Summary

Table of Content

Air Handling Units Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Air Handling Units Market Size

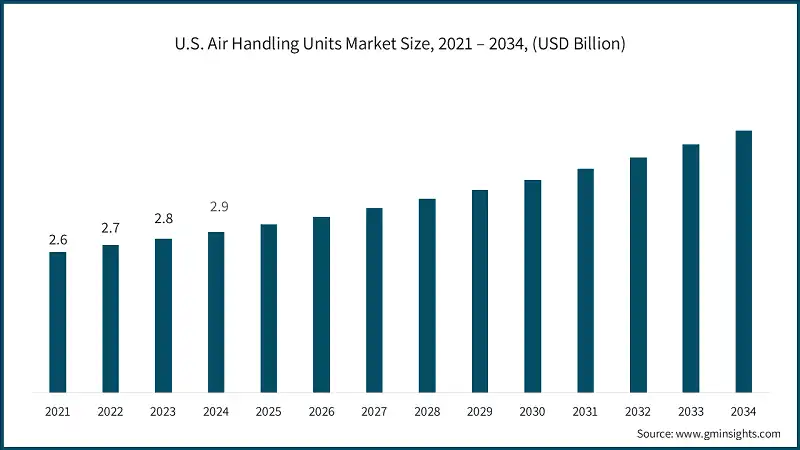

The air handling units market was estimated at USD 14.2 billion in 2024. The market is expected to grow from USD 14.8 billion in 2025 to USD 22.9 billion in 2034, at a CAGR of 4.8%, according to latest report published by Global Market Insights Inc.

To get key market trends

The growing focus on Indoor Air Quality (IAQ) is making health, comfort, and productivity more important. This shift is driving demand for Air Handling Units (AHUs) that have the latest filtration and air purification technologies. A 2023 Honeywell survey found that 72% of office workers were worried about IAQ at work. Many are looking for regular updates on air quality metrics. This shows that awareness and demand for cleaner, safer indoor environments are on the rise.

Stricter IAQ rules in industries like healthcare, real estate, and education are speeding up the use of high-performance AHUs. For example, the American Society of Heating, Refrigerating, and Air-Conditioning Engineers (ASHRAE) has set guidelines such as ASHRAE Standard 62.1, which outlines ventilation needs for acceptable IAQ. The Environmental Protection Agency (EPA) also stresses the need for good ventilation and air filtration to reduce indoor air pollutants. This is pushing businesses to invest in AHUs that have features like HEPA filters, activated carbon filters, UV-C light disinfection, and energy recovery systems to meet industry standards and keep occupants safe.

The healthcare sector held a large part of the AHU market in 2023 and continues to focus on IAQ due to its impact on patient outcomes and infection control. The Centers for Disease Control and Prevention (CDC) states that proper ventilation and air filtration are key to reducing the spread of infectious diseases. Hospitals and clinics are increasingly using AHUs with advanced filtration systems and antimicrobial coatings. For example, AHUs with HEPA filters can capture up to 99.97% of airborne particles as small as 0.3 microns, making them crucial in healthcare settings.

However, the high starting cost of AHUs, especially those with advanced features like energy recovery systems, variable air volume (VAV) controls, and IoT-enabled smart monitoring, is a barrier to wider adoption. An AHU with energy recovery systems typically costs between USD 10,000 and USD 30,000, based on capacity and specifications. This can be a big investment for small and medium-sized enterprises (SMEs) and industries with tight budgets. Additionally, incorporating smart technologies, while improving efficiency, raises the upfront costs of these systems.

