Summary

Table of Content

Airborne Radar Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Airborne Radar Market Size

The global airborne radar market was valued at USD 18.5 billion in 2025 with a volume of 1.8 billion units. The market is expected to grow from USD 19.8 billion in 2026 to USD 29 billion in 2031 and USD 44.8 billion in 2035 with a volume of 4.2 billion units, at a CAGR of 9.5% during the forecast period of 2026-2035.

To get key market trends

The global airborne radar systems market is growing rapidly, driven by the increasing need for enhanced security and defense capabilities. There will be increased spending on advanced radar technologies such as phased array radar and synthetic aperture radar (SAR), due to upgrades within the military. These improvements support military detection, tracking, and targeting for more complex operational challenges.

One of the key drivers for the airborne radar market is the growing need for Intelligence, Surveillance, and Reconnaissance (ISR) operations. For the effectiveness of new defense strategies, it is necessary to have real-time high-quality data. For instance, in February 2025, Israel Aerospace Industries (IAI) introduced its new C-Catcher surveillance radar that showcases the need for advanced radar technology for ISR operations. The C-Catcher surveillance radar has advanced tracking and detection features that meets the surveillance and intelligence needs of both armed and unarmed military forces, hence driving the market.

Another key driver for the airborne radar market is government spending on development and modernization of military and defense aircraft. This spending will result in an enhanced development environment for existing aircraft, as well as novel technological advancements. For example, the U.S. Department of Defense’s budget for FY2025 has allocated USD 61.2 billion for aircraft procurement and research and development. This budget will enable the installation of highly advanced military surveillance radar, thereby improving surveillance, targeting, and awareness. This will further increase the entire aircraft performance level, thereby requiring innovative radar technologies, which will lead to greater development in airborne radar for military purposes.

Between 2022 and 2024, the market witnessed steady expansion, increasing from USD 15.5 billion in 2022 to nearly USD 17.4 billion in 2024. Primary drivers of the market growth are modernization defense programs, expanding airborne surveillance, and increased acquisition of advanced AESA. Other reasons for increased market penetration during this period included more upgrades of fighter aircraft, increased volumes of airborne early warning systems, and increased adoption of Intelligence, Surveillance, and Reconnaissance (ISR) systems in military and homeland security.

Airborne Radar Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 18.5 Billion |

| Market Size in 2026 | USD 19.8 Billion |

| Forecast Period 2026 - 2035 CAGR | 9.5% |

| Market Size in 2035 | USD 44.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Government investments in the modernization of military & defense aircraft | Increased defense budgets and military upgrades are driving demand for advanced airborne radar systems. ~20% to market growth.Enhanced surveillance and intelligence needs across military and security sectors fuel the adoption of advanced radar technology and growth of ~30%. |

| Increasing demand for Intelligence, Surveillance, and Reconnaissance (ISR) Missions | Enhanced surveillance and intelligence needs across military and security sectors fuel the adoption of advanced radar technology and growth of ~30%. |

| Rising need for disaster management and search & rescue operations | Natural disasters and emergency response missions require effective radar systems for quick location and damage assessment, impacting ~15% of the market. |

| Surge in the demand for advanced airborne weather monitoring radars | The need for accurate weather tracking, especially in aviation and disaster forecasting, is driving radar market growth, contributing ~25% to market expansion. |

| Technological advancements in airborne radar systems | Continuous improvements in radar technology, such as phased array and synthetic aperture radar (SAR) are broadening the capabilities of the radar and in turn the market potential, accounting for ~10% of growth. |

| Pitfalls & Challenges | Impact |

| High Development and Procurement costs | Highly advanced radars require a large amount of research and development, manufacturing, and procurement costs, making smaller operators unable to implement cutting edge systems. |

| Cybersecurity threats in networked radar systems | Vulnerabilities in connected radar networks can expose sensitive defense operations to hacking or electronic interference. |

| Opportunities: | Impact |

| Multi-mode and software-defined radar development | It will allow versatile applications to drive adoption among different sectors including defense, commercial, and security. |

| Rising UAV and drone usage | Will drive demand for lightweight and miniaturized radar systems. |

| Market Leaders (2025) | |

| Market Leaders |

15.1% Market Share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia-Pacific |

| Emerging Countries | United States, United Kingdom, India, Japan, and China |

| Future outlook |

|

What are the growth opportunities in this market?

