Summary

Table of Content

U.S. Commercial Boiler Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

U.S. Commercial Boiler Market Size

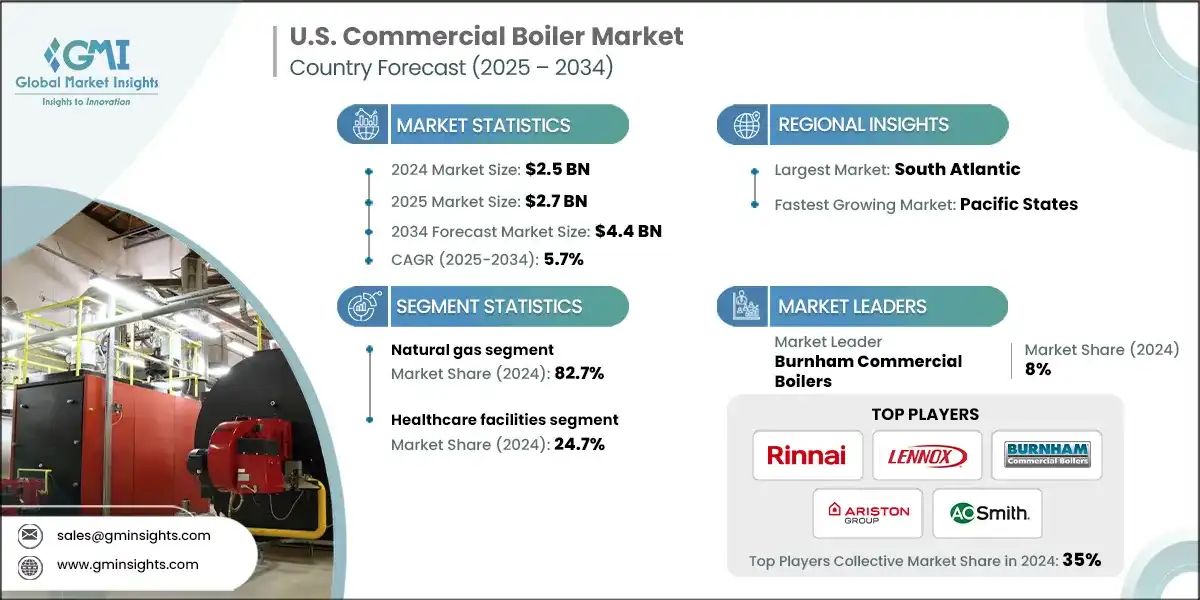

According to a recent study by Global Market Insights Inc., the U.S. commercial boiler market was estimated at USD 2.5 billion in 2024. The market is expected to grow from USD 2.7 billion in 2025 to USD 4.4 billion by 2034, at a CAGR of 5.7%.

To get key market trends

- Stricter energy codes in line with electrification and decarbonization mandates will accelerate demand for condensing and modular boiler systems. Retrofitting non-condensing boilers in association with expanding building performance standards will spur the adoption of high-efficiency platforms.

- A commercial boiler is a pressurized heating system designed to provide hot water or steam for space heating and domestic hot water in commercial facilities including schools, hospitals, offices, and manufacturing plants. Operating on various fuel sources including natural gas, coal, oil, and biomass.

- Smart control paired with fuel flexibility will bolster replacement activity by improving emissions and lifecycle value. In addition, resilience goals in line with extreme weather preparedness will augment retrofit and new install demand for dual-fuel, modular boiler configurations.

- For instance, in July 2025, AstraZeneca announced a landmark commitment to invest USD 50 billion in the U.S. by 2030, marking a significant expansion of its manufacturing and R&D operations. Additionally, the plan encompasses the enhancement of research and cell therapy production capabilities across key innovation hubs in Maryland, California, Massachusetts, Texas, and Indiana.

- Federal energy conservation standards together with electrification and climate mandate will accelerate adoption of condensing & high efficiency boiler systems across new construction and major retrofits. Growing demand for cost-optimized building operations will spur commercial boiler installations across urban centers.