Air Handling Units Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 14.2 Billion |

| Market Size in 2025 | USD 14.8 Billion |

| Forecast Period 2025 - 2034 CAGR | 4.8% |

| Market Size in 2034 | USD 22.9 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing demand for HVAC systems | With increasing global emphasis on sustainability and energy conservation, energy-efficient AHUs are gaining traction. Regulatory mandates and green building certifications are pushing commercial and industrial sectors to adopt advanced AHUs that reduce energy consumption and carbon footprint. |

| Rising awareness of IAQ | Post-pandemic, theres heightened awareness around air filtration and ventilation. AHUs with HEPA filters, UV-C disinfection, and humidity control are increasingly being adopted in schools, offices, and healthcare facilities to ensure healthier indoor environments. |

| Urbanization and Infrastructure Development | Rapid urbanization, especially in emerging economies, is fueling the construction of commercial buildings, hospitals, data centers, and malls all of which require robust HVAC systems. This infrastructure boom is directly boosting the demand for AHUs. |

| Pitfalls & Challenges | Impact |

| High initial investment and maintenance costs | Advanced AHUs with energy recovery systems and smart controls come with a high upfront cost. Additionally, regular maintenance and filter replacements can be expensive, especially for large-scale installations. |

| Complex installation and space constraints | Installing AHUs in existing buildings can be challenging due to space limitations and ductwork complexity. Retrofitting older buildings often requires significant structural modifications, which can deter adoption. |

| Opportunities: | Impact |

| Integration with smart building technologies | The rise of IoT and smart building ecosystems presents a major opportunity. AHUs integrated with sensors and AI-based controls can optimize airflow, temperature, and energy use in real-time, offering both comfort and efficiency. |

| Expansion in emerging markets | Countries in Asia-Pacific, Latin America, and Africa are witnessing rapid industrialization and urban growth. These regions offer untapped potential for AHU manufacturers, especially for mid-range and modular units tailored to local needs. |

| Market Leaders (2024) | |

| Market Leaders |

11% market share |

| Top Players |

The collective market share in 2024 is 27% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Emerging Country | Germany, China, UK, India |

| Future Outlook |

|

What are the growth opportunities in this market?

Air Handling Units Market Trends

The demand for heating, ventilation, and air conditioning (HVAC) systems, particularly Air Handling Units (AHUs), is witnessing significant growth, driven by rapid urbanization and the development of smart cities. According to the United Nations, 68% of the global population is projected to live in urban areas by 2050, up from 56% in 2020.

- This urban expansion is fueling the construction of new residential, commercial, and industrial buildings, thereby boosting the adoption of HVAC systems. AHUs, a critical component of HVAC systems, are increasingly being integrated into these structures to ensure optimal air quality and energy efficiency.

- The pursuit of green building certifications, such as Leadership in Energy and Environmental Design (LEED) and Building Research Establishment Environmental Assessment Method (BREEAM), is further driving the adoption of energy-efficient AHUs. These certifications emphasize reducing energy consumption and minimizing carbon footprints, aligning with global sustainability goals. For instance, the U.S. Green Building Council (USGBC) reported that LEED-certified buildings consume 25% less energy and 11% less water compared to non-certified buildings, highlighting the importance of energy-efficient systems like AHUs in achieving these benchmarks.

- To meet increasingly stringent Indoor Air Quality (IAQ) regulations, AHUs are now equipped with advanced air filtration technologies. These include Ultraviolet Germicidal Irradiation (UVGI) systems, which effectively neutralize airborne pathogens, and High-Efficiency Particulate Air (HEPA) filters, capable of capturing 99.97% of particles as small as 0.3 microns. The integration of these technologies is particularly critical in healthcare facilities, where maintaining high IAQ standards is essential. For example, the Centers for Disease Control and Prevention (CDC) recommends the use of HEPA filters in healthcare settings to reduce the transmission of airborne infections.

- Moreover, manufacturers are investing in research and development to enhance the performance and efficiency of AHUs. Companies like Carrier, Daikin, and Trane are introducing innovative solutions, such as variable air volume (VAV) systems and energy recovery ventilators (ERVs), to optimize energy usage and improve ventilation. According to a report by the U.S. Department of Energy, energy recovery systems can reduce HVAC energy consumption by up to 20%, underscoring their significance in modern AHU designs.

