Summary

Table of Content

Aerospace Plastics Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Aerospace Plastics Market Size

Aerospace Plastics Market size valued at around USD 47.6 million in 2019 and will showcase growth of around 8.4% from 2020 to 2026. Rising air passenger traffic coupled with start of several new air travel routs across the globe will drive the demand for new aircrafts, thereby augmenting plastic consumption.

To get key market trends

Aerospace grade plastics are lightweight high-performance plastics for acoustic, thermal, and chemical resistance in aircraft. Lightweight and good strength are key advantages supporting material usage in new advanced passenger aircrafts such as A320neo family, A350 XWB, among others. Further, proliferating tourism sector and rising business travels are driving the demand for aerospace grade plastics.

Aerospace Plastics Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2019 |

| Market Size in 2019 | 47.6 Million (USD) |

| Forecast Period 2020 to 2026 CAGR | 8.4% |

| Market Size in 2026 | 55.1 Million (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Technology advancements and product development will propel the market penetration

Ongoing developments of advanced polymers imparting chemical and flame resistance will fuel the market growth. For instance, in March 2017, Drake Plastics Ltd. Co. Plastics added Ryton R-4 in its advanced product portfolio for aerospace application. The airplanes operate at variable temperatures and require a high degree of thermal stability. The emergence of materials providing thermal stability without increasing the weight will induce significant growth potential.

The aerospace plastics industry will witness noteworthy demand with increasing aircraft fleet size. Aircraft manufacturers are taking initiatives for lowering gross weight to reduce emission and enhance performance. Stringent emission control initiatives adopted by governments across the globe are influencing the demand for lightweight and fuel-efficient aircrafts. According to the International Air Transport Association (IATA), the aerospace industry is working together to enhance fuel efficiency by an average of 1.5% per year and minimize carbon emissions to 50% by 2050 as compared to 2005.

Increasing replacement of metal components with plastics & composite materials will escalate the aerospace plastics demand. Polymers are around 10 times lighter than the metal counterparts without trade-off in durability. Manufacturers are utilizing plastics in interior applications for improved aesthetics and to maximize space within the aircraft interior. Moreover, its usage in galleys as insulators will further support the product demand.

Plastics are highly suitable for vacuum forming and easily transform into a wide variety of shapes. Materials can be easily moulded into complex shapes and geometries. Plastic manufacturers are improving the materials by enhancing their chemical composition and enriching their mechanical properties. Furthermore, the development of materials to replace aircraft doors and fuselages to withstand hydrolysis and radiation will boost the aerospace plastics market growth.

COVID-19 Impact

COVID-19 pandemic is adversely affecting aerospace sector with international air transport at halt across the globe. According to IATA financial outlook published in June 2019, the airlines are expected to lose USD 84.3 billion revenue in 2020. Additionally, Boeing incurred around 66% of lower aircraft deliveries in Q1 2020 as compared to Q1 2019. Further Airbus Q1 2020, report stated that, the company’s deliveries for Q1 2020 was around 24% lower as compared to Q1 2019. Exponential rise of cases in Europe, North America, and Asia Pacific for Q2 of 2020 will intensify adverse effect on aerospace industry for Q2 2020.

Aerospace Plastics Market Analysis

Increasing deployment of low-cost carriers is propelling the narrow body aerospace plastics industry size. The segment generated around USD 17 million revenue in 2019. Presence of wide airline networks along with expansion of air fleet in international markets is creating demand for new narrow body aircrafts. Creation of competitive fare structure offering economical air travel opportunities is escalating the demand for LCC, strengthening the market size expansion.

