Summary

Table of Content

Acetic Acid Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Acetic Acid Market Size

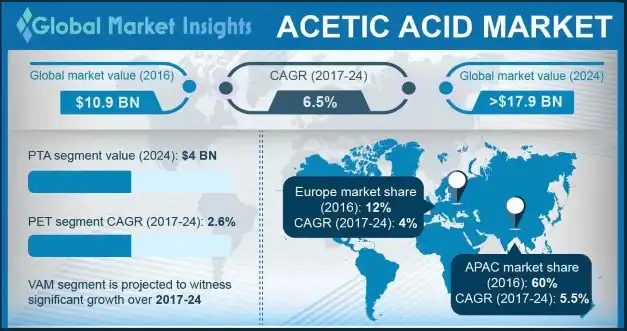

Acetic Acid Market size exceeded USD 10.9 Billion in 2016 and is predicted to witness more than 6% CAGR from 2017 to 2024.

To get key market trends

To get key market trends

Acetic acid also known as ethanoic acid, it is a colorless liquid that acts as a major precursor for the production of various chemicals used in textile, rubber and plastic industries among others. It acts as an intermediary for the formulation of various coatings, sealants, and greases that are widely used in the construction, electronics, and the packaging industry. Acetic acid market is projected to show substantial growth during the forecast period. The growing use of acetic acid in manufacturing of various products such as vinyl acetate monomers (VAM) and purified terephthalate acid is projected to boost the market size during the assessment period. Acetic acid is widely used to produce VAM, which is in turn used to manufacture various resins and polymers for adhesives, films, paints, coatings, textiles and other end-user products.

Polyvinyl acetate (PVA) and polyvinyl alcohol (PVOH) are the major derivatives manufactured using VAM. PVA is widely employed in textiles, adhesives, packaging films, photosensitive coatings and thickeners whereas, PVOH finds its applications in paper coatings, paints and industrial coatings owing to their excellent adhesion properties. The growing infrastructural investments across the globe is anticipated to propel the demand for coatings and sealants in turn positively contributing to the growth of the acetic acid monomers demand throughout the forecast period. Moreover, the rising application of acetic acid in production of terephthalic acid is also set to aid in the market growth during the forecast period. Terephthalic acid forms a major building block in manufacturing of polyester resins which is extensively used in polyester films, PET resins and polyester fibers. Additionally, terephthalic acid also finds its application in home furnishing and in manufacturing of textiles such as bed sheets, clothes, and curtains. The PET application segment held a market share close to 20% in 2016 and is projected to exhibit a CAGR of over 2.6% throughout the review period.

Acetic Acid Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2016 |

| Market Size in 2016 | 10.9 Billion (USD) |

| Forecast Period 2017 - 2024 CAGR | 6% |

| Market Size in 2024 | 17.9 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

The major players in the market are seen to invest in research and development activities to expand their production capacity. This on-going trend is projected to significantly contribute to the industry during the assessment period. For instance, Celanese Corporation, a major industry player announced the expansion of its acetic acid and VAM plant capacity each by 150 kilo tons in Clear Lake, Texas. Eastman Chemical Company another significant market player also announced the expansion of its carboxylic acid plant capacity at its U.S. facility in Longview, Texas.

Rising price of petroleum feedstock along with the presence of stringent regulations is likely to bring new business growth opportunities. The proficient players are constantly seen to shift towards the production of bio based acetic acid produced from sugar, corn, cheese whey waste, poplar tree, and other bakery residues. Bio based acetic acid possess same properties as convectional acid with minimal environmental damage. Moreover, with the price volatility of conventional raw materials such as methanol is projected to further boosted the shift to bio based acetic acid in the coming years.

Acetic Acid Market Analysis

The acetic acid market for VAM was the largest segment in 2016 and is expected to exhibit similar trend throughout the given period of 2017-2024. VAM is a primary intermediate which is used in the production of several polymers & resins for paints, coatings, adhesives, films, textiles, and other end-use products. The growing demand for these applications across the globe is anticipated to positively contribute to the growth of the segment by the end of the forecast period. Moreover, rapid industrialization & urbanization mainly in Asia Pacific and the Middle Eastern regions has led to strong rise in the construction industry which in turn will have subsequent impact on the product demand during the forecast timeframe. For instance, Asia Pacific construction industry is likely to witness gains close to 7% in the coming years. Furthermore, the rising demand for automobiles in the developing economies coupled with the growing shift of manufacturing bases shall also surge the demand for vinyl acetate monomer in the coming years.

PTA was the second largest application segment in 2016 and is projected to show the same trend throughout the assessment period. The segment is projected to reach USD 2.2 billion by the end of the forecast period. The rising demand for PTA for production of PET bottles and polyester films is anticipated to drive the growth of the segment.

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

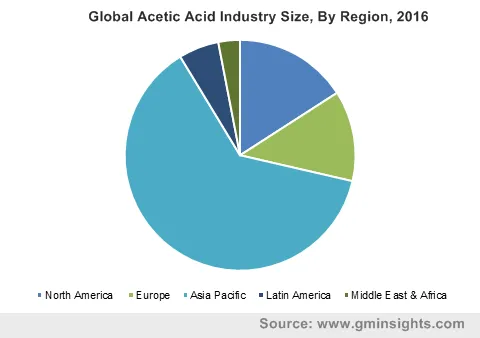

Asia Pacific has resulted in a greater demand for construction and textiles industries thereby substantially contributing to the growth of the market. The region held a market share of over 60% in 2016 and is projected to grow at a CAGR of 5.5%. Moreover, the rapidly growing pharmaceutical industry mainly in India and Japan among others is projected to generate substantial revenue during the forecast period. The product is widely used in the in manufacturing of disintegrant in the pharmaceutical industry, thereby growing demand for medicinal tablets shall aid in the growth of the overall market. According to the Department of Pharmaceuticals, the Indian domestic pharmaceutical market generate revenue over USD 16.5 billion in 2016 and is anticipated to exhibit a year on year growth of over 9.4%.

Acetic Acid Market Share

Acetic acid market is diversified with large number of small scale as well as big scale manufacturers around the globe. The major players active in the market include Major formulators include

- Mitsubishi Chemical Corporation

- Saudi International Petrochemicals

- Jiangsu Sopo (Group)

- Wacker Chemie

- Eastman Chemical Company

- DuPont

- British Petroleum

- Celanese Corporation

- GNFC Limited

- HELM AG

- LyondellBasell

- Sinopec

- Daicel Corporation

- PetroChina

Industry Background

Acetic acid is produced by methanol carboxylation process. This process accounted for over 65% of the global production. Methanol and carbon monoxide are used as raw materials in the production process. Acetic acid is used to produce vinyl acetate monomer, acetic anhydride, purified terephthalic acid, acetate esters, and others. The industry is witnessing a major upswing with the growing utilization trend of this acid as a raw material to produce PTA and VAM. It finds application as an intermediate in formulation of polyester, coatings, greases, and sealants, which are widely used across end-use sectors such as textiles, packaging, automotive, electronics, and paints & coatings.

Frequently Asked Question(FAQ) :

How much remuneration is the Acetic Acid industry projected to register in 2016

Overall Acetic Acid Market recorded a remuneration of $5 billion in 2016

What kind of growth will global Acetic Acid Market size observes during the forecast timeframe?

According to report, Acetic Acid Market size is estimated to be pegged at $5 billion by 2023.

Acetic Acid Market Scope

Related Reports