- Expanding commercial real estate development in association with increasing retrofitting and modernization of aging heating infrastructure will accelerate the product adoption. Integration of smart control systems coupled with predictive maintenance solutions will foster the shift toward intelligent and automated boiler operations.

- Growing district heating networks paired with the rising preferences for centralized heating solutions will augment the deployment of high-capacity commercial boilers across institutional establishments. Continuous technological advancements in boiler design coupled with digital monitoring solutions will accelerate the shift toward intelligent, connected, and self-optimizing heating units.

- For reference, in February 2025, Loblaw Companies Limited (L.TO) announced plans to invest approximately USD 1.6 billion in capital expenditure over the year. This strategic allocation is aimed at modernizing its existing retail infrastructure, expanding its national store footprint, and supporting the creation of approximately 8,000 new jobs across U.S.

- Growing preference for centralized heating systems in line with expanding district heating networks will push demand for high-performance boilers to cater to large-scale commercial facilities. Enhanced awareness toward lifecycle cost benefits combined with the availability of performance-based service contract will propel industry outlook.

- The U.S. commercial boiler market was valued at USD 2 billion in 2021 and grew at a CAGR of over 6% through 2024. Integration of building automation systems along with IoT-enabled predictive maintenance will support the development of fully automated commercial boiler operations, improving uptime and reliability.

- Rising demand for flexible and modular heating solutions in line with fluctuating seasonal heating needs will drive interest in modular and scalable commercial boiler systems for hotels, universities, and mixed-use buildings. Increasing emphasis on indoor comfort and occupant well-being along with rising energy costs will accelerate the installation of these heating units.

U.S. Commercial Boiler Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 2.5 Billion |

| Forecast Period 2025 – 2034 CAGR | 5.7% |

| Market Size in 2034 | USD 4.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Positive outlook toward healthcare sector | Boost demand for advanced commercial boilers in hospitals and clinics to ensure reliable hot water and heating solutions. |

| Rising demand for space heating in commercial buildings | Drives installation of energy-efficient boilers to maintain optimal indoor comfort across large facilities. |

| Implementation of stringent government regulations | Accelerates adoption of low-emission and high efficiency boiler technologies to meet compliance standards. |

| Pitfalls & Challenges | Impact |

| High initial investment | Limits adoption in cost-sensitive markets, slowing down modernization and retrofit projects. |

| Opportunities: | Impact |

| Integration of IoT and smart controls | Enables predictive maintenance and energy optimization, improving operational efficiency for end users. |

| Growing adoption of hybrid heating systems | Creates demand for boilers compatible with renewable energy sources, enhancing sustainability credentials. |

| Expansion of commercial infrastructure projects | Increase the need for high-capacity boilers to meet heating and hot water requirements in new buildings. |

| Retrofitting of aging boiler systems | Drives market growth as facilities upgrade to energy-efficient and low-emission models to meet modern standards. |

| Market Leaders (2024) | |

| Market Leaders |

8% market share |

| Top Players |

Collective market share in 2024 is 35% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | South Atlantic |

| Fastest Growing Market | Pacific States |

| Future outlook |

|

What are the growth opportunities in this market?

U.S. Commercial Boiler Market Trends

- The healthcare sector in the country is experiencing a consistent rise in infrastructure investments fueled by increasing patient volumes, medical tourism, and advancements in healthcare technology. Commercial boilers play a crucial role in hospitals and healthcare facilities by ensuring reliable space heating, sterilization processes, and hot water supply for patient care.

- Growing emphasis on energy efficiency, hospitals are shifting toward modern boiler systems that offer high efficiency, low emissions, and improved reliability to meet operational demands while reducing overall energy costs. Furthermore, the expansion of long-term care facilities, specialty clinics, and diagnostic centers across the country will fortify U.S. commercial boiler market scenario.

- For illustration, in July 2025, SaskEnergy launched its Commercial Boiler Rebate Program as a strategic initiative to promote the adoption of high-efficiency, properly sized commercial boilers. The program is designed to support both new construction and retrofit projects and reduce long-term operational costs, while advancing energy efficiency goals across the province.

