Summary

Table of Content

Active & Intelligent Packaging Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Active & Intelligent Packaging Market Size

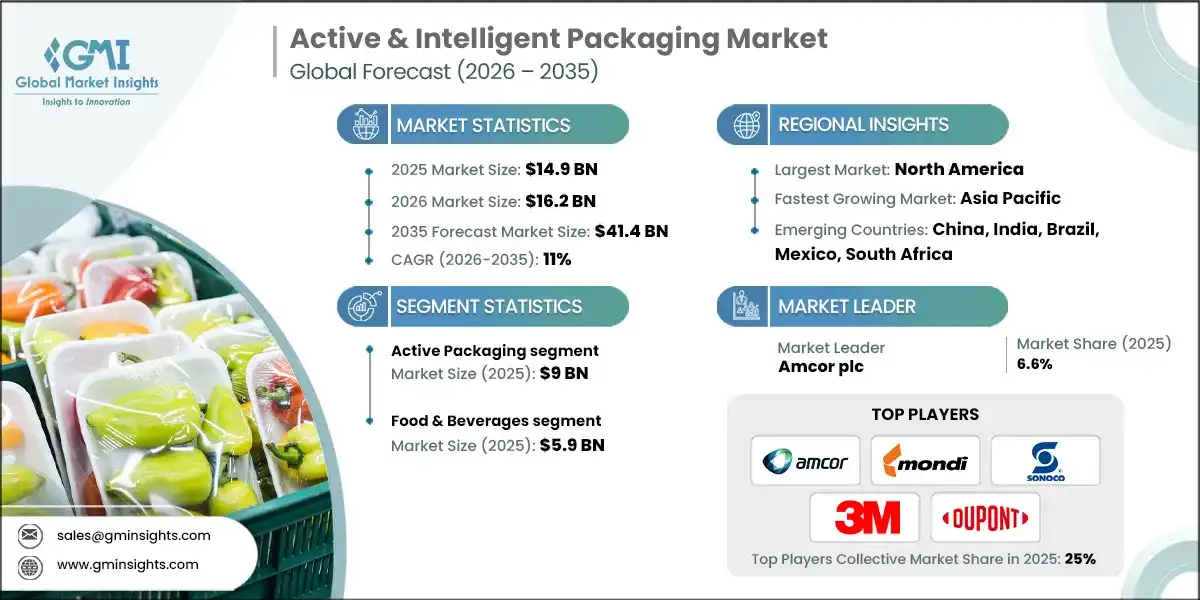

The global active & intelligent packaging market was valued at USD 14.9 billion in 2025. The market is expected to grow from USD 16.2 billion in 2026 to USD 41.4 billion by 2035, at a CAGR of 11% during the forecast period according to the latest report published by Global Market Insights Inc.

To get key market trends

Increased demand for longer shelf-life food products and increased consumer concern for the safety and quality of food has resulted in an increase in the number of active and intelligent packaging solutions being developed. The use of new materials for packaging as well as the development of more advanced sensor technology has resulted in increased growth of active and intelligent packages used by consumers. For instance, in February 2024, Aptar CSP Technologies collaborated with ProAmpac to launch ProActive Intelligence Moisture Protect (MP-1000), active packaging film. It combines Aptar CSP’s proprietary 3-Phase Activ-Polymer technology with ProAmpac’s flexible blown film expertise to deliver a patent pending moisture adsorbing flexible packaging solution. By incorporating the moisture adsorbing Activ-Polymer material into a flexible film structure, MP-1000 delivers high-quality moisture protection without the need for add-on desiccant sachets. The growth of the cold chain and e-commerce have also greatly increased the use of active and intelligent packages used by end users.

The increasing consumption of packaged and processed foods around the world supports continued growth in the industry. More consumers want packaging that can protect the quality and safety of the food they buy, as well as provide real-time information about the food's condition. In addition, active packaging technologies can help protect the quality of food. On the other hand, intelligent packaging technologies can help improve traceability and transparency.

Furthermore, growing awareness among manufacturers and retailers regarding the benefits of reducing waste and compliance with government regulations has also improved market demand for active and intelligent packaging solutions. Active and intelligent packaging is an advanced packaging technology that interacts directly with the packaged product and its environment to increase safety, quality and shelf life and provide data about the condition of the packaged product.