Airborne Radar Market Trends

- Manufacturers are focusing on multi-mode airborne radar systems integrating surveillance, weather mapping, SAR/GMTI imaging, and targeting into a single system. The increasing availability of Compact AESA radars, designed specifically for UAVs and lightweight tactical platforms, shows the current demand for military programmable ISR and the growing commercial demand for retrofitting in civil aviation.

- Manufacturers prefer to incorporate surveillance, weather mapping, SAR and GMTI imaging, and targeting all together in multi-mode airborne radar systems. The availability of Compact AESA radars, developed for UAVs and lightweight tactical platforms, demonstrates the demand for military programmable ISR and the demand for retrofitting in civil aviation.

- For instance, Thales' I-Master is a lightweight radar that integrates all weather surveillance features, including pattern tracking, change detection, and wide-area coverage. I-Master has long-range, multi-target detection over land and sea for both moving and stationary targets. The convergence of these technologies is leading radar manufacturers to new frontiers and shaping the diversification of their R&D investments geographically and across various industry requirements.

- Close integration of cutting-edge technologies and upgrades in defense fleets is fueling demand for new installations of advanced radar systems, with growth clearly evident. Retrofitting projects are critical in legacy aircraft as in military and commercial arenas, aircraft modernization is done by software and hardware upgrades without having to replace the whole aircraft platform.

- The increasing rate of technological innovation is significant shown by the development of Software Defined Radars, Active Electronically Scanned Arrays (AESA) Radars, and Artificial Intelligence integrated Radars. In July 2025, an Israeli tech startup, Scanary created a radar system that uses Artificial Intelligence and Augmented Reality. This system can scan 25,000 people in an hour for security purposes and identify, display, and evaluate threats in real-time highlighting the role AI in innovation of hybrid radars.

Airborne Radar Market Analysis

Learn more about the key segments shaping this market

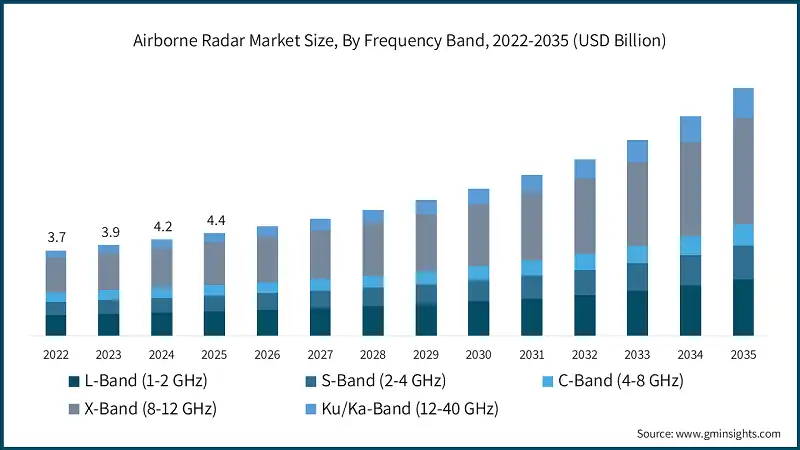

Based on frequency band, the market is segmented into L-Band (1–2 GHz), S-Band (2–4 GHz), C-Band (4–8 GHz), X-Band (8–12 GHz), and Ku/Ka-Band (12–40 GHz).

- The X-Band (8–12 GHz) segment was valued at USD 7.7 billion in 2025. X-Band airborne radars dominate the segment due to their excellent range, resolution, and overall performance in fire control, synthetic aperture radar (SAR), and target tracking for other military tactical uses. There is an increasing demand for compact, lightweight X-Band AESA systems on UAVs and fighter jets. This is driven by the increasing need for high-precision surveillance and border security.

- The Ku/Ka-Band (12-40 GHz) segment is expected to grow at a CAGR of 12.4% by 2035. In military applications, these radars are advancing quickly in the detection and tracking of missiles, imaging radar, and terrain mapping and guidance. The high bandwidth further provides a military communications relay and situational awareness. Adoption is further enhanced by miniaturization of advanced frequency agile systems despite atmospheric attenuation challenges at high frequencies.

Based on range, the airborne radar market is segmented into short range (<50 km), medium range (50–200 km), and long range (>200 km).