- The growing floor space in commercial buildings, including offices, educational institutions, retail complexes, and hospitality facilities, is driving the need for efficient space heating solutions. These boilers provide centralized and consistent heating, ensuring occupant comfort during harsh winters while keeping operational costs in check.

- Urbanization and the development of smart cities in the country have also increased the installation of modern HVAC systems integrated with advanced commercial boilers. In addition, the rise of hybrid heating systems, combining boilers with renewables technologies including solar thermal panels and heat pumps, is gaining traction in commercial establishments.

- Stringent U.S. regulations focusing on building energy efficiency and carbon emission reduction are accelerating the replacement of aging boiler systems with modern, compliant technologies. Policies including the U.S. Department of Energy’s energy efficiency standards and state-level buildings codes are encouraging businesses to install high-efficiency, low-emissions boilers.

- For citation, in December 2022, the Federal Energy Management Program released updated guidelines specifically targeting natural gas boilers with input ratings below 300,000 Btu/h. These revised directives exclude higher-capacity commercial units, thereby streamlining federal procurement processes and reinforcing compliance with federal energy efficiency standards.

- These regulations aim to minimize greenhouse gas emissions while improving operational energy performance across commercial facilities. Moreover, governments incentives, tax credits, and rebate programs are driving the transition toward energy-efficient boiler systems in both existing and new commercial buildings.

U.S. Commercial Boiler Market Analysis

Learn more about the key segments shaping this market

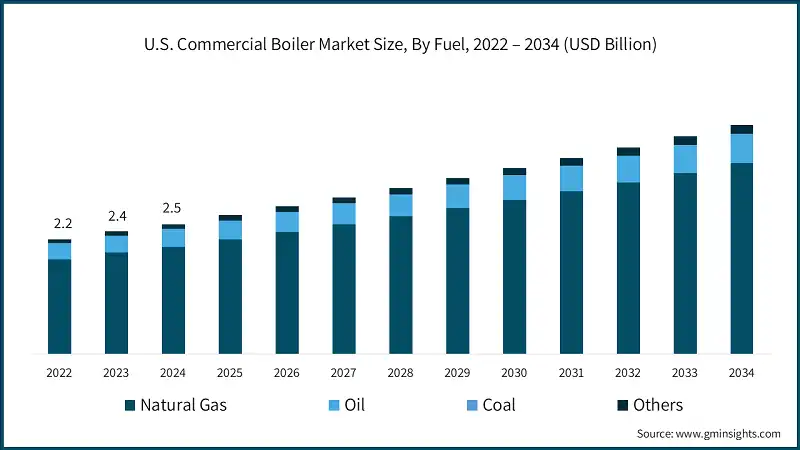

- Based on fuel, the industry is segmented into coal, oil, natural gas, and others. The natural gas boiler holds a market share of 82.7% in 2024 and is projected to grow at a growth rate of over 5.5% through 2034.

- Growing preference for cleaner and cost-efficient fuels is pushing commercial facilities toward natural gas boilers, reducing dependency on high-emission alternatives, which will foster business outlook. Expanding natural gas pipeline infrastructure across urban and semi-urban regions is improving accessibility, making installation more feasible for commercial properties.

- For instance, in May 2025, Siemens Healthineers announced a USD 150 million investment to support its strategic expansion initiatives in the U.S. This capital deployment is focused on scaling production capacity, enhancing customer service infrastructure, and creating new employment opportunities across key operational sites.

- The oil boiler market is anticipated to reach over USD 500 million by 2034. Rural and off-grid commercial facilities with limited access to natural gas pipelines continue to rely on oil-fired boilers for heating. Growing emphasis on bio-based heating oils is improving the sustainability profile of oil boilers.

- The coal based boiler market was valued at USD 12.9 million in 2024. Increasing demand for coal-fired boilers is witnessing a gradual decline owing to emissions concerns, yet some industrial and institutional facilities continue usage in regions with low-cost coal availability. Rising retrofitting initiatives are integrating cleaner combustion technologies to reduce particulate and CO2 emissions from coal boilers.

- Based on technology, the industry is segmented into non-condensing and condensing. The condensing segment will exceed USD 3.5 billion by 2034. These boilers capture latent heat from flue gases, offering higher thermal efficiencies compared to traditional models. This efficiency advantage aligns with commercial building operators aiming to minimize operational costs.