Between 2022 and 2024, the market experienced steady growth, increasing from USD 12.5 billion in 2022 to approximately USD 14 billion in 2024. The increase in digital technologies, including RFID, QR code, and smart sensor integration in food, pharmaceutical, and logistics applications, was one of the major trends during this period. Increasingly stringent environmental regulations and the corporate pursuit of sustainability goals contributed to this growth in active & intelligent packaging materials specifically those made from biodegradable materials as well. Together these trends gave rise to a greater degree of supply chain visibility and reduced product waste, thereby laying the groundwork for further adoption of active & intelligent packaging solutions.

Active & Intelligent Packaging Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 14.9 Billion |

| Market Size in 2026 | USD 16.2 Billion |

| Forecast Period 2026 - 2035 CAGR | 11% |

| Market Size in 2035 | USD 41.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising Demand for Food Safety and Quality | Drives market growth by accelerating adoption of active packaging solutions that prevent contamination and extend shelf life. |

| Growth of E-Commerce and Cold Chain Logistics | Supports market expansion by increasing demand for intelligent packaging that monitors temperature and handling during transit. |

| Advancements in Smart Sensors and RFID Technologies | Strengthens adoption by enabling real-time product tracking, freshness monitoring, and supply chain transparency. |

| Regulatory Focus on Food Waste Reduction and Traceability | Drives uptake of active and intelligent packaging to comply with shelf-life extension and traceability requirements. |

| Adoption of Sustainable and Biodegradable Packaging | Expand market opportunities by integrating smart and active functions into eco-friendly packaging materials. |

| Pitfalls & Challenges | Impact |

| High Cost and Complexity of Advanced Packaging Technologies | Restrains market growth by limiting adoption among small and mid-sized manufacturers due to higher material, sensor, and integration costs. |

| Recycling and Regulatory Compliance Challenges | Impacts scalability as multi-layer, sensor-integrated packaging complicates recycling processes and increases compliance requirements across regions. |

| Opportunities: | Impact |

| Integration of Digital Technologies and IoT-Enabled Packaging | Creates growth opportunities by enabling real-time monitoring, predictive quality control, and data-driven supply chain optimization. |

| Expansion in Pharmaceutical and Healthcare Packaging Applications | Expands market potential by increasing adoption of intelligent and active packaging for drug safety, compliance monitoring, and cold-chain assurance. |

| Market Leaders (2025) | |

| Market Leaders |

6.6% Market Share in 2025 |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Active & Intelligent Packaging Market Trends

- The increasing number of manufacturers implementing intelligent packaging technologies, which assist in maintaining food safety and freshness as well as improving traceability, is one of the primary factors affecting the growth of the Intelligent Packaging Market. Nestlé, for example, announced that 86% of its packaging now has elements that will make it recyclable, while also featuring intelligent indicators that measure product quality, and fresh sensors that allow them to maintain the highest quality of their products during transportation.

- The increasing number of regulations and industry standards across global markets promoting the use of packaging solutions that will reduce food waste, and improve traceability, is a key factor driving faster adoption of active and intelligent packaging, through efforts such as EU’s Farm to Fork Strategy to cut food waste in half by 2030.

- Consumer demand for transparency, information and product safety is influencing consumer trust in intelligent packaging solutions and ultimately creating opportunities for increased investments and innovations in this area.

- Another factor influencing this growth in the active packaging market is the integration of IoT and sensor technologies into packaging to provide real-time temperature, humidity, and condition monitoring of products. This enables manufacturers and retailers to reduce product spoilage along the distribution chain, whilst ensuring product quality standards are maintained.

- Additionally, there are increasing investment opportunities from both public and private organizations into smart/sustainable packaging technologies that will contribute to accelerating the commercialization and innovation of these products. Governmental and non-government organizations support several initiatives that promote food waste reduction and the adoption of intelligent packaging technologies.

- Ultimately, the market will likely continue to be a rapidly evolving industry within the next several years as technological innovations, regulatory support of Packaging and Sustainability initiatives evolve.