- The medium range (50–200 km) segment held market share of 57.7% in 2025. This segment holds the largest market share attributing to adoption of systems by defense and civil agencies that balance detection distance and resolution for border surveillance, air traffic control, and coastal monitoring. Its adaptability across military and commercial applications drives strong procurement and integration efforts globally.

- The long-range (>200 km) segment is expected to grow at a CAGR of 7.3% during the forecast period. This growth is caused by the demand for airborne early warning, long end, and strategic air defense. For the AEW&C and ISR platforms, increased investment is crucial to the defense and border security ISR platforms. There is a need for extended detection capability for sustained investment for defense and border security agencies.

Learn more about the key segments shaping this market

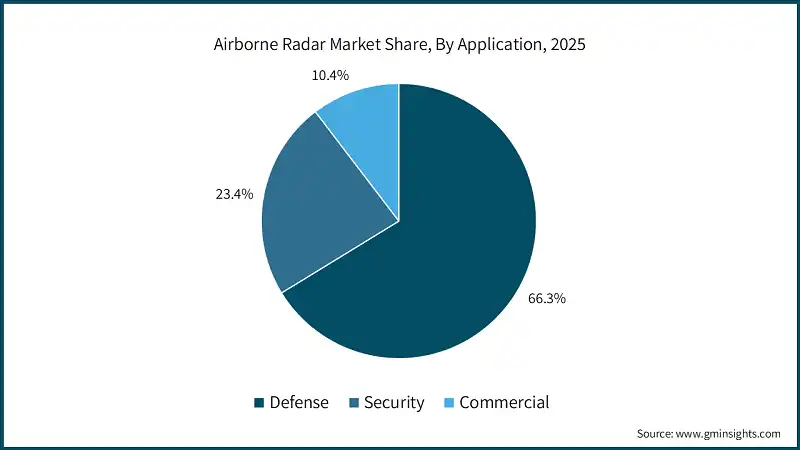

Based on applications, the airborne radar market is segmented into defense, security, and commercial.

- The defense segment held market share of 66.3% and accounted for USD 12.3 billion in 2025. The growing demand for UAVs (unmanned aerial vehicles) equipped with radars has been driving defense operations through providing extended and persistent surveillance and reconnaissance, showing a preference for enhanced platform versatility and a higher degree of networked situational awareness within the defense forces.

- For instance, NATO’s Alliance Ground Surveillance (AGS) fleet of RQ-4D “Phoenix” remotely piloted aircraft uses synthetic aperture radar (SAR) and various other radar sensors, to support persistent intelligence, surveillance, and reconnaissance missions across NATO territories. These unmanned platforms improve situational awareness and provide autonomous long-range detection without putting crew at risk.

- The security segment is projected to grow at a CAGR of 7.5% in the forecast period. The reasons for this growth are increased demand for homeland security, border surveillance, and maritime situational awareness. The more recent incorporation of sophisticated/automated threat detection and signal processing leads to increased monitoring capability and reduced need for human operators in surveillance missions.

Looking for region specific data?

North America Airborne Radar Market

North America dominated the global market with a market share of 34.1% in 2025.

- Rising defense modernization spending across the United States and Canada drives airborne radar demand. The U.S. Department of Defense prioritizes airborne ISR, early warning, and maritime patrol capabilities, with radar central to survivability, situational awareness, and multi-domain operations across air, sea, cyber, and space environments.

- Increased defense modernization spending in both Canada and the United States is boosting the demand for airborne radar in North America. In particular, the U.S. Department of Defense emphasizes airborne ISR, early warning, and maritime patrol.

- Increased civil aviation safety and traffic is driving the use of airborne radars. In 2023, the Federal Aviation Administration recorded over 45,000 commercial flights, increasing the exposure to weather and terrain risks. It leads to growing demand for retrofits and OEM installations with the FAA regulations across commercial, business, and regional aircraft fleets for collision avoidance, weather radar and terrain awareness.

- The FAA-led NextGen airspace modernization and the ICAO performance-based navigation standards are driving the demand for more advanced radar-enabled avionics, which is increasing retrofit and line-fit installations across commercial, business, and regional aircraft fleets.