- Healthcare facilities, universities, and hospitality centers are increasingly opting for condensing systems as they provide consistent heating with reduced fuel consumption. Integration with advanced building automation and low-temperature heating networks supports the wider adoption of condensing boilers across the commercial sectors.

- For reference, in FY 2025, the U.S. Department of Housing and Urban Development allocated USD 35.2 billion over 11% of its total USD 296.2 billion budget toward strategic priorities such as affordable housing, community revitalization, and urban development.

- The non-condensing commercial boiler market was valued at USD 1 billion in 2024. These boilers remain in demand fueled by their proven reliability and simpler design, making them a practical choice for budget-conscious projects. Moreover, many commercial buildings with legacy heating systems find non-condensing models easier to integrate without extensive system modification.

Learn more about the key segments shaping this market

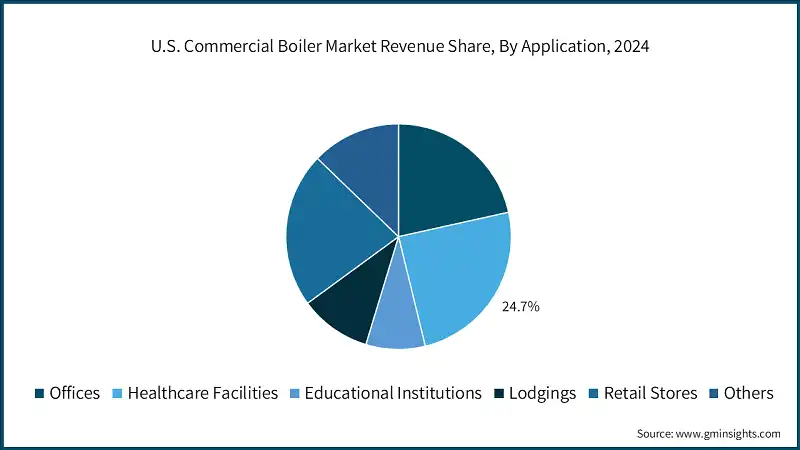

- Based on application, the U.S. commercial boiler market is segmented into educational institutions, offices, retail stores, lodgings, healthcare facilities and others. The healthcare facilities segment holds a share of 24.7% in 2024 and is set to exceed USD 1 billion by 2034.

- Hospitals and clinics demand highly reliable boiler systems to maintain controlled temperature for patient safety and comfort. These facilities require boilers with high uptime capabilities and low maintenance to meet uninterrupted heating demands. Additionally, boilers serve dual roles in space heating and providing steam for sterilization processes in medical equipment.

- For citation, in March 2025, Johnson & Johnson unveiled plans to invest over USD 55 billion in the U.S. over the next four years, marking a 25% increase over its previous investment cycle. This strategic commitment spans manufacturing, research and development, and technology infrastructure, and is expected to significantly enhance the company’s U.S. operations.

- The office boiler segment is set to reach over USD 950 million by 2034. Increasing urbanization and office expansion projects in metropolitan areas drive demand for efficient heating systems to maintain comfortable indoor climates. Office buildings increasingly prefer boilers offering energy savings and lower operational costs to meet sustainability targets.

- The educational institutions boilers market was valued at USD 213 million in 2024. Schools and universities invest in modern heating infrastructure to provide comfortable learning environments. These facilities adopt high-efficiency boilers to align with green buildings certification and reduce energy costs.

- For illustration, in August 2025, Apple announced USD 100 billion commitment to its U.S. operations. In addition, this total planned investment in the country to USD 600 billion over the next four years.

- The lodgings boiler market is set to reach over USD 400 million by 2034. Robust expansion of hotels, resorts, and motels increases demand for high-capacity commercial boilers to ensure guest comfort. Hospitality facilities prioritize boilers that provide quick hot water delivery for rooms, kitchen, and laundry.

- The retail stores boiler market was valued at USD 557.7 million in 2024. These facilities prioritize maintaining comfortable temperatures to improve shopper experience and staff productivity. In addition, high-capacity boilers meet extensive heating and hot water needs in multi-story retail complexes.

