Home > Chemicals & Materials > Specialty Chemicals > Custom Synthesis > Acetic Acid Market

Acetic Acid Market Size

- Report ID: GMI1594

- Published Date: May 2017

- Report Format: PDF

Acetic Acid Market Size

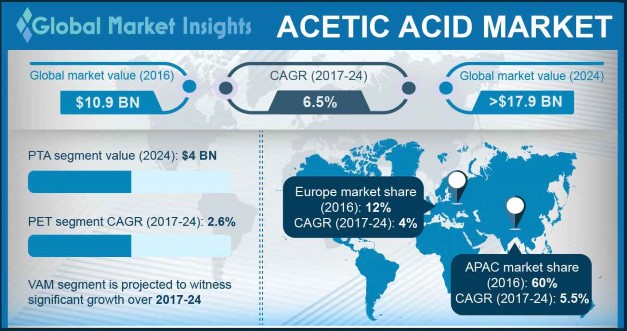

Acetic Acid Market size exceeded USD 10.9 Billion in 2016 and is predicted to witness more than 6% CAGR from 2017 to 2024.

Acetic acid also known as ethanoic acid, it is a colorless liquid that acts as a major precursor for the production of various chemicals used in textile, rubber and plastic industries among others. It acts as an intermediary for the formulation of various coatings, sealants, and greases that are widely used in the construction, electronics, and the packaging industry. Acetic acid market is projected to show substantial growth during the forecast period. The growing use of acetic acid in manufacturing of various products such as vinyl acetate monomers (VAM) and purified terephthalate acid is projected to boost the market size during the assessment period. Acetic acid is widely used to produce VAM, which is in turn used to manufacture various resins and polymers for adhesives, films, paints, coatings, textiles and other end-user products.

Polyvinyl acetate (PVA) and polyvinyl alcohol (PVOH) are the major derivatives manufactured using VAM. PVA is widely employed in textiles, adhesives, packaging films, photosensitive coatings and thickeners whereas, PVOH finds its applications in paper coatings, paints and industrial coatings owing to their excellent adhesion properties. The growing infrastructural investments across the globe is anticipated to propel the demand for coatings and sealants in turn positively contributing to the growth of the acetic acid monomers demand throughout the forecast period. Moreover, the rising application of acetic acid in production of terephthalic acid is also set to aid in the market growth during the forecast period. Terephthalic acid forms a major building block in manufacturing of polyester resins which is extensively used in polyester films, PET resins and polyester fibers. Additionally, terephthalic acid also finds its application in home furnishing and in manufacturing of textiles such as bed sheets, clothes, and curtains. The PET application segment held a market share close to 20% in 2016 and is projected to exhibit a CAGR of over 2.6% throughout the review period.

| Report Attribute | Details |

|---|---|

| Base Year: | 2016 |

| Acetic Acid Market Size in 2016: | 10.9 Billion (USD) |

| Forecast Period: | 2017 to 2024 |

| Forecast Period 2017 to 2024 CAGR: | 6% |

| 2024 Value Projection: | 17.9 Billion (USD) |

| Historical Data for: | 2013 to 2016 |

| No. of Pages: | 312 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | Application and Region |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

The major players in the market are seen to invest in research and development activities to expand their production capacity. This on-going trend is projected to significantly contribute to the industry during the assessment period. For instance, Celanese Corporation, a major industry player announced the expansion of its acetic acid and VAM plant capacity each by 150 kilo tons in Clear Lake, Texas. Eastman Chemical Company another significant market player also announced the expansion of its carboxylic acid plant capacity at its U.S. facility in Longview, Texas.

Rising price of petroleum feedstock along with the presence of stringent regulations is likely to bring new business growth opportunities. The proficient players are constantly seen to shift towards the production of bio based acetic acid produced from sugar, corn, cheese whey waste, poplar tree, and other bakery residues. Bio based acetic acid possess same properties as convectional acid with minimal environmental damage. Moreover, with the price volatility of conventional raw materials such as methanol is projected to further boosted the shift to bio based acetic acid in the coming years.