key location for OEMs and suppliers targeting the broader Middle East and North Africa region.

Aircraft Lavatory Systems Market Share

The major players in the aircraft lavatory systems industry are JAMCO Corporation, RTX, Safran, Diehl, and Geven. These players together held a market share of 67.1% in 2025. Their strong presence in both line-fit and retrofit programs, as well as their extensive range of lavatory solutions for commercial, regional, business, and military aircraft, allow them to dominate the market.

These companies differentiate themselves in the market by focusing on R&D outlays, cabin integration, light and compact designs, and advanced hygiene with touchless technology. Their focus on high-growth markets like wide-body aircraft, retrofit modernization programs, and eco-friendly lavatory systems, along with their extensive global manufacturing and service networks and strong ties with the major OEMs, fuel the growth of the global market.

Aircraft Lavatory Systems Market Companies

Prominent players operating in the aircraft lavatory systems industry are as mentioned below:

- AeroAid Ltd

- AVIC Cabin Systems

- CIRCOR Aerospace

- Diehl Stiftung & Co. KG

- EFW GmbH

- FACC AG

- Geven spa

- JAMCO Corporation

- RTX

- Safran S.A.

- ST Engineering

- THE YOKOHAMA RUBBER CO., LTD.

- JAMCO Corporation: One of the leading manufacturers of aircraft lavatory systems, JAMCO Corporation offers integrated modules for widebody, mid-size, and regional aircraft. Its expertise in lightweight, space-efficient designs, hygiene optimization, and modular cabin integration, along with strong OEM relationships and global service support, ensures dependability, superior performance, and a competitive advantage in commercial, business, and military aviation markets.

- RTX Corporation: RTX (Collins Aerospace) is one of the leading suppliers of aircraft lavatory systems, providing end-to-end solutions for commercial, business, and regional aircraft. The company’s focus on sound engineering, regulatory requirements, smooth cabin integration, and touchless technology, along with a worldwide manufacturing and service infrastructure, ensures high reliability and efficiency. This makes it a distinct leader in the market in terms of both line-fit and retrofit solutions.

- Safran: Safran provides advanced toilet solutions as part of its cabin offerings—lightweight, modular, and ergonomic designs that emphasize cleanliness, accessibility, and seamless integration with the aircraft cabin. The company caters to both global OEM programs and aftermarket support. Its emphasis on innovation, sustainability, and aviation standards provides the foundation for reliability, passenger comfort, and a strong competitive position in the global market.

- Diehl Stiftung & Co. KG: Diehl Stiftung is the leading provider of premium restroom systems for business and commercial aircraft, emphasizing cabin integration, durability, and modular solutions. High dependability, operational efficiency, and a distinct competitive advantage in line-fit and retrofit solutions are guaranteed by its proficiency in lightweight design, hygiene optimization, and regulatory compliance, along with a robust European OEM network and worldwide service support.

- Geven S.p.A.: Geven delivers modular and customizable aircraft lavatory systems for narrowbody and widebody aircraft. The company focuses on flexible cabin integration, light weight, and quality manufacturing. With worldwide OEM partnerships and service networks, Geven provides reliable performance, compliance with aviation standards, and competitive differentiation for line-fit installations and retrofit modernization projects

Aircraft Lavatory Systems Industry News

- In January 2026, Jamco announced acquisition of Schuschke, a German specialist in aircraft lavatory and cabin interior components. This move strengthens Jamco's global platform in aviation interiors, particularly for Airbus programs where Schüschke holds key supplier positions.

- In September 2025, Diehl Aviation, a German aerospace supplier, inaugurated its new production site in Querétaro, Mexico. Total investment reached about USD 50 million, supporting components like Airbus A220 overhead stowage and future Eve eVTOL interiors.

- In December 2025, Jamco Corporation announced its acquisition of Iacobucci HF Aerospace (IHFA). The transaction positions Jamco, a leading Japanese cabin interiors maker, to enhance its widebody aircraft offerings by integrating IHFA's specialized galley inserts like espresso makers, ovens, and trash compactors.

The aircraft lavatory systems market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue (USD Million) from 2022 – 2035 for the following segments:

Market, By Aircraft Type

Commercial aircraft

Narrow body aircraft

- Wide body aircraft

- Regional aircraft

- Business jets

- Freighters

- Military aircraft

Market, By Technology

- Vacuum technology

- Recirculating technology

- Others

Market, By Fit Type

- Line-fit

- Retrofit

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What was the market share of the commercial aircraft segment in 2025?

The commercial aircraft segment dominated the market in 2025, accounting for 82% of the market share. High production volumes, growing air travel demand, and fleet expansions supported its leadership.

What is the projected value of the aircraft lavatory systems market by 2035?

The market size for aircraft lavatory systems is expected to reach USD 1.4 billion by 2035, growing at a CAGR of 7.2%. This growth is fueled by increasing long-haul operations, fleet modernization, and regulatory compliance requirements.

What is the market size of the aircraft lavatory systems industry in 2026?

The market size for aircraft lavatory systems is projected to reach USD 730.7 million in 2026, reflecting steady growth driven by retrofit demand and compliance with stringent safety standards.

What is the aircraft lavatory systems market size in 2025?

The market size for aircraft lavatory systems is valued at USD 684.7 million in 2025. Increasing global aircraft deliveries and rising demand for lightweight, space-efficient cabin designs are driving market growth.

What was the valuation of the line-fit fiber segment in 2025?

The line-fit fiber segment accounted for 70.9% of the market in 2025. Airlines prioritized certified, high-quality lavatory systems during production to meet hygiene, safety, and accessibility standards.

What is the growth outlook for the recirculating technology segment during the forecast period?

The recirculating technology segment is expected to grow at a CAGR of 6.3% during the forecast period. Its lower water consumption, ease of maintenance, and cost-effectiveness make it attractive for smaller aircraft and regional jets.

Which region leads the aircraft lavatory systems market?

North America led the market in 2025, capturing 38.9% of the global market share. The region's dominance is driven by high aircraft production rates, fleet modernization, and strong aftermarket demand.

What are the upcoming trends in the aircraft lavatory systems industry?

Key trends include the adoption of lightweight, modular lavatory systems, increased focus on hygiene and accessibility, and advancements in waste management technologies. Airlines are also prioritizing space-efficient designs to optimize cabin layouts and improve fuel efficiency.

Who are the key players in the aircraft lavatory systems market?

Key players include JAMCO Corporation, RTX, Safran S.A., Diehl Stiftung & Co. KG, and Geven spa. These companies are focusing on innovative designs, regulatory compliance, and expanding their product portfolios to meet evolving market demands.

Aircraft Lavatory Systems Market Scope

Related Reports