Looking for region specific data?

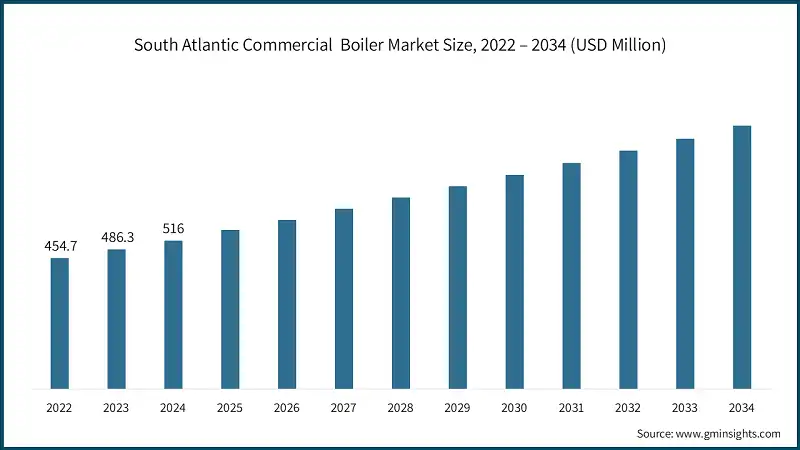

- The South Atlantic dominated the commercial boiler market dominating 20.6% share in 2024 and generated USD 516 million in revenue. The region, with its mix of urban centers and growing commercial infrastructure, is witnessing rising demand for energy-efficient commercial boilers.

- Increasing investment in commercial real estate and healthcare facilities are driving boiler replacements with modern systems that offer reliability and lower operational costs. A growing preference for natural gas-fired boilers is evident, supported by expanding gas pipeline infrastructure.

- For reference, in July 2025, Biogen announced plans to invest an additional USD 2 billion to expand its existing manufacturing operations in North Carolina’s Research Triangle Park (RTP). This strategic investment is aimed at enhancing production capacity, supporting pipeline growth, and strengthening Biogen’s long-term presence in the region.

- The Pacific States commercial boiler market is expected to reach over USD 850 million by 2034. The region is experiencing a shift toward low-emission commercial boilers owing to stringent state-level environmental policies. Rapid expansion of commercial complexes, hospitals, and educational facilities is accelerating demand for high efficiency condensing boilers.

- The North East commercial boiler market will witness a CAGR of over 4.5% till 2034. The region is known for its harsh winter, has a consistent and growing need for commercial boilers in buildings ranging from offices to universities. Aging infrastructure across states including New York and Massachusetts is driving boiler replacements projects with modern, high-efficiency systems.

- For instance, in June 2025, General Motors announced plans to invest approximately USD 4 billion over the next two years to expand its domestic manufacturing footprint. This investment is aimed at boosting U.S. production capacity for both electric vehicles and gas.

- The East North Central commercial boilers market was valued at USD 324.2 million in 2024. Cold winter in the region drives strong seasonal demand for high-capacity commercial boilers across multiple sectors. Modernization projects in educational institutions and hospitals are creating demand for energy-efficient, low-maintenance boiler technologies.

U.S. Commercial Boiler Market Share

- The top 5 companies in the U.S. commercial boiler industry are Rinnai America, Lennox International, Burnham Commercial Boilers, Ariston Holding, and A. O. Smith contributing around 35% of the market in 2024. The market exhibits moderate to high competition propelled by the presence of established domestic and international players offering a wide product portfolio.

- A.O. Smith faces intense competition in the market, primarily from players offering energy-efficient, low-emission, and smart control-enabled boilers. The company competes by leveraging its strong brand reputation, extensive product line, and focus on high efficiency condensing technologies.

- Burnham Commercial Boilers operates in highly competitive market, facing pressure from manufacturers emphasizing energy efficiency, low emissions, and advanced control systems. The company competes by offering durable and versatile applications across commercial sectors.

