Summary

Table of Content

Aerospace Maintenance Chemicals Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Aerospace Maintenance Chemicals Market Size

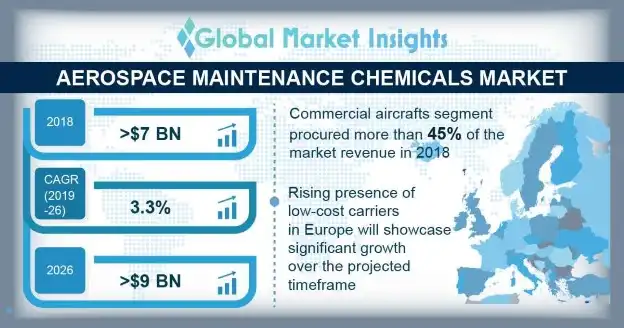

Aerospace Maintenance Chemicals Market size was valued at over USD 7 billion in 2018 and is estimated to exhibit over 3% CAGR from 2019 to 2026.

To get key market trends

Aerospace maintenance chemicals are used to protect, maintain quality, and to remove paints & coatings of airframe structures, aircraft components, and cabin interiors. Several chemicals are available for various maintenance applications including aircraft cleaners, leather cleaners, paint removers, paint strippers, degreasers, wash & polish solutions, and specialty solvents. Aircraft components are extremely costly, and downtime can incur heavy losses to airlines. Maintenance process enable airlines to operate their aircrafts with optimum efficiency.

Growing air passenger traffic along with rising flight frequency across the globe are driving the aerospace maintenance chemicals market share. According to the International Air Transport Association (IATA), in 2018 around 4.4 billion passengers flew with an increase of 6.9% over 2017. Around 22,000 city pairs are connected till 2018 by direct flights, that grew by 1,300 over 2017.

Aerospace Maintenance Chemicals Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2018 |

| Market Size in 2018 | 7.35 Billion (USD) |

| Forecast Period 2019 to 2026 CAGR | 3.3% |

| Market Size in 2026 | 9.46 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Aerospace Maintenance Chemicals Market Analysis

According to SGI Aviation and IATA, over 27,000 commercial aircrafts were operating across the globe till 2015 with an average age of 12.6 years. Additionally, around 50% of aircrafts are still in operating conditions with an age of around 25 years. These figures are showcasing huge requirement for maintenance activities, thereby boosting the maintenance chemicals revenue generation over the study timeframe. Moreover, according to the Maintenance Cost Task Force (MCTF) of IATA, representing around 18% of the world’s aircraft fleet in 2017, reported that its airline fleet size has an average age of 8.9 years.

In January 2019, Boeing announced that the company sold 806 commercial jets in 2018, up by 6% as compared to 2017. Also, Airbus SE delivered 800 commercial aircrafts up by 11% as compared to 2017. Heavy maintenance activities are performed around every 18 months to 6 years depending on the aircraft types. Thus, aircrafts sold in 2018 will be in maintenance cycle from 2020 and onwards, thereby showcasing higher maintenance chemicals demand over the projected timeframe.

Limited chemical shelf life along with the requirement of proper storage facilities with adequate temperature and humidity are escalating the inventory cost. Hazardous nature of several chemicals is adversely affecting the health of aircraft maintenance employees, thereby imposing constant pressure on industry players to develop new products with reduced hazardous materials. Additionally, stringent government regulations such as REACH legislation are demanding industry participants to develop substitutes for various cleaners & solutions.

Learn more about the key segments shaping this market

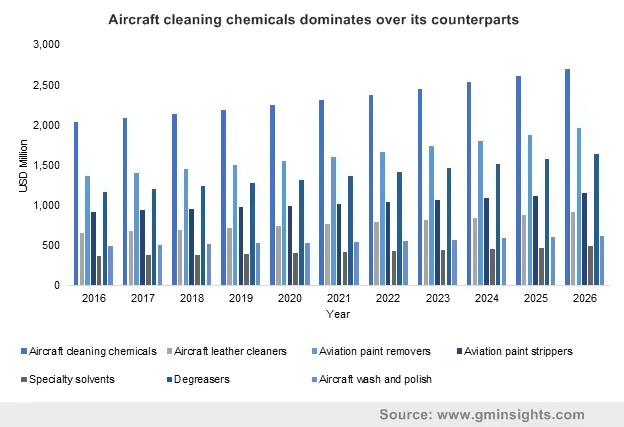

Passenger’s experience is playing a significant role in selecting airlines, thereby airlines are providing attention towards offering cleaner and hygiene experience to passengers. Rising frequencies of flights and continuous contact of cabin interior with passengers degrades the aircraft interiors, thereby requiring frequent cleaning operations. Aircraft cleaning accounts for around half of the volume share in aerospace maintenance chemicals market.

Aviation paint strippers will showcase considerable growth in the aerospace maintenance chemicals market owing to rising painting activities to provide and maintain unique aesthetics of aircrafts by various airlines. These are mainly hydrogen peroxide activated chemicals designed to remove polyurethane, epoxy, and other paints from the aircraft exteriors and interiors. The availability of several paint strippers with easy to operate and non-toxicity of chemicals are further supporting the product demand.

Growing commercial aircraft fleet across the globe owing to increasing international and domestic flights are showcasing considerable growth in the aerospace maintenance chemical market. For instance, in June 2019, India’s domestic air passenger traffic rose by 7.9% as compared to June 2018. Additionally, according to IATA, the overall global air passenger traffic grew by 5% in June 2019. Commercial aircrafts in aerospace maintenance chemicals market holds over 45% of the revenue share in 2018.