Active & Intelligent Packaging Market Analysis

Learn more about the key segments shaping this market

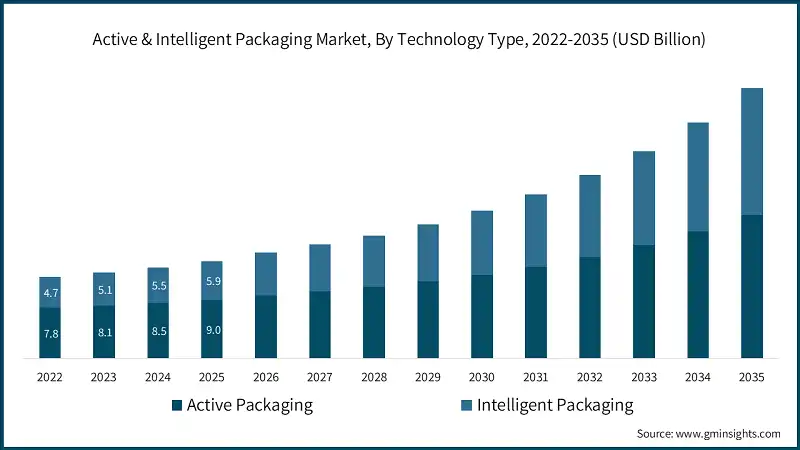

The global active & intelligent packaging industry was valued at USD 12.5 billion and USD 13.1 billion in 2022 and 2023, respectively. The market size reached USD 14.9 billion in 2025, growing from USD 14 billion in 2024.

Based on technology type, the global market is divided into Active Packaging and Intelligent Packaging. The Active Packaging segment accounted for the market size of USD 9 billion in 2025.

- Active Packaging has a considerable market share in the overall market since Active Packaging is widely used in shelf-life extension, quality maintenance, as well as the prevention of contamination by using oxygen scavengers, moisture absorbers, and antimicrobial components.

- Active Packaging is preferred as it has the ability to interact with the packaged product, which is a major advantage when it comes to food, beverages, as well as pharmaceuticals.

- Additionally, the broad adoption of active packaging is supported by well-established manufacturing processes, proven effectiveness, and compatibility with conventional packaging formats, making it the dominant segment in terms of market revenue and volume.

- The intelligent packaging segment is anticipated to grow at the fastest CAGR of 12.8% over the forecast period, as it has multiple applications for product monitoring, traceability, and consumer interaction.

- The demand for Intelligent Packaging has been on the rise owing to the ability to offer information regarding the condition of the product through the use of sensors, RFID/NFC tags, QR codes, and freshness indicators.

- The rapid adoption of Intelligent Packaging is driven by growing demand in e-commerce, cold-chain logistics, pharmaceuticals, and high-value food products, where real-time monitoring and data-driven insights are critical for maintaining quality and compliance.

Learn more about the key segments shaping this market

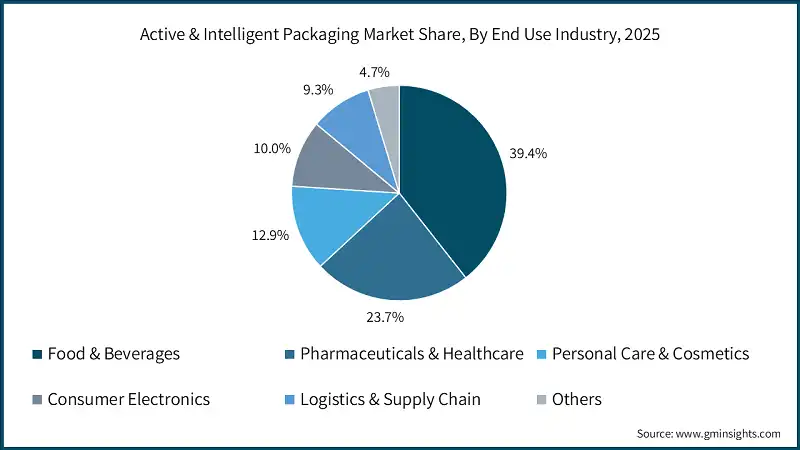

Based on end use industry, the active & intelligent packaging market is classified into Food & Beverages, Pharmaceuticals & Healthcare, Personal Care & Cosmetics, Consumer Electronics, Logistics & Supply Chain, and Others. The Food & Beverages segment dominated the market in 2025 with a revenue of USD 5.9 billion.

- The Food & Beverages segment holds the largest market share because active & intelligent packaging solutions are widely utilized in the product segment in relation to shelf life extension, freshness maintenance, spoilage prevention, and food safety regulations.

- Applications utilize technologies like oxygen scavengers, moisture absorbers, antimicrobial packaging, or freshness indicators. These ensure the quality of the product.

- Many food and beverage manufacturers continue to adopt these packaging solutions to reduce waste, improve supply chain efficiency, and meet regulatory and consumer expectations, further strengthening this segment’s dominance.

- The Logistics & Supply Chain segment is experiencing the fastest growth with a CAGR of 13.4% during the forecast period, driven by increasing adoption of intelligent packaging solutions that provide real-time monitoring, traceability, and condition tracking.