- Ariston Holding competes against well-established domestic and international players emphasizing high-efficiency heating solutions, low-emissions, and digital integration. With its global presence and strong R&D capabilities, the company leverages technological innovation to offer energy-efficient and eco-friendly boilers that align with the country's decarbonization goals.

- Lennox International faces intense competition fueled by the demand for energy-efficient, low emissions, and smart heating solutions. Competing against both global and domestic manufacturers, the company differentiates itself through advanced HVAC integration, high-efficiency condensing boilers, and strong after-sales support.

- Over the past 3 years, the market has become noticeably more competitive, as manufacturers rapidly respond to demand for energy-efficient condensing systems and smart controls. Companies have emphasized modular designs fuel-flexible burners, and enhanced service offerings, racing to deliver operational value.

U.S. Commercial Boiler Market Companies

- In the first quarter of 2025, Babcock & Wilcox Enterprises generated USD 181.2 million in revenue from continuing operations, reflecting a 10% year-over-year increase compared to USD 164.3 million in first quarter 2024. This growth was primarily driven by USD 8.5 million in contributions from a natural gas project and a USD 10 million uplift in parts sales, underscoring the company’s strategic focus on diversified energy solutions and aftermarket services.

- For the full year 2024, Ariston Holding reported net revenue of USD 3.1 billion, reflecting a 12.7% year-over-year decline on an organic basis. Fourth-quarter revenue stood at USD 849.7 million, down 6.8% compared to the same period in 2023, though showing sequential improvement quarter-over-quarter. Adjusted EBIT for the year totaled USD 1.16 million, marking a 48% decrease from the prior year, highlighting ongoing market challenges and margin pressures.

- In the fourth quarter of 2024, Lennox delivered a robust financial performance, reporting revenue of USD 1.3 billion and operating income of USD 245 million. The company also achieved a 250 basis point expansion in segment margin, which reached a record high of 18.4%, reflecting strong operational execution and margin enhancement initiatives.

Major players operating in the U.S. commercial boiler market are:

- A.O. Smith

- AERCO

- Ariston Holding

- Babcock & Wilcox Enterprises

- Bosch Thermotechnology

- Bradford White Corporation

- Burnham Commercial Boilers

- Clayton Industries

- Cleaver-Brooks

- Columbia Heating Products

- Daikin Industries

- Energy Kinetics

- Fulton

- HTP

- Hurst Boiler & Welding

- Lennox International

- Lochinvar

- Miura America

- Navien

- NTI Boilers

- P.M. Lattner Manufacturing

- Parker Boiler

- PB Heat

- Precision Boilers

- Rentech Boiler Systems

- Rinnai America

- Thermal Solutions

- U.S. Boiler Company

- Viessmann

- WM Technologies

U.S. Commercial Boiler Industry News

- In January 2025, Bosch unveiled the Buderus SSB Gen 2 Boiler, featuring a suite of advanced upgrades over its predecessor. With output capacities ranging from 798 to 8,192 MBH, the Gen 2 model is designed to deliver enhanced performance, reliability, and flexibility, positioning it as a highly effective solution for a broad array of commercial heating applications.

- In July 2024, Bradford White Corporation successfully completed the strategic acquisition of FloLogic, prominent player in automatic shut-off and advanced plumbing leak detection technologies tailored for light commercial applications. This acquisition reinforces Bradford White’s commitment to innovation and high-performance solutions, while significantly strengthening its portfolio of smart water management technologies.

- In May 2024, Daikin Industries entered a strategic partnership with Miura, following board approvals from both companies. Under the terms of the agreement, Daikin acquired a 4.67% equity stake in Miura, while Miura assumed a 49% ownership in Daikin Applied Systems. This collaboration is aimed at leveraging the complementary strengths of both organizations including their respective product portfolios, technological capabilities, and service networks to deliver integrated, comprehensive energy solutions to the market

- In January 2024, AERCO introduced the CFR, the industry’s first stainless steel condensing boiler engineered for installation within a Category I Vent system. Delivering up to 87.6% thermal efficiency, CFR sets a new performance benchmark for Category I boilers. Available in 1,500 MBH and 3,000 MBH models, it also offers a cost-effective upgrade path for facilities seeking to replace aging non-condensing boiler systems with high-efficiency alternatives.

