Home > Aerospace & Defense > Aircraft Parts > Fuel Systems > Aerial Refueling Systems Market

Aerial Refueling Systems Market Analysis

- Report ID: GMI2155

- Published Date: Jun 2020

- Report Format: PDF

Aerial Refueling Systems Market Analysis

In 2019, military aircraft held around 90% share in the market owing to utilization of air to air refueling systems to enhance the range of defense missions and allowing them to fly farther than that they would have normally managed. The in-flight refueling plays crucial role in strategic missions and aerial conflicts. Various countries are growing their tanker fleet to strengthen their air force.

For instance, in September 2019, the U.S. Air Force ordered 15 Boeing KC-46 multirole tankers to support its increasing military aircraft fleet. Further, less susceptibility of pilot error and fatigue at receiving aircraft will positively influence the market penetration across various applications.

Refueling pods leads the aerial refueling systems market on account of its utilization for carrying the fuel. The industry players are increasing the fuel carrying capacity of the pods to refuel more than one aircraft. In August 2016, Cobham developed Wing Aerial Refueling Pod (WARP) with stronger vertices and higher operating speed. The system is capable of transferring around 400 gallons fuel per minute to refuel more than one aircrafts.

Boom component segment in the market will witness around 5% growth through 2026 led by its employment for transferring the fuel from the carrier to the supplier. Refueling probes and hose play an important role in AAR system. The complete process brings the aircrafts in proximity that may lead to an accident. Thus, the system is undergoing automation for better control and enhancing safety.

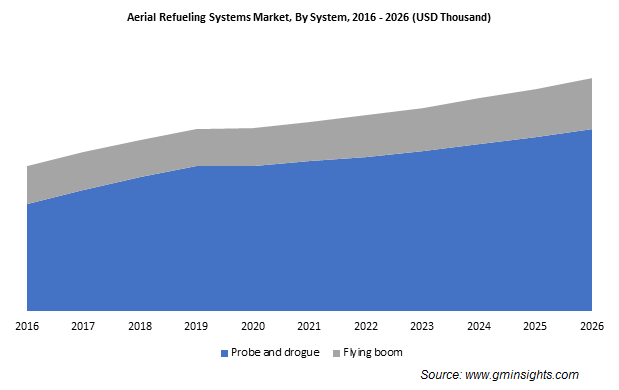

Probe & drogue aerial refueling systems market will register gains of around 3.5% between 2020 and 2026 due to its flexibility. The system is capable of transferring fuel up to three receivers simultaneously. The Hose Drogue Unit (HDU) is safer, easy to install and allows greater relative movement between the carrier and receiver. Further, when one of the HDU unit becomes unserviceable during course, the tanker can still unload the fuel. However, low transfer rate and its limitation for large sized military aircrafts will restrict the product penetration.

OEM segment dominates the market size with increasing demand from military and commercial aircrafts. Growth in aircraft fleet size to serve growing passengers and missions will enhance service demand. Proliferating demand of refueling tankers to increase the flight course will fuel the segment penetration. Further, end-user propensity towards product quality, reliability and cost effective after sales services will drive the segment growth.

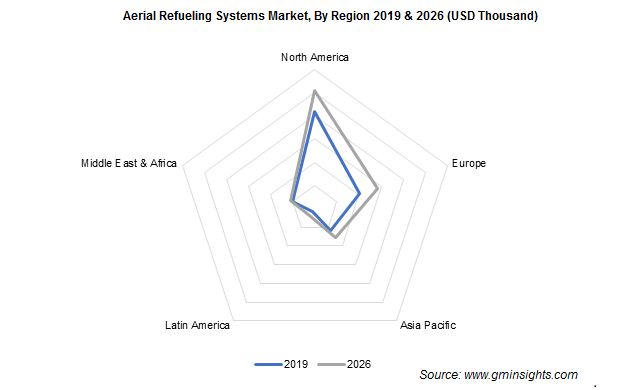

In 2019, North America accounted for over 50% market share owing to presence of largest refueling fleets. The U.S. fleet includes over 400 KC-135s and 55 large KC-10s. The U.S. Air Force and Marine Corps are enhancing their fleet to sustain their aerial supremacy that in turn will influence the market expansion across the region. Moreover, the region is witnessing replacement of old refueling tankers with versatile ones to strengthen refueling capability.