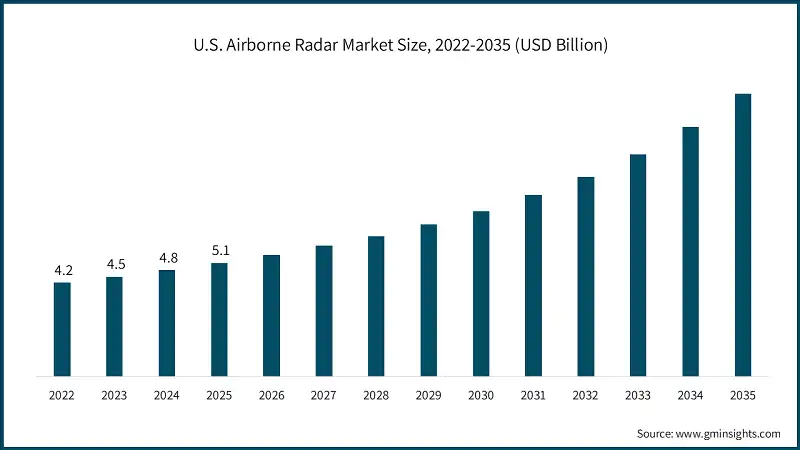

The U.S. airborne radar market was valued at USD 4.2 billion and USD 4.5 billion in 2022 and 2023, respectively. The market size reached USD 5.1 billion in 2025, growing from USD 4.8 billion in 2024.

- The demand for airborne radars is influenced by the Next-Generation Airborne ISR and the U.S. Air Forces’ E-7 Wedgetail programs. These use advanced AESA radars for long range detection, multi-target tracking, and engagement in contested airspace. The U.S. Department of Defense has been supporting market expansion via contracts for the next-generation propulsion system.

- Increased demand for U.S. Customs, Border Protection and Coast Guard radar for use in homeland security and maritime border surveillance is driving the adoption of airborne radar. Airborne maritime patrol and reconnaissance aircraft integrated with surface-search radar support counter-narcotics, illegal migration monitoring, and Arctic domain awareness

Europe Airborne Radar Market

Europe market accounted for USD 4.3 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

- The European investment in airborne radars is driven by regional security concerns from the Russia-Ukraine conflict. There is an acceleration in investments for Electronic Warfare, ISR, and airborne early warning across NATO members.

- As per EASA data, Europe operates over 5,000 large commercial aircraft, that drives the demand for next-gen airborne weather and navigation radar via both OEM installations as well as retrofit programs, sustaining market growth due to increased upgrades in avionics, recurring replacement demand, and greater radar integration in growing fleets of commercial and business aviation.

UK airborne radar market dominated the Europe market, showcasing strong growth potential.

- The UK’s E-7 Wedgetail program is shaping demand for airborne radars. The UK’s Ministry of Defense (MoD) confirmed operational capability will be achieved by the mid-decade. This will allow them to support the acquisition of next generation, advanced surveillance radars, and the platform is designed to replace legacy systems which drives demand for digitally scanned, persistent, electronically protected, and NATO interoperable command and control (C2) systems.

- The UK MoD funding secures supply chain and innovative continuity for airborne systems radars long lead production, which enables the integration timeline to align with airborne radars system combat air modernizations for the overarching systems.

Asia Pacific Airborne Radar Market

The Asia Pacific market is projected to reach a CAGR of 10.6% during the analysis period.

- The demand for airborne radar is increasing across Asia Pacific due to the increasing military aviation. According to Stockholm International Peace Research Institute (SIPRI), the regional defense expenditure was USD 575 billion in 2022, and the highest contributors were China and India. The targeted military investments are in early warning, maritime surveillance, and ISR aircraft for territorial conflicts and securing sea lanes. Such systems are integrated with advanced, multi-mode radars which drive the procurement and domestic development of airborne surveillance radars.

- Another key driver of the market is the expansion of commercial aviation in Asia Pacific. According to ICAO, Asia Pacific region is the world’s fastest growing aviation market, contributing over 40% of the global surge in air travel demand. The growth of airline fleets coupled with exposure to severe weather and complex terrain drives the need for weather, terrain, and navigation radars in the widebody, narrowbody, and regional aircraft sectors.

Indian airborne radar market is estimated to grow with a CAGR of 12.4% during the forecast period, in the Asia Pacific market.