Air Handling Units Market Analysis

Learn more about the key segments shaping this market

Based on product type, the market is segmented into heating or cooling coils, filters, dampers fans, air handlers, blowers and others (humidifiers or dehumidifiers, isolators, etc.). The filters segment exceeded USD 4.1 billion in 2024.

- Filters are a critical component of air handling units, playing a central role in ensuring indoor air quality (IAQ) by removing dust, allergens, pathogens, and other airborne contaminants. With growing concerns around health, especially in post-pandemic environments, the demand for high-efficiency filters such as HEPA, ULPA, and activated carbon filters has surged. These filters not only protect occupants but also safeguard sensitive equipment in environments like hospitals, laboratories, and data centers.

- Moreover, filters significantly influence the operational efficiency and lifecycle of AHUs. Advanced filtration systems reduce the load on downstream components like coils and fans, thereby enhancing energy efficiency and reducing maintenance needs.

- As regulatory standards for IAQ become more stringent globally, filters are no longer optional add-ons but essential, performance-defining elements of AHU systems. Their dominance is expected to grow further with the integration of smart sensors that monitor filter health and air quality in real time.

Learn more about the key segments shaping this market

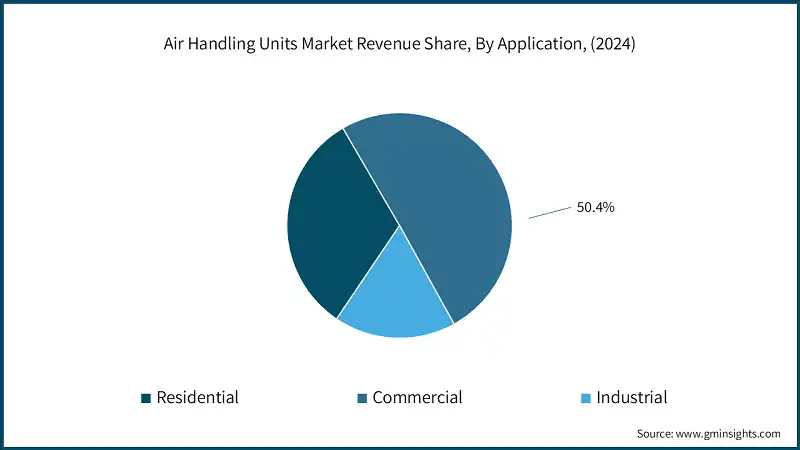

Based on the application, the air handling units market is segmented into residential, commercial, and industrial. The commercial segment held around 50.4% of the market share in 2024.

- Commercial buildings are mandated to comply with stringent energy efficiency standards, as outlined in municipal building codes and programs like Energy Star. These regulations drive the adoption of energy-efficient Air Handling Units (AHUs), which not only reduce operational costs but also ensure adherence to energy conservation policies. According to the U.S. Department of Energy, commercial buildings account for approximately 18% of total energy consumption in the United States, highlighting the critical need for energy-efficient solutions such as advanced AHUs.

- In healthcare facilities, including hospitals, maintaining optimal indoor air quality is paramount to ensuring the safety and comfort of patients and staff. These facilities must strictly regulate parameters such as humidity, temperature, and air quality to prevent the spread of airborne contaminants and maintain a sterile environment.

- AHUs equipped with advanced features, such as humidity control, HEPA (High-Efficiency Particulate Air) filters, and UV-C light disinfection systems, are increasingly in demand. For instance, HEPA filters can capture 99.97% of particles as small as 0.3 microns, significantly improving air quality in critical environments.

Looking for region specific data?

In 2024, the U.S. contributed significantly to the air handling units market growth in North America, accounting for 78.2% share in the region.

- North America represents a mature and technologically advanced market for air handling units (AHUs), driven by stringent energy efficiency regulations and a growing emphasis on indoor air quality (IAQ). The United States and Canada have well-established HVAC infrastructures, supported by retrofitting activities in commercial and institutional buildings.