The U.S. commercial boiler market research reports include in-depth coverage of the industry with estimates & forecast in terms of volume (Units), capacity (MMBTU/hr) & revenue (USD Million) from 2021 to 2034, for the following segments:

Market, By Fuel

- Natural gas

- Oil

- Coal

- Others

Market, By Capacity

- ≤ 0.3 - 2.5 MMBTU/hr

- > 2.5 - 10 MMBTU/hr

- > 10 - 50 MMBTU/hr

- > 50 - 100 MMBTU/hr

- > 100 - 250 MMBTU/hr

Market, By Technology

- Condensing

- Non-condensing

Market, By Product

- Hot water

- Steam

Market, By Application

- Offices

- Healthcare facilities

- Educational institutions

- Lodgings

- Retail stores

- Others

The above information has been provided for the following regions and states:

- East North Central

- Illinois

- Indiana

- Michigan

- Ohio

- Wisconsin

- West South Central

- Arkansas

- Louisiana

- Oklahoma

- Texas

- South Atlantic

- Delaware

- Florida

- Georgia

- Maryland

- North Carolina

- South Carolina

- Virginia

- West Virginia

- Washington D.C.

- North East

- Connecticut

- Maine

- Massachusetts

- New Hampshire

- Rhode Island

- Vermont

- New Jersey

- New York

- Pennsylvania

- East South Central

- Alabama

- Kentucky

- Mississippi

- Tennessee

- West North Central

- Iowa

- Kansas

- Minnesota

- Missouri

- Nebraska

- North Dakota

- South Dakota

- Pacific States

- Alaska

- California

- Hawaii

- Oregon

- Washington

- Mountain States

- Arizona

- Colorado

- Utah

- Nevada

- New Mexico

- Idaho

- Montana

- Wyoming

Frequently Asked Question(FAQ) :

Who are the key players in the U.S. commercial boiler market?

Major key players include A.O. Smith, AERCO, Ariston Holding, Babcock & Wilcox Enterprises, Bosch Thermotechnology, Bradford White Corporation, Burnham Commercial Boilers, Clayton Industries, Cleaver-Brooks, Columbia Heating Products, Daikin Industries, Energy Kinetics, Fulton, HTP, Hurst Boiler & Welding, Lennox International, Lochinvar, Miura America.

Which region leads the U.S. commercial boiler market?

South Atlantic held 20.6% share with USD 516 million in 2024, driven by urban development and growing commercial infrastructure investments.

What are the upcoming trends in the U.S. commercial boiler market?

Key trends include adoption of IoT-enabled predictive maintenance, integration of hybrid heating systems with renewables, smart control systems, and shift toward modular and fuel-flexible boiler configurations.

What is the growth outlook for the natural gas boiler segment from 2025 to 2034?

Natural gas boilers hold 82.7% market share in 2024 and are projected to grow at over 5.5% through 2034, fueled by preference for cleaner and cost-efficient fuels.

What is the projected market size of condensing boilers by 2034?

Condensing boilers are projected to exceed USD 3.5 billion by 2034, due to higher thermal efficiency, reduced fuel consumption, and integration with advanced building automation systems.

What was the valuation of the healthcare facilities segment in 2024?

Healthcare facilities held 24.7% market share in 2024 and are set to exceed USD 1 billion by 2034, supported by demand for reliable heating systems in hospitals and clinics.

What is the current U.S. commercial boiler market size in 2025?

The market size is projected to reach USD 2.7 billion in 2025.

What is the market size of the U.S. commercial boiler in 2024?

The market size was USD 2.5 billion in 2024, with a CAGR of 5.7% expected through 2034 driven by stricter energy codes, decarbonization mandates, and rising adoption of high-efficiency condensing and modular systems.

What is the projected value of the U.S. commercial boiler market by 2034?

The U.S. commercial boiler market is expected to reach USD 4.4 billion by 2034, propelled by energy efficiency regulations, smart control integration, and expanding commercial infrastructure projects.

U.S. Commercial Boiler Market Scope

Related Reports