- The applications make use of smart sensors, RFID/NFC tags, as well as IoT-enabled packaging in an effort to provide temperature control and prevent spoilage during transport.

- With the growing e-commerce, cold chains, and international trade, the use of active and smart packaging in logistics is anticipated to accelerate, thereby making a significant contribution to the overall growth of the market.

Looking for region specific data?

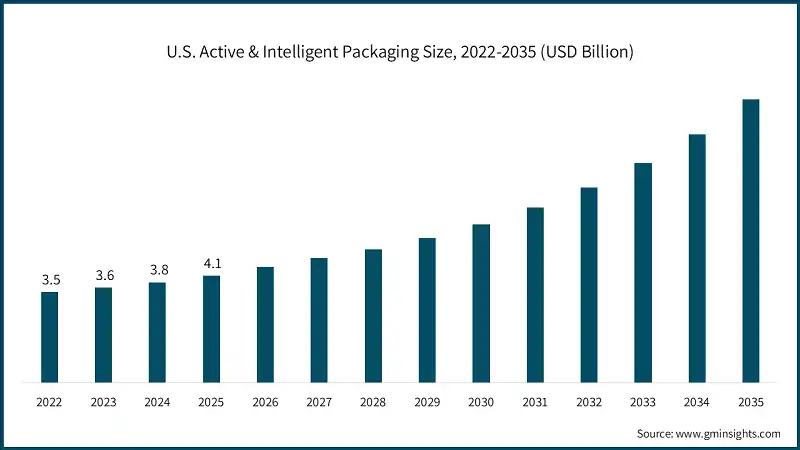

North America dominated the global active & intelligent packaging market with a market share of 31.7% in 2025.

- A favorable environment for industries, heavy investments regarding the production of foods and beverages, well-developed logistics, and a strong R&D environment are the key factors that are encouraging the regional market.

- The U.S. has a well-established packaging and supply chain innovation ecosystem. This region has prominent universities, research facilities, and packaging technology companies that play an important part in innovation related to active packaging, intelligent labels, and integrating smart sensors.

- Furthermore, growing demand from sectors such as food and beverages, pharmaceuticals, healthcare, and e-commerce has created substantial need for active and intelligent packaging products.

- Supportive government legislation on food safety, traceability, and waste reduction, along with associated initiatives on sustainable packaging, act as drivers for market growth in the region.

The U.S. active & intelligent packaging market was valued at USD 3.5 billion and USD 3.6 billion in 2022 and 2023, respectively. The market size is projected to reach USD 4.1 billion in 2025, growing from USD 3.8 billion in 2024.

- The U.S. retains a leading position in the active and intelligent packaging industry, thanks to its strong food, beverage, and pharmaceutical industry with emphasis on advanced technological capabilities and facilitating regulatory frameworks. There are a number of prominent players in the nation offering packaging technology as well as solution development skills involving intelligent sensors, RFID/NFC solutions, and freshness indicators.

- Additionally, the presence of top-tier research institutions and extensive innovation in sustainable materials, cold-chain logistics, and digital packaging technologies further accelerate the development and adoption of advanced active and intelligent packaging products.

The Europe active & intelligent packaging market accounted for USD 5 billion in 2025 and is expected to witness strong growth over the forecast period.

- Europe holds a significant share of the global active and intelligent packaging market, supported by advanced food, beverage, and pharmaceutical manufacturing infrastructure, increasing government initiatives, and rising investments in smart and sustainable packaging solutions.

- The region benefits from a collaborative ecosystem of academic institutions, research organizations, and packaging technology providers, which accelerates innovation and adoption of advanced active and intelligent packaging solutions.

Germany dominates the Europe market, showcasing strong growth potential.

- Within Europe, Germany has one of the significant shares of active and intelligent packaging, driven by its well-established food, beverage, and pharmaceutical manufacturing infrastructure, good industrial base and favorable government initiatives.

- The focus of the country on food safety, food traceability, and sustainable food packaging solutions has encouraged the emergence and commercialization of intelligent food packaging technology.

- In addition, the strong industrial ecosystem and adaptability of new technologies in Germany make it easier to implement active and intelligent packages in the food, pharma, and consumer products markets.

The Asia-Pacific active & intelligent packaging market is expected to grow to the highest CAGR of 12% during the forecast period.

- The region is witnessing rapid market expansion, driven by increasing food, beverage, and pharmaceutical manufacturing, rising demand from e-commerce and cold-chain logistics, and greater adoption of smart and active packaging technologies.