- According to the U.S. Department of Energy, HVAC systems account for approximately 40% of total energy consumption in commercial buildings, underscoring the importance of energy-efficient AHUs in reducing operational costs. The demand for AHUs is particularly strong in data centers and healthcare facilities, where precise air control and temperature regulation are critical to maintaining operational efficiency and compliance with industry standards.

Asia Pacific air handling units market is expected to grow at 5.1% CAGR during the forecast period.

- The Asia-Pacific region is the fastest-growing market for AHUs, driven by rapid urbanization, industrialization, and infrastructure development in countries such as China, India, and Southeast Asia. According to the International Energy Agency (IEA), the region is expected to account for nearly 60% of global energy demand growth by 2040, emphasizing the need for energy-efficient HVAC solutions.

- The rising middle class, coupled with increasing construction of commercial spaces and the expansion of the healthcare and hospitality sectors, is fueling demand for AHUs. In China, for instance, the government’s focus on improving indoor air quality through initiatives like the "Healthy China 2030" plan is accelerating the adoption of advanced AHUs.

Europe air handling units market is expected to grow at 4.6% CAGR during the forecast period.

- Europe continues to lead the global market in sustainability and green building initiatives, making it a key region for energy-efficient and eco-friendly AHUs. The European Union's regulatory frameworks, such as the Energy Performance of Buildings Directive (EPBD), mandate the use of energy-efficient HVAC systems, driving innovation in low-energy and heat recovery technologies.

- According to the European Commission, buildings account for 40% of the EU's energy consumption and 36% of its greenhouse gas emissions, highlighting the critical role of AHUs in achieving climate goals. Countries like Germany, the United Kingdom, and the Nordic nations are at the forefront of this transition, with a growing preference for modular and compact AHUs designed for space-constrained urban environments.

Air Handling Units Market Shares

- The top companies in the air handling units industry include Carrier Corporation, Daikin Industries, LG Electronics, Toshiba Corporation, and Trane Technologies, and collectively hold a share of 27% in the market. These prominent players are proactively involved in strategic endeavors, such as, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

- Carrier Corporation stands out with its custom-engineered AHUs like the AERO® and 39CC series, offering unmatched design flexibility, modularity, and advanced filtration systems. Its strong presence in data centers, healthcare, and pharmaceutical sectors is bolstered by antimicrobial coatings, UV-C integration, and energy recovery technologies, making it a go-to for high-performance, application-specific solutions.

- Daikin Industries leverages its global manufacturing footprint and innovation in inverter and refrigerant technologies to deliver energy-efficient and environmentally sustainable AHUs. With a strong presence in both commercial and marine HVAC markets, Daikin’s focus on smart controls, anti-corrosion treatments, and custom-built systems gives it a robust edge in diverse and demanding environments.

- LG Electronics differentiates itself through integration of its AHUs with VRF systems (like MULTI V) and smart building platforms. Its AHUs are known for easy installation, inverter-driven direct drive fans, and seamless BMS compatibility, offering energy savings and simplified maintenance. LG’s commitment to decarbonization and electrification further strengthens its position in future-ready HVAC solutions.

Air Handling Units Market Companies

Major players operating in the air handling units industry are:

- Bosch Thermotechnology GmbH

- Carrier Global Corporation

- CIAT Group

- Daikin Industries, Ltd.

- FläktGroup Holding GmbH

- Hitachi, Ltd.

- Johnson Controls International PLC

- Lennox International Inc.

- LG Electronics Inc.

- Mitsubishi Electric Corporation

- Munters Group AB

- Systemair AB

- Trane Technologies plc

- TROX GmbH

- Zehnder Group International AG

Toshiba Corporation positions itself as a technology-driven player with a focus on compact, energy-efficient AHUs tailored for smart buildings and green infrastructure. While not as dominant globally as others, Toshiba’s emphasis on quiet operation, modularity, and IAQ compliance makes it a preferred choice in premium commercial and residential projects.

