Home > Industrial Machinery > HVAC > Filters > U.S. Baghouse Filters Market

U.S. Baghouse Filters Market Size

- Report ID: GMI1672

- Published Date: Jun 2017

- Report Format: PDF

U.S. Baghouse Filters Market Size

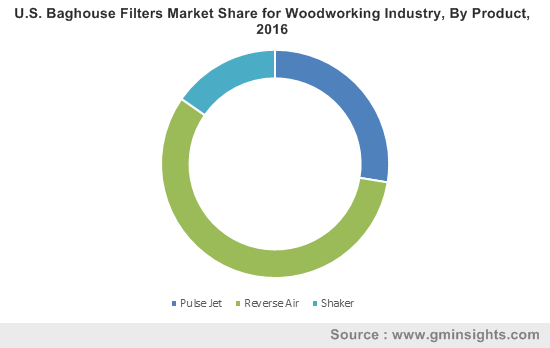

U.S. Baghouse Filters Market size for woodworking industry was worth above USD 60 million in 2016 and expects gains at over 4%.

Positive outlook towards wood working industry due to increasing consumer spending on renovation and remodeling should favor U.S. baghouse filters market size. Increasing demand for wood components in building construction such as flooring, doors & windows, and composite panels due to availability of various laminated designs along with consumer inclination towards luxury homes may stimulate product demand in the manufacturing units.

U.S. wood products industry was valued at over USD 70 billion with total manufacturing units of surpassing 900 in 2016. These manufacturing companies are engaged in highly automated and sophisticated manufacturing process to ensure high quality and minimal waste which should favor baghouse filters market growth in the U.S.

| Report Attribute | Details |

|---|---|

| Base Year: | 2015 |

| U.S. Baghouse Filters Market Size in 2015: | 60 Million (USD) |

| Forecast Period: | 2016 to 2024 |

| Forecast Period 2016 to 2024 CAGR: | 4% |

| 2024 Value Projection: | 85 Million (USD) |

| Historical Data for: | 2013 to 2015 |

| No. of Pages: | 280 |

| Tables, Charts & Figures: | 166 |

| Segments covered: | Product, Application, and Region |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

The industry generates large amount of dust by shaping, milling, sawing, cutting, and laminating in the workshops. Baghouse filters are made to collect fine dust particles and prevent workers from potential health risk. These dust collectors follow regulatory standards which helps in maintaining air quality at workstations. Growing awareness about hazards from dust particles in the manufacturing industry should drive this dust collector equipment demand.

Average annual expenditure on furniture amounted to around USD 500 per consumer. Availability of efficient distribution channel along with rise in consumer spending on smart furniture and home furnishings stores is likely to boost U.S. baghouse filters market size for woodworking applications.

NFPA 664 standard for prevention of fire and explosion in wood working & processing industry and NFPA 654 standards for prevention of fire explosion from processing manufacturing & handling of combustible particles will promote U.S. baghouse filters market size.

Additionally, regulatory guidelines stated by OSHA for industrial and worker safety classifies wood dust as nuisance dust and limits its exposure to minimum. The regulation also states the maximum permissible exposure for nuisance to dust is 15 mg/m3 of the total dust. OSHA standards also regulate the indoor air quality of the working environment thereby promoting dust collectors and filters demand to maintain air quality and minimizes health hazards.