- India's growing defense procurement still prioritizes airborne surveillance and early warning systems. The demand for the Airborne Radar System is driven by the Netra AEW&C programs along with the maritime patrol Netra AEW & C, and fighter aircraft upgrades. This is further enhanced by the recent incremental budgets and ‘Make in India’ initiatives to boost the domestic production of radars.

- India's defense aerospace systems being equipped with next-gen indigenous avionics drives the demand of market in India. It includes the GaN-based AESA radars being developed for the Su-30MKI and Tejas fighters. This increases the airborne radar deployment and operational competitiveness.

Middle East and Africa Airborne Radar Market

Saudi Arabia leads the Middle East and Africa market, exhibiting remarkable growth during the analysis period.

- A key driver for airborne radar procurement in Saudi Arabia has been the Vision 2030 defense localization and military modernization. Significant demand in Royal Saudi Air Force investments in the upgrades of fighters, airborne early warning, and border surveillance aircraft is sustained by the large defense budgets of the countries.

- Expanding demand for high-end airborne surveillance and targeting radars to strengthen multi-domain situational awareness is driving the market in Saudi Arabia. This is visible as interest of Saudi defense authorities grows towards airborne ISR Aircraft, as shown in active campaigns and proposals such as GlobalEye from Saab.

Airborne Radar Market Share

The airborne radar industry is led by players such as Lockheed Martin, RTX Corporation (Raytheon), Northrop Grumman, BAE Systems, and Thales Group. These five companies cumulatively accounted for 45.4% market share in 2025. These companies emphasize on R&D of enhancement of radar multifunctionality, electronic warfare resilience, and AI-enabled autonomous capabilities while having strong business bases in terms of diversified product offerings, technological capabilities, and geographical operations.

These companies drive and enhance the effects of strategic alliances through mergers, acquisitions, joint partnerships, and innovative collaboration, and further radar system development, seamless integration with airborne platform diversity, and the expansion of their global installations and support services. On the other hand, niche market small tech firms and new tech companies meet the demand for operational flexibility and sustainable enduring growth through the modern defence and security sectors with their innovations in software-defined radar, AI based signal processing, and advanced materials.

Airborne Radar Market Companies

Prominent players operating in the airborne radar industry are as mentioned below:

- Airbus SE

- ASELSAN

- BAE Systems

- Boeing

- Elbit Systems

- General Dynamics

- Hensoldt AG

- Israel Aerospace Industries (IAI)

- L3Harris Technologies

- Leonardo S.p.A.

- Lockheed Martin

- Mitsubishi Electric

- Northrop Grumman

- RTX Corporation (Raytheon)

- Saab AB

- Telephonics Corporation

- TERMA

- Thales Group

Lockheed Martin Corporation led the airborne radar market in 2025 with a 15.1% share, driven by the advanced radar systems that integrate with next-generation fighter jets and airborne platforms for early warning. Lockheed Martin's leading position in the market is due to strong R&D power, broad defense contracts, and the company's mainstay partnerships with military around the globe.

RTX Corporation (Raytheon) held 12.7% of the market, benefiting from its advanced AESA radar technology and powerful solutions for electronic warfare. Raytheon shows innovation in the field of GaN radar, and artificial intelligence (AI) signal processing, that has led the company to become preferred radar supplier for many international defense systems.

Northrop Grumman controlled 5.5% of the market, focusing on scalable radar solutions for both manned and unmanned platforms. It has long-range surveillance radars and integrated sensor networks, strong after sales support and maintenance systems in place that enhances the value of the systems for the end user.

BAE Systems accounted for 6.1% of the market, driven by its flexible airborne radar suites made for tactical and maritime aircraft. The company emphasizes on modular design, electronic countermeasures, and interoperability within allied forces ensures steady demand across multiple defence sectors.

Thales Group held 6% of the market, the company specializes in multi-function radar systems and airborne surveillance. Thales Group was also one of the first companies to use integrated ai with cyber security and multi-mode features and strengthened its position in both the European and global defense markets.

Airborne Radar Industry News

- In October 2025, L3Harris was awarded the contract to supply airborne early warning and control aircraft radar solutions for South Korea. This contract expands the surveillance systems under the South Korea's national defense program and illustrates the increasing need for integrated airborne radars.