Trane Technologies excels with its broad and customizable AHU portfolio, including the Performance Climate Changer and CoolSense systems. Known for system integration, energy efficiency, and IAQ optimization, Trane’s AHUs are engineered for both standard and mission-critical applications. Their focus on ease of serviceability and advanced control systems ensures long-term operational value.

Air Handling Units Industry News

- In July 2025, CIAT launched the CLIMACIAT Floway in 2025, a high-efficiency, dual-flow AHU range offering enhanced IAQ and energy savings. The units are designed for flexibility and compliance with evolving environmental standards.

- In February 2025, AHR Expo, Daikin showcased a full suite of decarbonized HVAC solutions, including low-GWP refrigerants (R-32), inverter-driven compressors, and electrified heating. The company introduced the Magnitude® WME-D chiller with R-515B refrigerant and expanded its Rebel rooftop heat pump portfolio, reinforcing its commitment to sustainability and energy efficiency.

- In 2024, Bosch made a major move in 2024 by acquiring the residential and light commercial HVAC business from Johnson Controls and Hitachi, marking the largest acquisition in its history. This strategic expansion strengthens Bosch’s position in North America and Asia-Pacific.

The air handling units market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Billion) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Product Type

- Heating or cooling coils

- Filters

- Dampers

- Fans

- Air handlers

- Blowers

- Others (humidifiers/dehumidifiers, isolators, etc.)

Market, By Category

- Packaged AHU

- Rooftop AHU

- Modular AHU

- Heat recovery AHU

- Energy recovery AHU

- Others (cleanroom AHU, outdoor AHU, etc.)

Market, By Capacity

- Below 5,000 CFM

- 5,000 CFM – 10,000 CFM

- Above 10,000 CFM

Market, By Control and Connectivity

- Standalone AHUs

- BMS-Integrated AHUs

- IoT-Enabled Smart AHUs

Market, By Application

- Residential

- Commercial

- Industrial

Market, By Distribution Channel

- Direct

- Indirect

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What are the upcoming trends in the air handling units market?

Key trends include integration with smart building technologies and IoT, advanced air filtration technologies like UVGI and HEPA filters, energy recovery systems, green building certifications adoption, and focus on sustainability and intelligent climate control.

Who are the key players in the air handling units market?

Key players include Carrier Global Corporation, Daikin Industries Ltd., LG Electronics Inc., Toshiba Corporation, Trane Technologies plc, Bosch Thermotechnology GmbH, CIAT Group, FläktGroup Holding GmbH, Hitachi Ltd., Johnson Controls International PLC, Lennox International Inc., Mitsubishi Electric Corporation, Munters Group AB, Systemair AB, TROX GmbH, and Zehnder Group International AG.

Which region leads the air handling units market?

The U.S. dominated about 78.2% share of the North American air handling units market in 2024.

What was the valuation of commercial application segment in 2024?

The commercial segment held about 50.4% of the global air handling units market share in 2024, driven by stringent energy efficiency standards and IAQ requirements in healthcare facilities.

What is the market size of the air handling units in 2024?

The market size exceeded USD 14.2 billion in 2024, with a CAGR of 4.8% expected from 2025 to 2034 driven by rising demand for advanced IAQ solutions and increasing focus on energy efficiency.

What is the growth outlook for Asia Pacific from 2025 to 2034?

The Asia Pacific air handling units market is expected to grow at 5.1% CAGR through 2034, driven by rapid urbanization, industrialization, and infrastructure development.

How much revenue did the filters segment generate in 2024?

The filters segment generated USD 4.1 billion in 2024, supported by growing concerns around health and the demand for high-efficiency filters like HEPA and activated carbon filters.

What is the projected value of the air handling units market by 2034?

The air handling units market is expected to reach USD 22.9 billion by 2034, propelled by stringent IAQ regulations, green building certifications, and integration with smart building technologies.

What is the current air handling units market size in 2025?

The market size is projected to reach USD 14.8 billion in 2025.

Air Handling Units Market Scope

Related Reports