Home > Aerospace & Defense > Aircraft Parts > Hydraulics and Pneumatics > Aerospace Accumulator Market

Aerospace Accumulator Market Analysis

- Report ID: GMI2344

- Published Date: Jul 2020

- Report Format: PDF

Aerospace Accumulator Market Analysis

Metal bellow aerospace accumulator market generated around USD 6.2 million revenue in 2019 and is projected to expand at 3.5% CAGR till 2026. Metal below accumulators have low spring rate and provide superior performance as compared to bladder and piston accumulators. It provides a hermetic sealing between hydraulic fluid and charged gas, thus minimizing the leakage.

The teflon guide ensures negligible friction, thus allowing swift movement of bellows inside the housing. Moreover, these accumulators require minimal maintenance and have a prolonged life. It possesses excellent media resistance over a broad temperature range, enhancing its performance in hostile environments. Rising demand for wide body aircraft will induce significant growth potential in the industry landscape.<

Steel segment is likely to hold more than 60% aerospace accumulator market share by 2026. Stainless steel possesses excellent corrosion resistance, making it a preferred material. Additionally, it possesses mechanical properties and superior heat resistance, that results in strength retention at elevated temperatures. However, the increasing adoption of composite materials for accumulators owing to enhanced performance, longevity, and reduced weight will hamper steel segment growth.

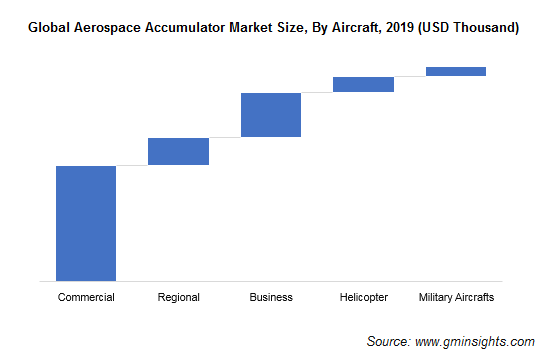

In 2019, commercial aircraft segment revenue was over USD 4.5 million ascribed to rising commercial aircraft demand. Global air traffic has increased exponentially in the last decade. Emergence of low-cost air carriers, shifting preference toward air travel, growing disposable income of middle-class populace in emerging economies, are some of the factors augmenting the air traffic. These trends are positively influencing the demand for commercial aircraft.

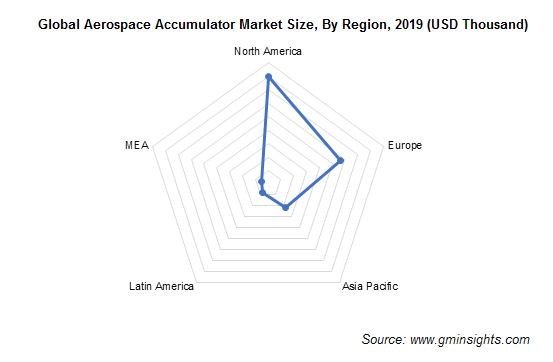

North America aerospace accumulator market accounted for more than 45% share in 2019 owing to presence of well-established aerospace industry in the region. Key manufacturers operating in the region include Bombardier, the Boeing Company, Lockheed Martin Corporation, Northrop Grumman, United Technologies Corporation, Raytheon Company, GE Aviation, and General Dynamics Corporation.

The U.S. is the largest aircraft manufacturer in the world, accounting for over 35% of the global aircraft production. The country has around one-third share in the global commercial aircraft production. The presence of state-of-the-art manufacturing facilities across the country is augmented aerospace industry growth in the last few decades. Moreover, focused research & development activities coupled with rising military expenditure will enhance the regional aerospace accumulator demand.