- Governments in several countries like China, Japan, South Korea, and India have been supporting advanced packaging solutions by developing infrastructure, offering finance facilities, and finding public-private partnership opportunities.

- Moreover, the presence of a strong manufacturing base, increasing technology adoption, and local suppliers of packaging technologies is driving the demand for active and intelligent packaging solutions in the food, pharmaceutical, and consumer products segments.

China is estimated to grow significantly within the Asia-Pacific market.

- China leads the Asia-Pacific active and intelligent packaging market, due to the large investment that has been made in the manufacturing of food, beverage, and pharmaceutical products, among others.

- The Chinese government focuses on food safety, traceability, and sustainable packaging, offering funds and government assistance in developing the market.

- With strong manufacturing capacity, expanding logistics infrastructure, and rising domestic and export demand, China is at the forefront of active and intelligent packaging adoption and development in the Asia-Pacific region.

Brazil leads the Latin American active & intelligent packaging market, showing strong growth during the analysis period.

- Brazil is one of the emerging key growth centers in the region owing to growing food, beverage, and pharmaceutical manufacturing, rising e-commerce penetration, and increasing usage of smart and active packaging technologies within the country.

- The country’s large industrial base and increasing use of intelligent labels, freshness indicators, and active packaging solutions in food and consumer goods are generating strong demand.

- Additionally, supportive government policies and public-private initiatives promoting food safety, traceability, and sustainability are further boosting market growth.

South Africa is expected to witness substantial growth in the Middle East and Africa active & intelligent packaging industry during the forecast period.

- The country shows significant potential, due to the growing number of industries, pharmaceutical, as well as the growing usage of intelligent packaging solutions.

- Various government and infrastructure development initiatives and collaborations with leading smart packaging technology providers from across the globe are expected to accelerate the growth of the market even further.

Active & Intelligent Packaging Market Share

The competitive landscape of the global active & intelligent packaging industry is characterized by intense competition, continuous technological innovation, and strategic collaborations among leading packaging solution providers. Top players such as Amcor plc, Mondi Group, Sonoco Products Company, 3M Company, and DuPont de Nemours, Inc. hold a combined market share of approximately 25% in the global market. These market leaders are actively working on their R&D activities to develop innovative active as well as intelligent technologies such as freshness indicators, intelligent sensors, temperature-sensitive packaging, and sustainable materials for various industries such as the food & beverages sector, pharmaceutical sector, personal care products market, and logistics market.

The market is also experiencing mergers and acquisitions and strategic partnerships that cover the expansion of geographical reach, manufacturing strengths, and the adoption of innovative packaging solutions. Small, specialized packaging companies are making contributions through offerings such as smart films with the properties of biodegradable plastics, interactive packaging, and internet-of-things-based packaging solutions.

Active & Intelligent Packaging Market Companies

Prominent players operating in the active & intelligent packaging industry are as mentioned below:

- 3M Company

- Amcor plc

- Avery Dennison Corporation

- CCL Industries Inc.

- Coveris Holdings S.A.

- Constantia Flexibles Group GmbH

- Dai Nippon Printing Co., Ltd.

- DuPont de Nemours, Inc.

- Huhtamäki Oyj

- Mondi plc

- Multisorb Technologies, Inc.

- Sealed Air Corporation

- Sonoco Products Company

- Stora Enso Oyj

Amcor plc

Amcor plc is a leading player in the active and intelligent packaging market with a market share of 6.6%. The company specializes in innovative active packaging solutions integrating active components like oxygen scavengers, moisture absorbers, and freshness indicators onto food, beverage, and pharmaceutical products. Its solid global manufacturing footprint, significant R&D investments, and focus on green and high-performance packaging reinforce its front-runner position in the market.

Mondi Group

Mondi Group holds a market share of 4.5% in the active and intelligent global packaging market. The company focuses on sustainable and flexible packaging solutions combined with intelligent packaging technologies, including RFID/NFC-enabled labels, freshness indicators, and smart films. Its competitive edge is supported by strong R&D capabilities, global production facilities, and partnerships with leading food, beverage, and pharmaceutical manufacturers.

Sonoco Products Company

Sonoco Products Company commands a market share of 4.7% and is recognized for its comprehensive portfolio of active and intelligent packaging solutions. The company offers temperature-sensitive packaging, interactive labels, smart protective packaging, and sustainable materials for food, healthcare, and consumer goods. Sonoco leverages strong global distribution networks, customer support, and ongoing innovation to maintain its competitive position and drive growth in the market.