Learn more about the key segments shaping this market

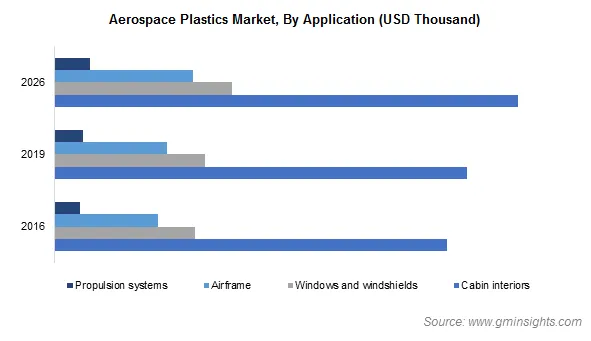

Cabin interiors segment leads the market with over 50% share in 2019 and is expected to hold its leading position through 2026. Plastics are used in several cabin interior applications such as door slides, latches, drawers, stowage bins parts, stowage bin doors, seating, and other interior decorations. Aircraft manufacturers are developing high impact, fire-rated thermoplastic materials with improved durability, and chemical resistance. Moreover, the development of components complying with fungus test will escalate the industry growth.

Learn more about the key segments shaping this market

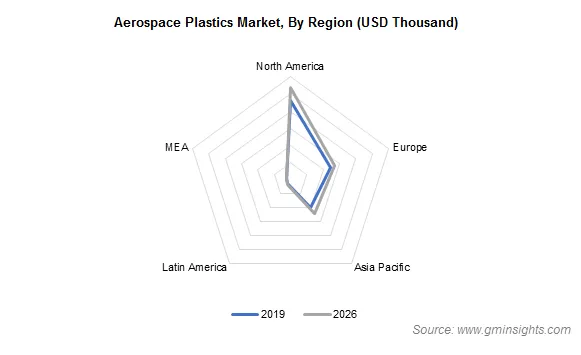

North America aerospace plastics market is predicted to generate over USD 25 million revenue by 2026. The presence of multiple aircraft manufacturers will drive the regional market demand. Aircraft manufacturers are employing lightweight components for complying with stringent regulatory standards imposed by multiple regulatory bodies such as the FAA. The materials have higher ductility compared to ceramics and lower weight than metal alloys.

Aerospace Plastics Market Share

Collaboration with other manufacturers or research institutions for product development are key strategies applied by manufacturers to enhance its market share. For instance, in August 2018, Solvay, Faurecia Clean Mobility, and Premium AEROTEC announced their collaboration to develop advanced materials and process technology to enhance the production of thermoplastic composites for aerospace & automotive industries.

Key plastics manufacturers operating in the market include:

- BASF SE

- Paco Plastics & Engineering, Inc

- Paco Plastics BV

- EPTAM Precision Plastics

- Solvay

- Saint Gobain

- Victrex Plc

- Superior Plastics

This market research report on aerospace plastics includes in-depth coverage of the industry with estimates & forecast in terms of volume in tons & revenue in USD thousand from 2016 to 2026, for the following segments:

Market, By Aircraft

Commercia aircraft

- Narrow body

- Wide body

- Regional jet

- Business jet

- Helicopters

- Military jets

Market, By Application

Cabin interiors

- Windows & windshields

- Airframe

- Propulsion system

Market, By Fit

Line fit

- Retrofit

Market, By Region:

North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Poland

- Russia

- Netherlands

- Sweden

- Asia Pacific

- China

- India

- Japan

- South Korea

- Singapore

- Australia

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- Saudi Arabia

- Qatar

- UAE

- South Africa

- South Africa

Frequently Asked Question(FAQ) :

How much size did the aerospace plastics market register in 2019?

The market size of aerospace plastics surpassed USD 47.6 million in 2019.

How much will the aerospace plastics industry share grow during the forecast timeline?

The industry share of aerospace plastics is anticipated to grow at 8.4% CAGR between 2020 to 2026.

Which are the prominent aerospace plastics manufacturers across the globe?

Key aerospace plastics manufacturers include BASF SE, Paco Plastics & Engineering, Inc., Paco Plastics BV, EPTAM Precision Plastics, Solvay, Saint Gobain, Victrex Plc., Superior Plastics, amongst others.

How did cabin interiors segment fare in the aerospace plastics market in 2019?

According to this report, the cabin interiors application segment accounted for more than 50% market share in 2019.

What are the projections for North America aerospace plastics industry?

North America market for aircraft plastics is predicted to generate over USD 25 million revenue by 2026 owing to the presence of multiple aircraft manufacturers in the region.

Aerospace Plastics Market Scope

Related Reports