- In August 2025, Raytheon presented the first mass produced Advanced Electronically Scanned Array (AESA) radar for the KF 21 fighter. This represented a significant achievement in domestic avionics and the rapid development of South Korea's sophisticated airborne sensors.

- In September 2025, Raytheon launched its new radar APG 82(V)X Advanced Electronically Scanned Array (AESA) consisting of the new generation Gallium Nitride (GaN) Technology. This new technology has improved power management and thermal mitigation. This gives the radar the capability to detect, track and engage air targets at longer ranges, providing air to air and air to ground engagement as well as electronic warfare.

The airborne radar market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion, volume in units) from 2022 to 2035, for the following segments:

Market, By Platform

- Military aircraft

- Fighter jets

- Transport & tanker aircraft

- Special mission aircraft

- Helicopters

- Attack helicopters

- Reconnaissance & utility helicopters

- Unmanned aerial vehicles (UAVs)

- Male UAVs (medium-altitude long-endurance)

- Hale UAVs (high-altitude long-endurance)

- Tactical UAVs (swarm coordination, counter-UAV)

- Urban air mobility (UAM) / eVTOLs

- Passenger air taxis

- Cargo drones

- Aerostats & tethered drones

Market, By Range

- Short range (< 50 km)

- Medium range (50-200 km)

- Long range (> 200 km)

Market, By Frequency Band

- L-Band (1-2 GHz)

- S-Band (2-4 GHz)

- C-Band (4-8 GHz)

- X-Band (8-12 GHz)

- Ku/Ka-Band (12-40 GHz)

Market, By Technology

- Passive ESA (PESA)

- Digital AESA

- Hybrid AESA

- ASEA tile (Advanced Modular Arrays)

- Mechanical/electro-mechanical

Market, By Application

- Defense

- Airborne early warning & control (AEW&C)

- Fire control & targeting

- Electronic warfare (EW) & countermeasures

- Security

- Border & maritime patrol

- Counter-UAS & drone detection

- Commercial

- Weather & environmental monitoring

- Aviation safety (terrain avoidance, TCAS)

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

Which region leads the airborne radar industry?

The U.S. market reached USD 5.1 billion in 2025, growing from USD 4.8 billion in 2024. This growth is fueled by strong Department of Defense investments in ISR, early warning, maritime patrol, and NextGen avionics modernization programs.

What are the key trends in the airborne radar industry?

Key trends include the adoption of multi-mode AESA radars, software-defined radar architectures, AI-powered threat detection, miniaturized radar for UAVs, and increasing retrofit installations in both military and commercial aircraft fleets.

Who are the leading companies in the airborne radar market?

Major industry players include Lockheed Martin, RTX Corporation (Raytheon), Northrop Grumman, BAE Systems, and Thales Group, which together held 45.4% of the global market in 2025 through strong R&D, advanced AESA technologies, and extensive defense contracts.

How much revenue did the defense application segment generate in 2025?

The defense segment accounted for USD 12.3 billion in 2025, holding 66.3% market share, driven by rising deployment of UAV-mounted radar systems and increasing demand for networked situational awareness in modern military operations.

What share did the medium-range radar segment hold in 2025?

The medium-range (50–200 km) segment held 57.7% of the airborne radar market in 2025, led by its balanced performance for border surveillance, coastal monitoring, and air traffic control applications across defense and civil sectors.

How much was the X-Band radar segment valued in 2025?

The X-Band (8–12 GHz) segment was valued at USD 7.7 billion in 2025, due to its superior resolution, precision, and widespread use in fire control, SAR imaging, and tactical military applications.

What is the market size of the airborne radar market in 2025?

The market was valued at USD 18.5 billion in 2025, with a volume of 1.8 billion units, reflecting strong demand from the aerospace & defense industry for advanced surveillance and mission-critical radar systems.

What is the projected value of the airborne radar market by 2035?

The airborne radar industry is expected to reach USD 44.8 billion by 2035, growing at a value CAGR of 9.5% from 2026 to 2035, driven by advancements in AESA, software-defined radar, and expanding defense and commercial aviation demand.

What is the current airborne radar market size in 2026?

The market is projected to reach USD 19.8 billion in 2026, supported by rising investments in military aviation modernization and ISR capabilities.

Airborne Radar Market Scope

Related Reports