Active & Intelligent Packaging Industry News

- In September 2024, Aptar Food Protection launched SeaWell active packaging system into the e-commerce category. The novel active packaging solution designed to help maintain seafood freshness, quality and aesthetics has now been adopted for direct-to-consumer shipping of various seafood items including filets, whole fish and shellfish such as crab legs, scallops, and shrimps. SeaWell active packaging utilizes food contact-safe absorbent materials embedded into its proprietary Drip-Lock technology to trap excess fluids inside pockets or wells, which are a patented design.

The active & intelligent packaging market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Billion from 2022 – 2035 for the following segments:

Market, By Technology Type

- Active packaging

- Oxygen scavengers

- Moisture absorbers

- Ethylene absorbers

- Antimicrobial agents

- Temperature control packaging

- Flavor/odor absorbers

- Intelligent packaging

- Time-temperature Indicators (TTIs)

- RFID tags and QR codes

- Freshness indicators

- Gas sensors

- Smart labels

- Interactive packaging

Market, By Functionality

- Shelf-life extension

- Moisture control

- Oxygen control

- Ethylene control

- Antimicrobial protection

- Quality assurance

- Freshness indicators

- Time-temperature indicators

- Traceability & safety

- RFID tags

- QR codes

- Tamper evident packaging

- Consumer engagement

- Interactive packaging

- Smart labels

Market, By Packaging Material

- Plastics

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Paper & paperboard

- Corrugated paperboard

- Cartons

- Glass

- Bottles

- Jars

- Metals

- Cans

- Foils

- Biodegradable materials

- Starch-based materials

- Polylactic Acid (PLA)

Market, By End Use Industry

- Food & beverages

- Perishable foods

- Processed foods

- Beverages

- Bakery and confectionery

- Pharmaceuticals & healthcare

- Medicines

- Medical devices

- Nutraceuticals

- Personal care & cosmetics

- Skincare products

- Haircare products

- Cosmetics

- Consumer electronics

- Mobile phones

- Wearable devices

- Accessories

- Logistics & supply chain

- Warehousing

- Transportation

- Retail

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What is the growth outlook for intelligent packaging technology?

The intelligent packaging segment is expected to grow at a CAGR of 12.8% through the forecast period, supported by rising use of RFID tags, freshness indicators, QR codes, and real-time condition monitoring solutions.

Which region leads the active & intelligent packaging market?

The U.S. market reached USD 4.1 billion in 2025, growing from USD 3.8 billion in 2024. Growth is driven by strong food, beverage, and pharmaceutical industries along with advanced packaging innovation and regulatory focus on traceability.

What are the key trends in the active & intelligent packaging industry?

Key industry trends include integration of IoT-enabled smart sensors, adoption of sustainable and biodegradable packaging materials, and increased use of intelligent labels for traceability and consumer engagement.

Who are the key players in the active & intelligent packaging market?

Major companies operating in the industry include Amcor plc, Mondi Group, Sonoco Products Company, 3M Company, DuPont de Nemours, Inc., Avery Dennison Corporation, CCL Industries Inc., and Sealed Air Corporation.

Which end-use industry led the active & intelligent packaging market in 2025?

The food & beverages segment led the active & intelligent packaging industry with revenue of USD 5.9 billion in 2025, driven by high demand for freshness monitoring, spoilage prevention, and food safety compliance.

How much revenue did the active packaging segment generate in 2025?

The active packaging segment generated USD 9 billion in 2025, maintaining dominance due to its widespread use in oxygen scavenging, moisture control, antimicrobial protection, and shelf-life enhancement.

What is the projected value of the active & intelligent packaging market by 2035?

The active & intelligent packaging industry is expected to reach USD 41.4 billion by 2035, due to advancements in smart sensors, RFID integration, and growing cold-chain and e-commerce demand.

What is the current active & intelligent packaging industry size in 2026?

The market is projected to reach USD 16.2 billion in 2026, supported by increased adoption of smart packaging technologies in food, pharmaceutical, and logistics industries.

What is the market size of the active & intelligent packaging industry in 2025?

The active & intelligent packaging market size was USD 14.9 billion in 2025 and is expected to grow at a CAGR of 11% from 2026 to 2035, driven by rising demand for food safety, quality assurance, and shelf-life extension across packaging applications.

Active & Intelligent Packaging Market Scope

Related Reports