Business aircrafts will showcase considerable growth in the market owing to rising international business travels. Business aircrafts are required to maintain high luxury interiors to enhance customer satisfaction. The aircrafts use several luxurious leather interiors, thereby requiring frequent leather cleaner to ensure higher life of aircraft soft goods. Introduction of new high-end business aircrafts has resulted in the increased sales of aircrafts in 2018. According to the General Aviation Manufacturers Association (GAMA), 707 business jets were delivered in 2018 as compared to 677 units in 2017.

Learn more about the key segments shaping this market

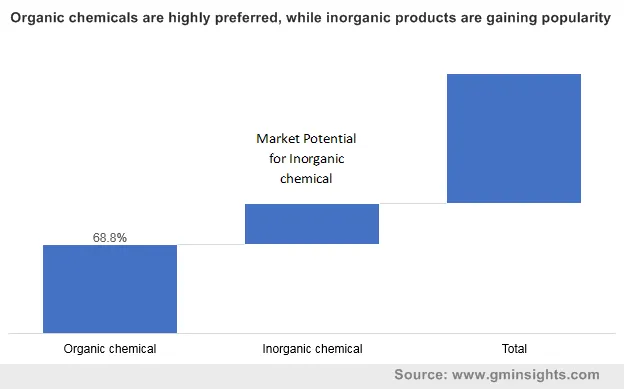

Stringent government regulations along with rising concern for health safety are the main factors driving the development in organic chemicals. Organic chemicals are preferred owing to the availability of several product portfolio with faster maintenance operations. Usage of lower volatile organic compound content products are minimizing the adverse health effects. Additionally, growing demand for toxic free chemicals coupled with suitable viscosity of these chemicals will further escalate the aerospace maintenance chemicals market demand.

Rising presence of low-cost carriers in Europe is likely to showcase significant growth potential over the projected timeframe. According to the CAPA – Centre for Aviation, passengers travelling with Europe’s 30 airliners groups using LLC increased from 40.6% to 42.3% in 2018 as compared to 2017. Affordable and lower fares offered by these carriers for international flights such are augmenting their demand. Additionally, improved chemical performance and stringent regulations are providing opportunity for players to enhance product offering and achieve competitiveness in industry.

Aerospace Maintenance Chemicals Market Share

Advanced product development along with strengthening distribution networks are the major initiatives taken by industry players to enhance their market share in the aerospace maintenance chemicals market. For instance, in August 2017, Nuvite Chemical Compounds launched NPC/3 dry wash product line for airframe maintenance. New products enhance the characteristics of NPC/3 with low odour and minimal dust. This strategy enabled the company to improve their product offering with added benefits.

Aerospace Maintenance Chemicals Market include

- 3M

- Aerochemicals

- Aircraft Spruce and Specialty Co.

- Arrow Solutions

- Aviation Chemical Solutions, Inc.

- Callington Haven Pty. Ltd.

- The Dow Chemical Company (Dow)

- Eastman Chemical Company

- Hansair Logistics, Inc.

- Henkel AG & Co. KGaA

- High Performance Composites & Coatings Private Limited

- Hypercoat Enterprises Pte Ltd.

- Klean Strip

- KLX, Inc.

- Krayden, Inc.

- McGean-Rohco, Inc.

- NUVITE Chemical Compounds

- Pexa

- Sil-Mid Limited

- Socomore

- W.W. Grainger, Inc.

- Chemetall

Aerospace Maintenance Chemicals Market, by Product

- Aircraft cleaning chemicals

- Aircraft leather cleaners

- Aviation paint removers

- Aviation paint strippers

- Specialty solvents

- Degreasers

- Aircraft wash and polish

Aerospace Maintenance Chemicals Market, by Aircraft

- Commercial aircraft

- Single engine piston

- Business aircraft

- Military aircraft

- Helicopters

- Space

- Others

Aerospace Maintenance Chemicals Market, by Nature of Chemical

- Organic chemical

- Inorganic chemical

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Russia

- Italy

- Poland

- Netherlands

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Australia

- Thailand

- Malaysia

- Vietnam

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- Saudi Arabia

- Qatar

- UAE

- Oman

- South Africa

Frequently Asked Question(FAQ) :

Which is the highest revenue pocket for aerospace maintenance chemicals?

Commercial aircraft maintenance is the highest revenue generating pocket owing to growing commercial aircraft fleet across the globe with increasing international and domestic flights.

How much compound growth is expected for aerospace maintenance chemicals for next few years?

As per Global Market Insights, Inc. the worldwide market is expected to grow at over 3% compound annual growth during 2019-2026.

How much did the global aerospace maintenance chemicals market size account for in 2018?

The market size of aerospace maintenance chemicals was exceeded USD 7 billion in 2018.

How much growth will the aerospace maintenance chemicals industry share witness during the forecast timeframe?

The industry share of aerospace maintenance chemicals is projected to expand at over 3% CAGR during 2019 to 2026.

What are aerospace maintenance chemicals used for?

Aerospace maintenance chemicals are used to protect, maintain quality and to remove paints & coatings of airframe structures, aircraft components, and cabin interiors.

Aerospace Maintenance Chemicals Market Scope

Related Reports